P1,000,000.00 and accumulated depreciation of P500,000.00. This is being depreciated using the straight line method and with an estimated useful life of 10 years. On December 31, 2021, a six year old delivery equipment with an original cost of P200,000.00 was traded in for a brand new delivery equipment in the amount of P400,000.00. This new equipment is also depreciated using the straight line method and has a useful life of 10 years. How much is the depreciation expense on 2022?

P1,000,000.00 and accumulated depreciation of P500,000.00. This is being depreciated using the straight line method and with an estimated useful life of 10 years. On December 31, 2021, a six year old delivery equipment with an original cost of P200,000.00 was traded in for a brand new delivery equipment in the amount of P400,000.00. This new equipment is also depreciated using the straight line method and has a useful life of 10 years. How much is the depreciation expense on 2022?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 14P: Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used...

Related questions

Question

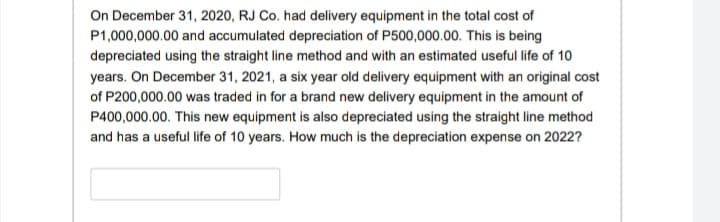

Transcribed Image Text:On December 31, 2020, RJ Co. had delivery equipment in the total cost of

P1,000,000.00 and accumulated depreciation of P500,000.00. This is being

depreciated using the straight line method and with an estimated useful life of 10

years. On December 31, 2021, a six year old delivery equipment with an original cost

of P200,000.00 was traded in for a brand new delivery equipment in the amount of

P400,000.00. This new equipment is also depreciated using the straight line method

and has a useful life of 10 years. How much is the depreciation expense on 2022?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College