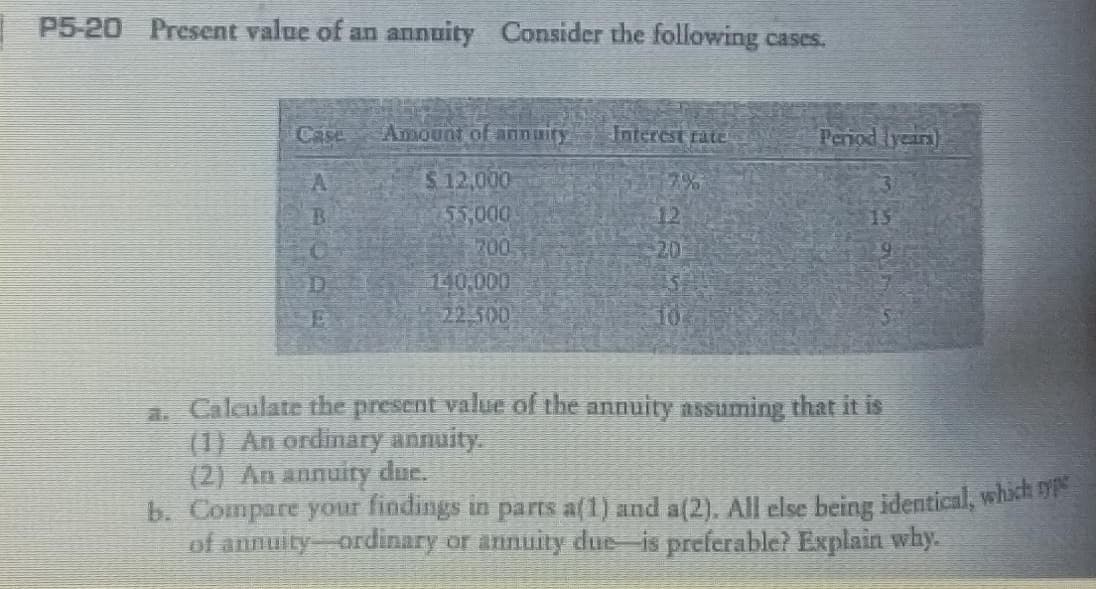

P5-20 Present value of an annuity Consider the following cases. Case Amount of annuity Interest rate Penod lyears) A $ 12,000 7% 55,000 700 12 20 B. 15 140,000 22500 a. Calculate the present value of the annuity assuming that it is (1) An ordinary annuity. (2) An annuity due. b. Compare your findings in parts a(1) and a(2). All else being identical, whih re of annuity-ordinary or annuity due is preferable? Explain why.

P5-20 Present value of an annuity Consider the following cases. Case Amount of annuity Interest rate Penod lyears) A $ 12,000 7% 55,000 700 12 20 B. 15 140,000 22500 a. Calculate the present value of the annuity assuming that it is (1) An ordinary annuity. (2) An annuity due. b. Compare your findings in parts a(1) and a(2). All else being identical, whih re of annuity-ordinary or annuity due is preferable? Explain why.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

ChapterA: Appendix - Time Value Of Cash Flows: Compound Interest Concepts And Applications

Section: Chapter Questions

Problem 20E

Related questions

Question

Transcribed Image Text:I P5-20 Present value of an annuity Consider the following cases.

Case

Amount of annuity

Interest rate

Penod lyears)

$12,000

55,000

A

12

200

20

140,000

22,500

10

a. Caleulate the present value of the annuity nssuming that it is

(1) An ordinary annuity.

(2) An annuity due.

b. Compare your findings in parts a(1) and a(2). All else being identical, whih

of annuity ordinary or annuity due-is preferable? Explain why.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you