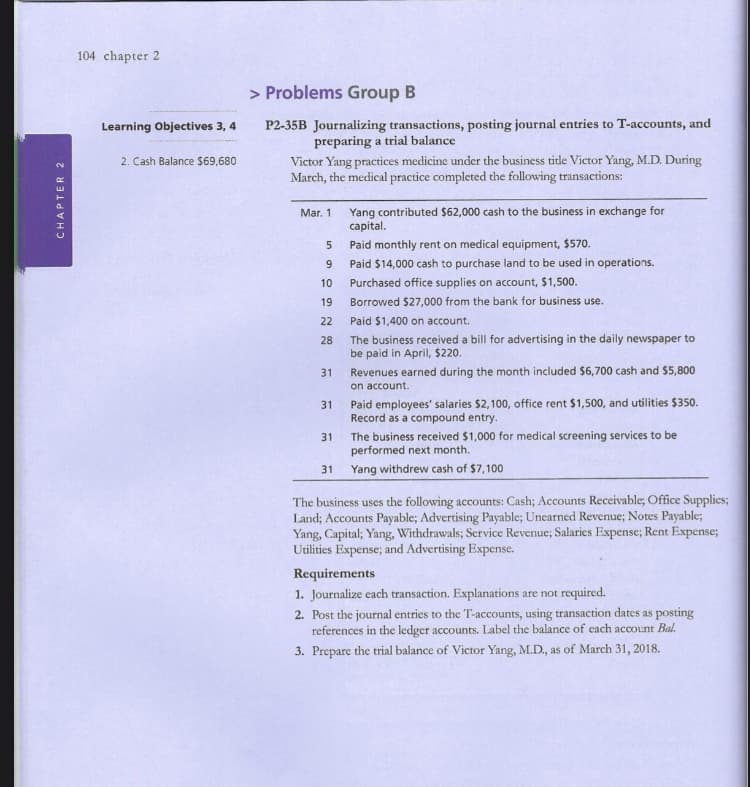

P2-35B Journalizing transactions, posting journal entries to T-accounts, and preparing a trial balance Victor Yang practices medicine under the business title Victor Yang, M.D. During March, the medical practice completed the following transactions: Yang contributed $62,000 cash to the business in exchange for capital. Mar. 1 Paid monthly rent on medical equipment, $570. 9 Paid $14,000 cash to purchase land to be used in operations. 10 Purchased office supplies on account, $1,500. 19 Borrowed $27,000 from the bank for business use. 22 Paid $1,400 on account. The business received a bill for advertising in the daily newspaper to be paid in April, $220. 28 Revenues earned during the month included $6,700 cash and $5,800 on account. 31 31 Paid employees' salaries $2,100, office rent $1,500, and utilities $350. Record as a compound entry. The business received $1,000 for medical screening services to be performed next month. 31 31 Yang withdrew cash of $7,100 The business uses the following accounts: Cash; Accounts Receivable; Office Supplies; Land; Accounts Payable; Advertising Payable; Unearned Revenue; Notes Payable; Yang, Capital; Yang, Withdrawals; Scrvice Revenue; Salaries Expense; Rent Expense; Utilities Expense; and Advertising Expense. Requirements 1. Journalize each transaction. Explanations are not required. 2. Post the journal entries to the T-accounts, using transaction dates as posting references in the ledger accounts. Label the balance of each account Bal. 3. Prepare the trial balance of Victor Yang, M.D., as of March 31, 2018.

P2-35B Journalizing transactions, posting journal entries to T-accounts, and preparing a trial balance Victor Yang practices medicine under the business title Victor Yang, M.D. During March, the medical practice completed the following transactions: Yang contributed $62,000 cash to the business in exchange for capital. Mar. 1 Paid monthly rent on medical equipment, $570. 9 Paid $14,000 cash to purchase land to be used in operations. 10 Purchased office supplies on account, $1,500. 19 Borrowed $27,000 from the bank for business use. 22 Paid $1,400 on account. The business received a bill for advertising in the daily newspaper to be paid in April, $220. 28 Revenues earned during the month included $6,700 cash and $5,800 on account. 31 31 Paid employees' salaries $2,100, office rent $1,500, and utilities $350. Record as a compound entry. The business received $1,000 for medical screening services to be performed next month. 31 31 Yang withdrew cash of $7,100 The business uses the following accounts: Cash; Accounts Receivable; Office Supplies; Land; Accounts Payable; Advertising Payable; Unearned Revenue; Notes Payable; Yang, Capital; Yang, Withdrawals; Scrvice Revenue; Salaries Expense; Rent Expense; Utilities Expense; and Advertising Expense. Requirements 1. Journalize each transaction. Explanations are not required. 2. Post the journal entries to the T-accounts, using transaction dates as posting references in the ledger accounts. Label the balance of each account Bal. 3. Prepare the trial balance of Victor Yang, M.D., as of March 31, 2018.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter3: Journalizing Transactions

Section: Chapter Questions

Problem 1CP

Related questions

Question

100%

2nd one also need answers i donot how i posted sepated as all same so i post 2 times

Transcribed Image Text:104 chapter 2

> Problems Group B

Learning Objectives 3, 4

P2-35B Journalizing transactions, posting journal entries to T-accounts, and

preparing a trial balance

Victor Yang practices medicine under the business title Victor Yang, M.D. During

March, the medical practice completed the following transactions:

2. Cash Balance S69,680

Yang contributed $62,000 cash to the business in exchange for

capital.

Mar. 1

Paid monthly rent on medical equipment, $570.

9

Paid $14,000 cash to purchase land to be used in operations.

10

Purchased office supplies on account, $1,500.

19

Borrowed $27,000 from the bank for business use.

22

Paid $1,400 on account.

The business received a bill for advertising in the daily newspaper to

be paid in April, $220.

28

Revenues earned during the month included $6,700 cash and $5,800

on account.

31

31 Paid employees' salaries $2,100, office rent $1,500, and utilities $350.

Record as a compound entry.

The business received $1,000 for medical screening services to be

performed next month.

31

31

Yang withdrew cash of $7,100

The business uses the following accounts: Cash; Accounts Receivable; Office Supplies;

Land; Accounts Payable; Advertising Payable; Unearned Revenue; Notes Payable;

Yang, Capital; Yang, Withdrawals; Scrvice Revenue; Salaries Expense; Rent Expense;

Utilities Expense; and Advertising Expense.

Requirements

1. Journalize each transaction. Explanations are not required.

2. Post the journal entries to the T-accounts, using transaction dates as posting

references in the ledger accounts. Label the balance of each account Bal.

3. Prepare the trial balance of Victor Yang, M.D., as of March 31, 2018.

CHAPTER 2

Expert Solution

Step 1 Rules of Accounting :

Take a look at the three main rules of accounting:

- Debit what comes in and credit what goes out.

- Debit the receiver and credit the giver.

- Debit expenses and losses, credit income and gains.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning