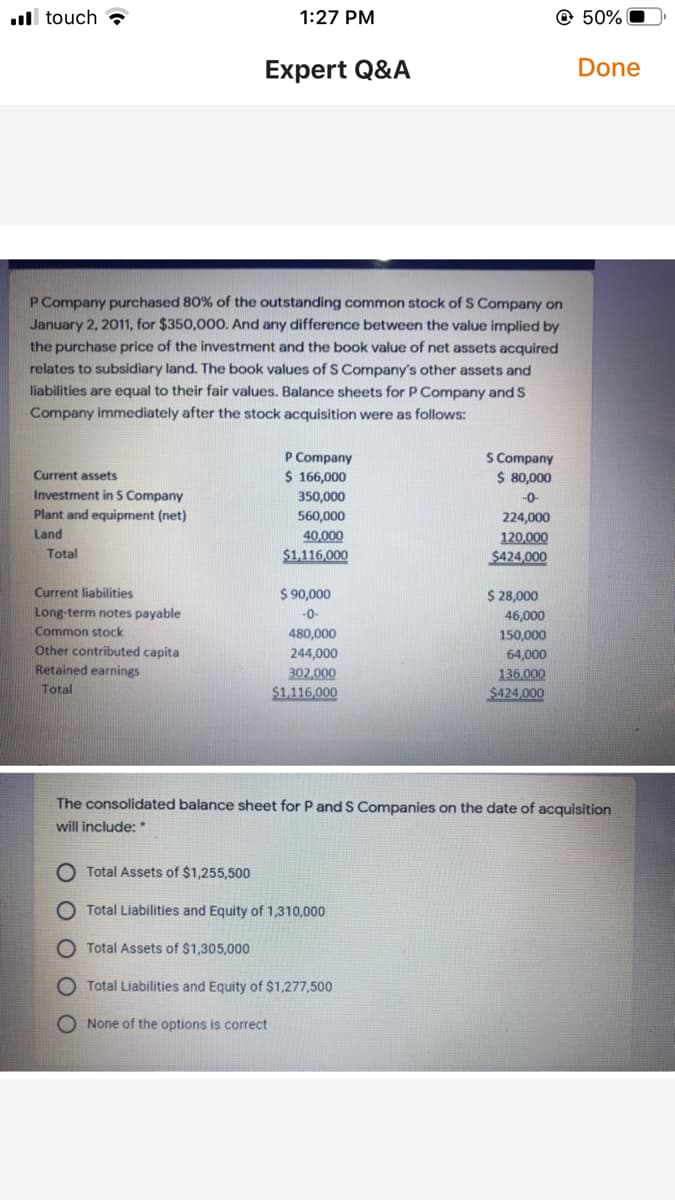

P Company purchased 80% of the outstanding common stock of S Company on January 2, 2011, for $350,000. And any difference between the value implied by the purchase price of the investment and the book value of net assets acquired relates to subsidiary land. The book values of S Company's other assets and liabilities are equal to their fair values. Balance sheets for P Company and S Company immediately after the stock acquisition were as follows: P Company $ 166,000 S Company $ 80,000 Current assets Investment in S Company Plant and equipment (net) 350,000 -0- 560,000 224,000 40,000 $1,116,000 Land 120,000 $424,000 Total Current liabilities Long-term notes payable Common stock Other contributed capita Retained earnings $ 90,000 $ 28,000 -0- 46,000 480,000 150,000 244,000 302.000 $1,116,000 64,000 136.000 Total $424,000 The consolidated balance sheet for P and S Companies on the date of acquisition will include: * O Total Assets of $1,255,500 Total Liabilities and Equity of 1,310,000 Total Assets of $1,305,000 O Total Liabilities and Equity of $1,277,500 None of the options is correct

P Company purchased 80% of the outstanding common stock of S Company on January 2, 2011, for $350,000. And any difference between the value implied by the purchase price of the investment and the book value of net assets acquired relates to subsidiary land. The book values of S Company's other assets and liabilities are equal to their fair values. Balance sheets for P Company and S Company immediately after the stock acquisition were as follows: P Company $ 166,000 S Company $ 80,000 Current assets Investment in S Company Plant and equipment (net) 350,000 -0- 560,000 224,000 40,000 $1,116,000 Land 120,000 $424,000 Total Current liabilities Long-term notes payable Common stock Other contributed capita Retained earnings $ 90,000 $ 28,000 -0- 46,000 480,000 150,000 244,000 302.000 $1,116,000 64,000 136.000 Total $424,000 The consolidated balance sheet for P and S Companies on the date of acquisition will include: * O Total Assets of $1,255,500 Total Liabilities and Equity of 1,310,000 Total Assets of $1,305,000 O Total Liabilities and Equity of $1,277,500 None of the options is correct

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 23E

Related questions

Question

Transcribed Image Text:ull touch

1:27 PM

50%

Expert Q&A

Done

P Company purchased 80% of the outstanding common stock of S Company on

January 2, 2011, for $350,000. And any difference between the value implied by

the purchase price of the investment and the book value of net assets acquired

relates to subsidiary land. The book values of S Company's other assets and

liabilities are equal to their fair values. Balance sheets for P Company and S

Company immediately after the stock acquisition were as follows:

P Company

$ 166,000

S Company

$ 80,000

Current assets

Investment in S Company

Plant and equipment (net)

350,000

560,000

-0-

224,000

Land

40,000

$1,116,000

120,000

Total

$424,000

Current liabilities

Long-term notes payable

Common stock

$ 90,000

$ 28,000

-0-

46,000

480,000

150,000

Other contributed capita

Retained earnings

244,000

64,000

302.000

$1,116,000

136.000

Total

$424,000

The consolidated balance sheet for P and S Companies on the date of acquisition

will include: *

O Total Assets of $1,255,500

O Total Liabilities and Equity of 1,310,000

O Total Assets of $1,305,000

O Total Liabilities and Equity of $1,277,500

O None of the options is correct

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning