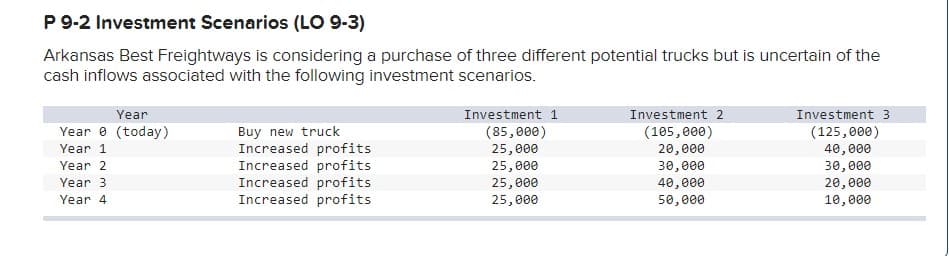

P 9-2 Investment Scenarios (LO 9-3) Arkansas Best Freightways is considering a purchase of three different potential trucks but is uncertain of the cash inflows associated with the following investment scenarios. Year Year 8 (today) Year 1 Year 2 Year 3 Year 4 Buy new truck Increased profits Increased profits Increased profits Increased profits Investment 1 (85,000) 25,000 25,000 25,000 25,000 Investment 2 (105,000) 20,000 30,000 40,000 50,000 Investment 3 (125,000) 40,000 30,000 20,000 10,000

P 9-2 Investment Scenarios (LO 9-3) Arkansas Best Freightways is considering a purchase of three different potential trucks but is uncertain of the cash inflows associated with the following investment scenarios. Year Year 8 (today) Year 1 Year 2 Year 3 Year 4 Buy new truck Increased profits Increased profits Increased profits Increased profits Investment 1 (85,000) 25,000 25,000 25,000 25,000 Investment 2 (105,000) 20,000 30,000 40,000 50,000 Investment 3 (125,000) 40,000 30,000 20,000 10,000

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter12: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 12.1.2P

Related questions

Question

Transcribed Image Text:P 9-2 Investment Scenarios (LO 9-3)

Arkansas Best Freightways is considering a purchase of three different potential trucks but is uncertain of the

cash inflows associated with the following investment scenarios.

Year

Year 0 (today)

Year 1

Year 2

Year 3

Year 4

Buy new truck

Increased profits

Increased profits

Increased profits

Increased profits

Investment 1

(85,000)

25,000

25,000

25,000

25,000

Investment 2

(105,000)

20,000

30,000

40,000

50,000

Investment 3

(125,000)

40,000

30,000

20,000

10,000

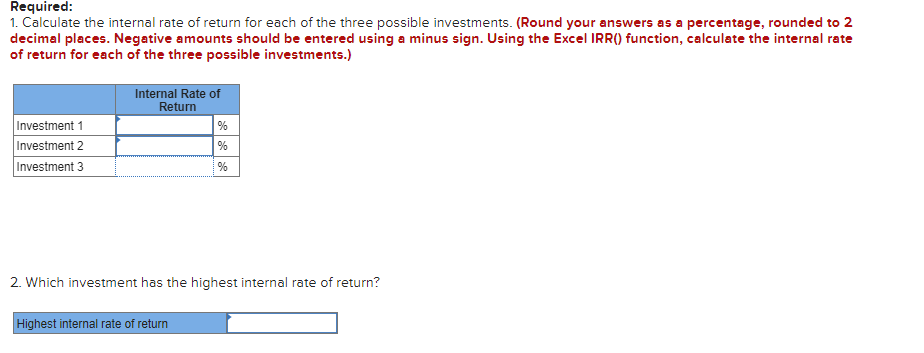

Transcribed Image Text:Required:

1. Calculate the internal rate of return for each of the three possible investments. (Round your answers as a percentage, rounded to 2

decimal places. Negative amounts should be entered using a minus sign. Using the Excel IRR() function, calculate the internal rate

of return for each of the three possible investments.)

Investment 1

Investment 2

Investment 3

Internal Rate of

Return

%

%

%

2. Which investment has the highest internal rate of return?

Highest internal rate of return

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning