You have the following information about two firms, Debt Free, Incorporated and Debt Spree, Incorporated. Both firms have the same prospects for sales and EBIT, and both have the same level of assets, tax rate and borrowing rate. They differ in their use of debt financing. Scenario Bad year Normal year Good year Total assets Tax rate Debt Equity Borrowing rate Sales $200 $ 275 $ 380 Debt Free $ 250 21% EBIT $12 $34 $51 $0 $ 250 16% Required: a. Calculate the interest expense for each firm: Debt Spree $ 250 21% $ 150 $ 100 16%

You have the following information about two firms, Debt Free, Incorporated and Debt Spree, Incorporated. Both firms have the same prospects for sales and EBIT, and both have the same level of assets, tax rate and borrowing rate. They differ in their use of debt financing. Scenario Bad year Normal year Good year Total assets Tax rate Debt Equity Borrowing rate Sales $200 $ 275 $ 380 Debt Free $ 250 21% EBIT $12 $34 $51 $0 $ 250 16% Required: a. Calculate the interest expense for each firm: Debt Spree $ 250 21% $ 150 $ 100 16%

Chapter5: Evaluating Operating And Financial Performance

Section: Chapter Questions

Problem 4EP

Related questions

Question

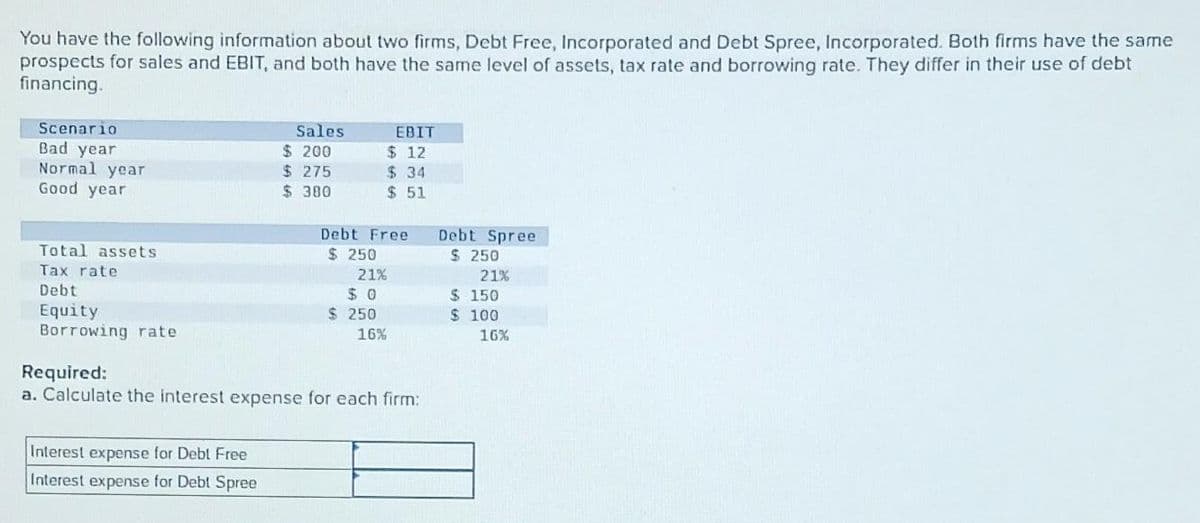

Transcribed Image Text:You have the following information about two firms, Debt Free, Incorporated and Debt Spree, Incorporated. Both firms have the same

prospects for sales and EBIT, and both have the same level of assets, tax rate and borrowing rate. They differ in their use of debt

financing.

Scenario

Bad year

Normal year

Good year

Total assets

Tax rate

Debt

Equity

Borrowing rate

Sales

Interest expense for Debt Free

Interest expense for Debt Spree

$200

$275

$380

Debt Free

$ 250

21%

EBIT

$12

$ 34

$ 51

$0

$ 250

16%

Required:

a. Calculate the interest expense for each firm:

Debt Spree

$ 250

21%

$150

$ 100

16%

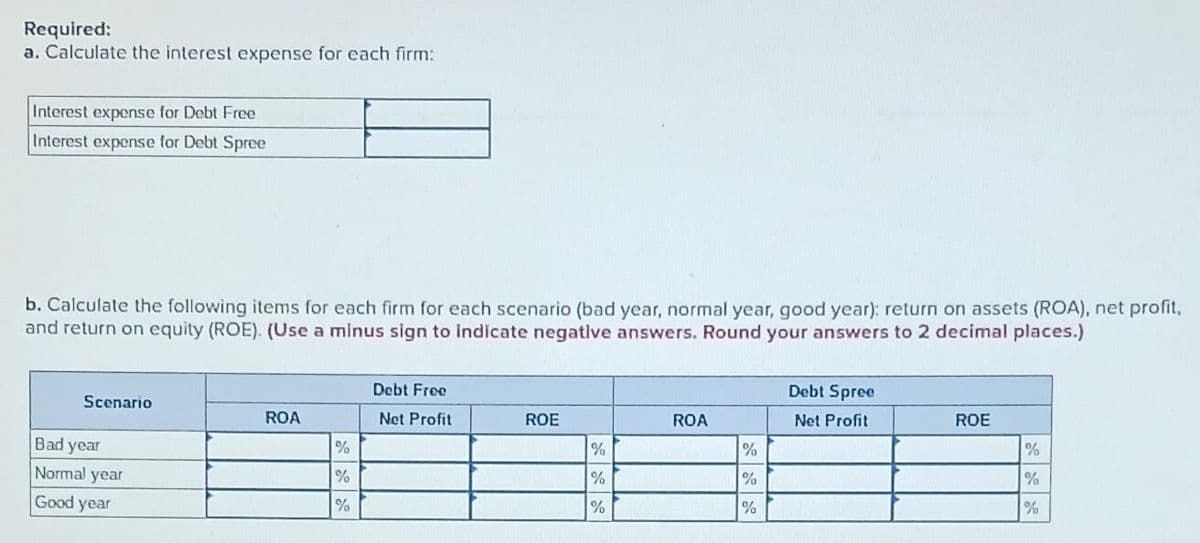

Transcribed Image Text:Required:

a. Calculate the interest expense for each firm:

Interest expense for Debt Free

Interest expense for Debt Spree

b. Calculate the following items for each firm for each scenario (bad year, normal year, good year): return on assets (ROA), net profit,

and return on equity (ROE). (Use a minus sign to indicate negative answers. Round your answers to 2 decimal places.)

Scenario

Bad year

Normal year

Good year

ROA

%

%

%

Debt Free

Net Profit

ROE

%

%

%

ROA

%

%

%

Debt Spree

Net Profit

ROE

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning