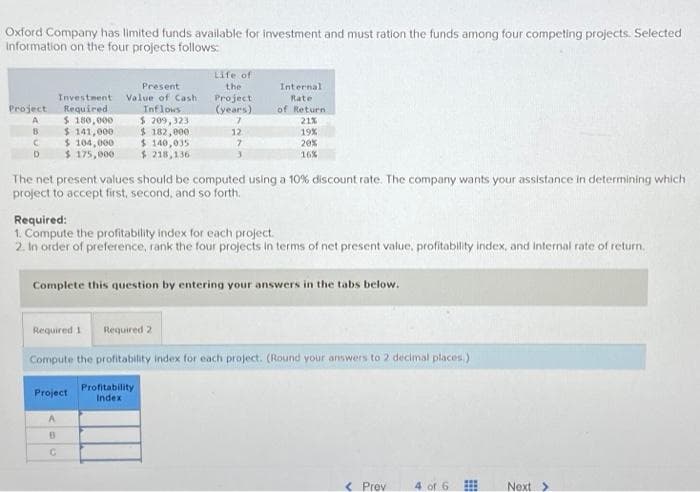

Oxford Company has limited funds available for investment and must ration the funds among four competing projects. Selected Information on the four projects follows: Investment Project Required A B C D $ 180,000 $ 141,000 $ 104,000 $ 175,000 Present Value of Cash Inflows $ 209,323 $ 182,000 $ 140,035 $218,136 Life of the Project (years) 7 12 7 Internal. Rate of Return. 21% 19% 20% 16% The net present values should be computed using a 10 % discount rate. The company wants your assistance in determining which project to accept first, second, and so forth. Required: 1. Compute the profitability index for each project. 2. In order of preference, rank the four projects in terms of net present value, profitability index, and internal rate of return.

Oxford Company has limited funds available for investment and must ration the funds among four competing projects. Selected Information on the four projects follows: Investment Project Required A B C D $ 180,000 $ 141,000 $ 104,000 $ 175,000 Present Value of Cash Inflows $ 209,323 $ 182,000 $ 140,035 $218,136 Life of the Project (years) 7 12 7 Internal. Rate of Return. 21% 19% 20% 16% The net present values should be computed using a 10 % discount rate. The company wants your assistance in determining which project to accept first, second, and so forth. Required: 1. Compute the profitability index for each project. 2. In order of preference, rank the four projects in terms of net present value, profitability index, and internal rate of return.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 13E: Buena Vision Clinic is considering an investment that requires an outlay of 600,000 and promises a...

Related questions

Question

Please help me.

Thankyou.

Transcribed Image Text:Oxford Company has limited funds available for investment and must ration the funds among four competing projects. Selected

Information on the four projects follows:

Investment

Project Required.

$ 180,000

A

B

C

D

$ 141,000

$ 104,000

$ 175,000

Present

Value of Cash

Inflows

Project

A

The net present values should be computed using a 10% discount rate. The company wants your assistance in determining which

project to accept first, second, and so forth.

B

C

$ 209,323

$ 182,000

$ 140,035

$218,136

Required:

1. Compute the profitability index for each project.

2. In order of preference, rank the four projects in terms of net present value, profitability index, and internal rate of return.

Complete this question by entering your answers in the tabs below.

Life of

the

Project

(years)

7

12

7

3

Required 1 Required 2

Compute the profitability index for each project. (Round your answers to 2 decimal places.)

Internal.

Rate

of Return

21%

19%

20%

16%

Profitability

Index

< Prev

4 of 6

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage