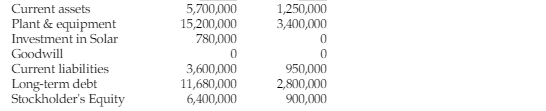

P Incorporated purchased 80% of The S Company on January 2, 2014, when S's book value was $800,000. P paid $700,000 for their acquisition, and the fair value of noncontrolling interest was $175,000. At the date of acquisition, the fair value and book value of S's identifiable assets and liabilities were equal. At the end of the year, the separate companies reported the following balances. Assuming that S has paid no dividends during the year, what is the ending balance of the noncontrolling interest in the subsidiary?

P Incorporated purchased 80% of The S Company on January 2, 2014, when S's book value was $800,000. P paid $700,000 for their acquisition, and the fair value of noncontrolling interest was $175,000. At the date of acquisition, the fair value and book value of S's identifiable assets and liabilities were equal. At the end of the year, the separate companies reported the following balances. Assuming that S has paid no dividends during the year, what is the ending balance of the noncontrolling interest in the subsidiary?

Chapter12: Capital Structure

Section: Chapter Questions

Problem 1PROB

Related questions

Question

P Incorporated purchased 80% of The S Company on January 2, 2014, when S's book value was $800,000. P paid $700,000 for their acquisition, and the fair value of noncontrolling interest was $175,000. At the date of acquisition, the fair value and book value of S's identifiable assets and liabilities were equal. At the end of the year, the separate companies reported the following balances. Assuming that S has paid no dividends during the year, what is the ending balance of the noncontrolling interest in the subsidiary?

Transcribed Image Text:Current assets

Plant & equipment

Investment in Solar

Goodwill

Current liabilities

Long-term debt

Stockholder's Equity

5,700,000

15,200,000

780,000

0

3,600,000

11,680,000

6,400,000

1,250,000

3,400,000

0

0

950,000

2,800,000

900,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you