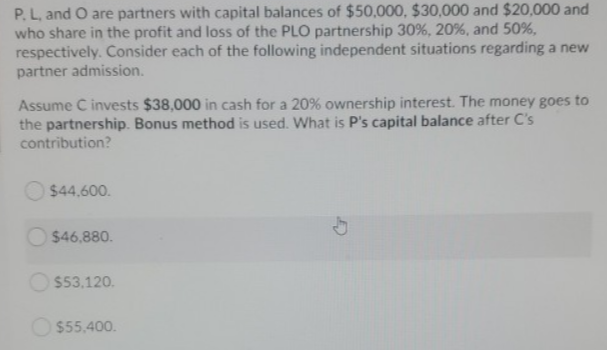

P. L, and O are partners with capital balances of $50,000, $30,000 and $20,000 and who share in the profit and loss of the PLO partnership 30%, 20%, and 50%, respectively. Consider each of the following independent situations regarding a new partner admission. Assume C invests $38,000 in cash for a 20% ownership interest. The money goes to the partnership. Bonus method is used. What is P's capital balance after C's contribution? $44,600. O $46,880. O $53.120. O $55,400.

P. L, and O are partners with capital balances of $50,000, $30,000 and $20,000 and who share in the profit and loss of the PLO partnership 30%, 20%, and 50%, respectively. Consider each of the following independent situations regarding a new partner admission. Assume C invests $38,000 in cash for a 20% ownership interest. The money goes to the partnership. Bonus method is used. What is P's capital balance after C's contribution? $44,600. O $46,880. O $53.120. O $55,400.

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 3EA: The partnership of Tasha and Bill shares profits and losses in a 50:50 ratio, and the partners have...

Related questions

Question

Transcribed Image Text:P. L, and O are partners with capital balances of $50,000, $30,000 and $20,000 and

who share in the profit and loss of the PLO partnership 30%, 20%, and 50%,

respectively. Consider each of the following independent situations regarding a new

partner admission.

Assume C invests $38,000 in cash for a 20% ownership interest. The money goes to

the partnership. Bonus method is used. What is P's capital balance after C's

contribution?

$44,600.

O $46,880.

O $53.120.

O $55,400.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT