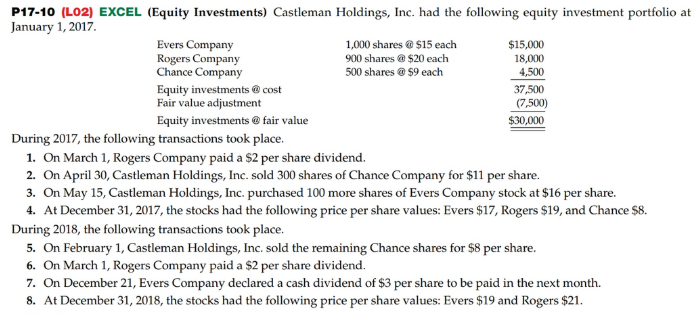

P17-10 (LO2) EXCEL (Equity Investments) Castleman Holdings, Inc. had the following equity investment portfolio at January 1, 2017. Evers Company Rogers Company Chance Company 1,000 shares @ $15 each $15,000 18,000 900 shares @ $20 each 500 shares @ $9 each 4,500 Equity investments @ cost Fair value adjustment 37,500 (7,500) Equity investments @ fair value $30,000 During 2017, the following transactions took place. 1. On March 1, Rogers Company paid a $2 per share dividend. 2. On April 30, Castleman Holdings, Inc. sold 300 shares of Chance Company for $11 per share. 3. On May 15, Castleman Holdings, Inc. purchased 100 more shares of Evers Company stock at $16 per share. 4. At December 31, 2017, the stocks had the following price per share values: Evers $17, Rogers $19, and Chance S8. During 2018, the following transactions took place. 5. On February 1, Castleman Holdings, Inc. sold the remaining Chance shares for $8 per share. 6. On March 1, Rogers Company paid a $2 per share dividend. 7. On December 21, Evers Company declared a cash dividend of $3 per share to be paid in the next month. 8. At December 31, 2018, the stocks had the following price per share values: Evers $19 and Rogers $21.

P17-10 (LO2) EXCEL (Equity Investments) Castleman Holdings, Inc. had the following equity investment portfolio at January 1, 2017. Evers Company Rogers Company Chance Company 1,000 shares @ $15 each $15,000 18,000 900 shares @ $20 each 500 shares @ $9 each 4,500 Equity investments @ cost Fair value adjustment 37,500 (7,500) Equity investments @ fair value $30,000 During 2017, the following transactions took place. 1. On March 1, Rogers Company paid a $2 per share dividend. 2. On April 30, Castleman Holdings, Inc. sold 300 shares of Chance Company for $11 per share. 3. On May 15, Castleman Holdings, Inc. purchased 100 more shares of Evers Company stock at $16 per share. 4. At December 31, 2017, the stocks had the following price per share values: Evers $17, Rogers $19, and Chance S8. During 2018, the following transactions took place. 5. On February 1, Castleman Holdings, Inc. sold the remaining Chance shares for $8 per share. 6. On March 1, Rogers Company paid a $2 per share dividend. 7. On December 21, Evers Company declared a cash dividend of $3 per share to be paid in the next month. 8. At December 31, 2018, the stocks had the following price per share values: Evers $19 and Rogers $21.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter8: Investing Activities

Section: Chapter Questions

Problem 11QE

Related questions

Question

Prepare a partial

Transcribed Image Text:P17-10 (LO2) EXCEL (Equity Investments) Castleman Holdings, Inc. had the following equity investment portfolio at

January 1, 2017.

Evers Company

Rogers Company

Chance Company

1,000 shares @ $15 each

$15,000

18,000

900 shares @ $20 each

500 shares @ $9 each

4,500

Equity investments @ cost

Fair value adjustment

37,500

(7,500)

Equity investments @ fair value

$30,000

During 2017, the following transactions took place.

1. On March 1, Rogers Company paid a $2 per share dividend.

2. On April 30, Castleman Holdings, Inc. sold 300 shares of Chance Company for $11 per share.

3. On May 15, Castleman Holdings, Inc. purchased 100 more shares of Evers Company stock at $16 per share.

4. At December 31, 2017, the stocks had the following price per share values: Evers $17, Rogers $19, and Chance S8.

During 2018, the following transactions took place.

5. On February 1, Castleman Holdings, Inc. sold the remaining Chance shares for $8 per share.

6. On March 1, Rogers Company paid a $2 per share dividend.

7. On December 21, Evers Company declared a cash dividend of $3 per share to be paid in the next month.

8. At December 31, 2018, the stocks had the following price per share values: Evers $19 and Rogers $21.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning