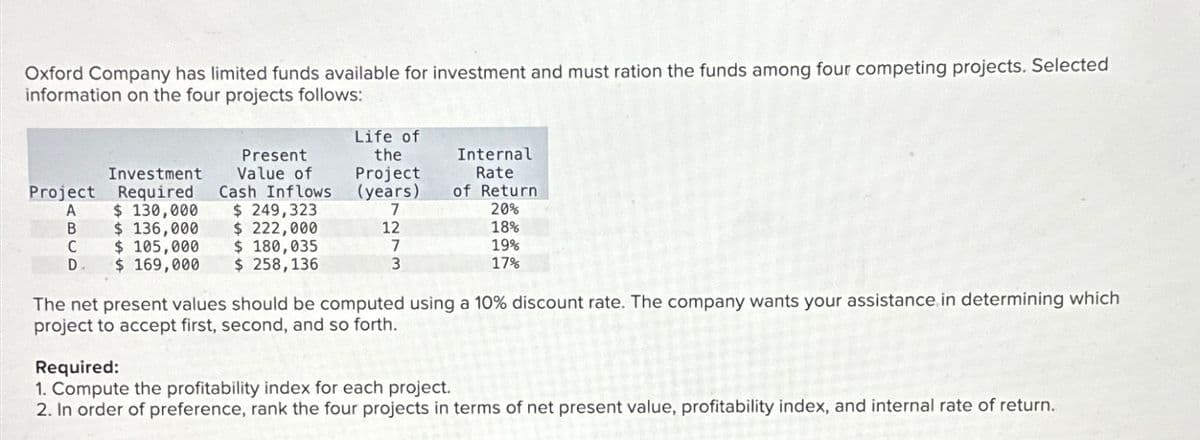

Oxford Company has limited funds available for investment and must ration the funds among four competing projects. Selected information on the four projects follows: Investment Present Value of Life of the Project Internal Rate Project Required Cash Inflows (years) of Return A $ 130,000 $ 249,323 7 20% B $ 136,000 $ 222,000 C D. $ 105,000 $169,000 $ 180,035 $ 258,136 12 7 3 18% 19% 17% The net present values should be computed using a 10% discount rate. The company wants your assistance. in determining which project to accept first, second, and so forth. Required: 1. Compute the profitability index for each project. 2. In order of preference, rank the four projects in terms of net present value, profitability index, and internal rate of return.

Oxford Company has limited funds available for investment and must ration the funds among four competing projects. Selected information on the four projects follows: Investment Present Value of Life of the Project Internal Rate Project Required Cash Inflows (years) of Return A $ 130,000 $ 249,323 7 20% B $ 136,000 $ 222,000 C D. $ 105,000 $169,000 $ 180,035 $ 258,136 12 7 3 18% 19% 17% The net present values should be computed using a 10% discount rate. The company wants your assistance. in determining which project to accept first, second, and so forth. Required: 1. Compute the profitability index for each project. 2. In order of preference, rank the four projects in terms of net present value, profitability index, and internal rate of return.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter26: Capital Investment Analysis

Section: Chapter Questions

Problem 2CMA: Staten Corporation is considering two mutually exclusive projects. Both require an initial outlay of...

Related questions

Question

Vishnu

Transcribed Image Text:Oxford Company has limited funds available for investment and must ration the funds among four competing projects. Selected

information on the four projects follows:

Investment

Present

Value of

Life of

the

Project

Internal

Rate

Project

Required

Cash Inflows

(years)

of Return

A

$ 130,000

$ 249,323

7

20%

B

$ 136,000

$ 222,000

C

D.

$ 105,000

$169,000

$ 180,035

$ 258,136

12

7

3

18%

19%

17%

The net present values should be computed using a 10% discount rate. The company wants your assistance. in determining which

project to accept first, second, and so forth.

Required:

1. Compute the profitability index for each project.

2. In order of preference, rank the four projects in terms of net present value, profitability index, and internal rate of return.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning