C. Assume the same facts except that Aretha's adjusted gross income before the rental loss is $145,000 and Betina's is $140,000. How much of the loss can Aretha and Betina deduct? Aretha Betina 9,600

C. Assume the same facts except that Aretha's adjusted gross income before the rental loss is $145,000 and Betina's is $140,000. How much of the loss can Aretha and Betina deduct? Aretha Betina 9,600

Chapter7: Losses—deductions And Limitations

Section: Chapter Questions

Problem 28P

Related questions

Question

I only need the answer for Aretha on part C. Thanks!

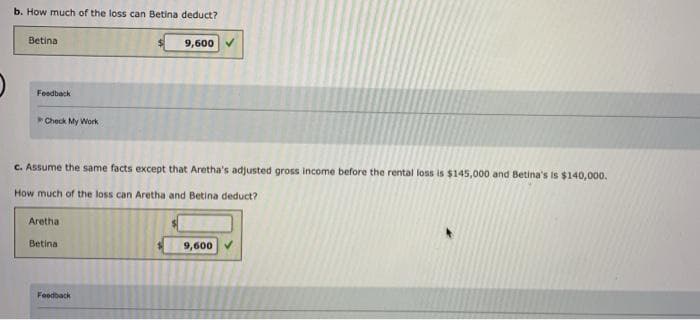

Transcribed Image Text:b. How much of the loss can Betina deduct?

Betina

9,600

Foedback

Check My Work

C. Assume the same facts except that Aretha's adjusted gross income before the rental loss is $145,000 and Betina's is $140,000.

How much of the loss can Aretha and Betina deduct?

Aretha

Betina

9,600

Feedback

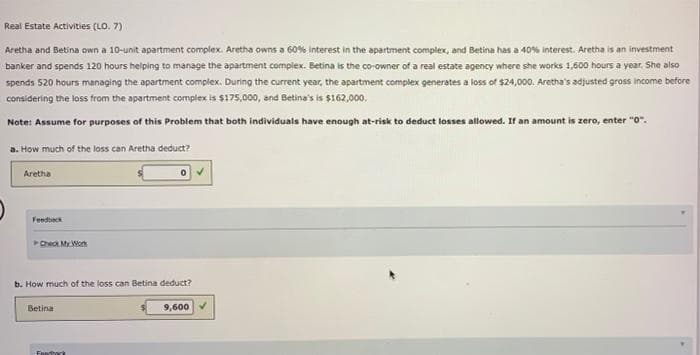

Transcribed Image Text:Real Estate Activities (LO. 7)

Aretha and Betina own a 10-unit apartment complex. Aretha owns a 60% interest in the apartment complex, and Betina has a 40% interest. Aretha is an investment

banker and spends 120 hours helping to manage the apartment complex. Betina is the co-owner of a real estate agency where she works 1,600 hours a year. She also

spends 520 hours managing the apartment complex. During the current year, the apartment complex generates a loss of $24,000. Aretha's adjusted gross income before

considering the loss from the apartment complex is $175,000, and Betina's is $162,000.

Note: Assume for purposes of this Problem that both individuals have enough at-risk to deduct losses allowed. If an amount is zero, enter "o".

a. How much of the loss can Aretha deduct?

Aretha

Feedbeck

Check My. Work

b. How much of the loss can Betina deduct?

Betina

9,600

Fanthack

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT