On January 1, 2011, Pat Corporation paid $400,000 for purchase of Sad Corporatic stockholders' equity consisted of $300,000 capital stock and $200,000 retained earnin were equal to fair values of Sad's assets and liabilities, except for a building and lan had a book value of $80,000, a fair value of $120,000, and a remaining useful life of land had a book value of $50,000 and a fair value of $150,000. Reguired · Calculate goedwill at the date of purchase of Sad Cornoration

On January 1, 2011, Pat Corporation paid $400,000 for purchase of Sad Corporatic stockholders' equity consisted of $300,000 capital stock and $200,000 retained earnin were equal to fair values of Sad's assets and liabilities, except for a building and lan had a book value of $80,000, a fair value of $120,000, and a remaining useful life of land had a book value of $50,000 and a fair value of $150,000. Reguired · Calculate goedwill at the date of purchase of Sad Cornoration

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 44P

Related questions

Question

I want a explain how i can fill this table with details ask me In this question

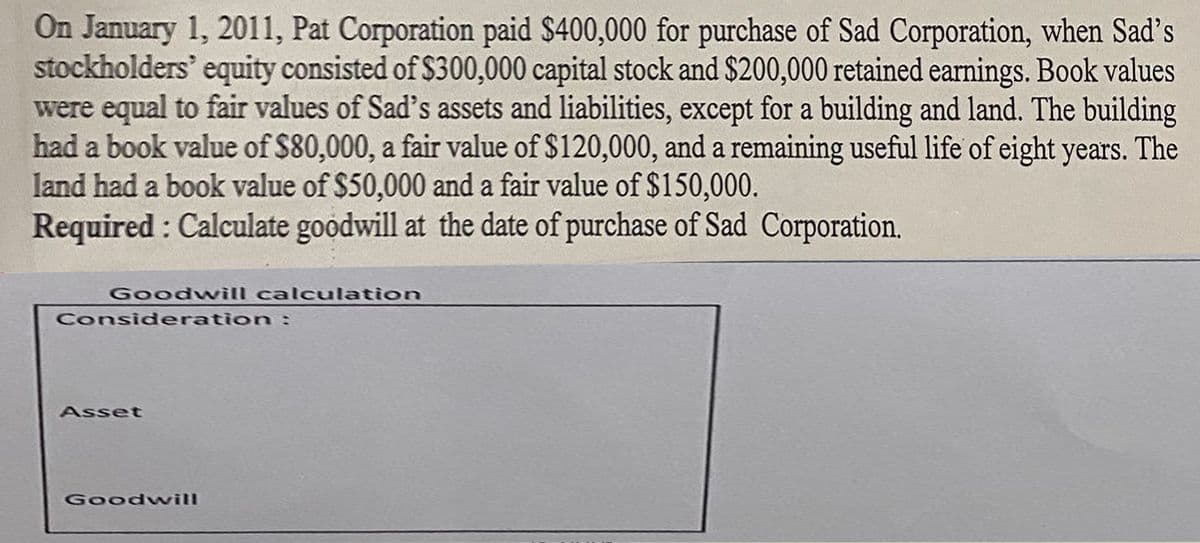

Transcribed Image Text:On January 1, 2011, Pat Corporation paid $400,000 for purchase of Sad Corporation, when Sad's

stockholders' equity consisted of $300,000 capital stock and $200,000 retained earnings. Book values

were equal to fair values of Sad's assets and liabilities, except for a building and land. The building

had a book value of $80,000, a fair value of $120,000, and a remaining useful life of eight years. The

land had a book value of $50,000 and a fair value of $150,000.

Required : Calculate goodwill at the date of purchase of Sad Corporation.

Goodwill calculation

Consideration :

Asset

Goodwvill

Transcribed Image Text:3. Goodwill calculation

Consideration :

Asset

Goodwill

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning