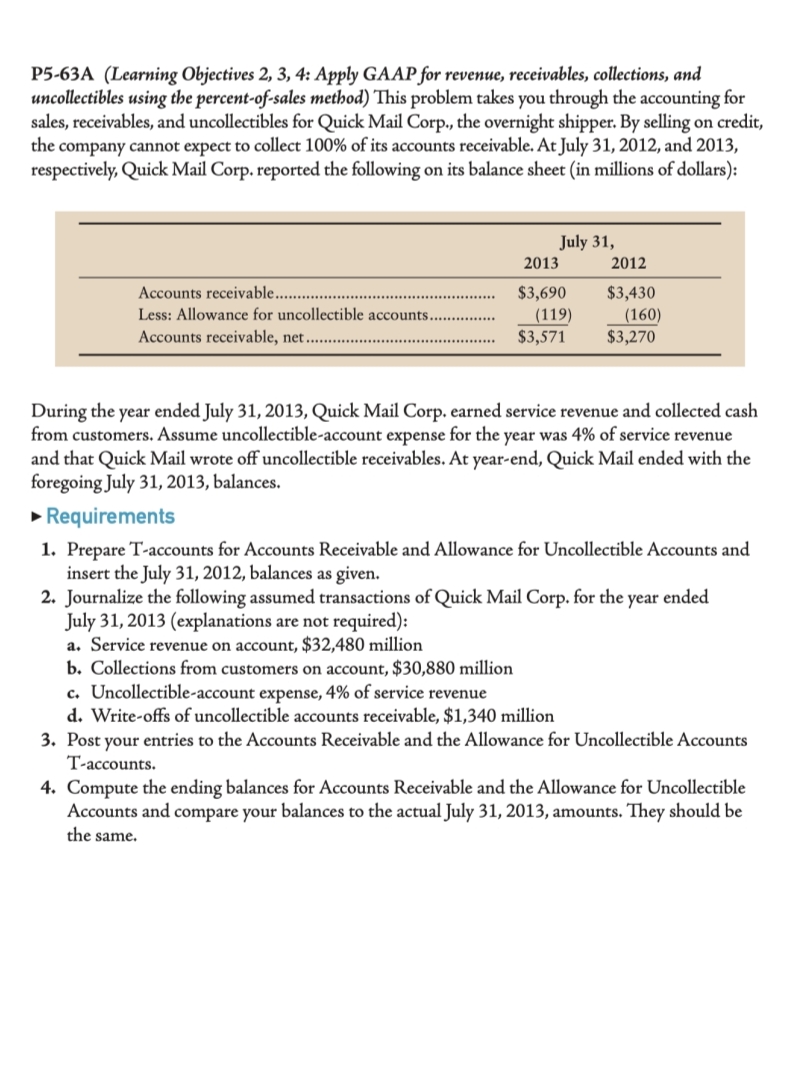

P5-63A (Learning Objectives 2, 3, 4: Apply GAAP for revenue, receivables, collections, and uncollectibles using the percent-of-sales method) This problem takes you through the accounting for sales, receivables, and uncollectibles for Quick Mail Corp., the overnight shipper. By selling on credit, the company cannot expect to collect 100% of its accounts receivable. At July 31, 2012, and 2013, respectively, Quick Mail Corp. reported the following on its balance sheet (in millions of dollars): July 31, 2013 2012 Accounts receivable. Less: Allowance for uncollectible accounts. . $3,690 (119) $3,430 (160) $3,270 Accounts receivable, net $3,571 During the year ended July 31, 2013, Quick Mail Corp. earned service revenue and collected cash from customers. Assume uncollectible-account expense for the year was 4% of service revenue and that Quick Mail wrote off uncollectible receivables. At year-end, Quick Mail ended with the foregoing July 31, 2013, balances. • Requirements 1. Prepare T-accounts for Accounts Receivable and Allowance for Uncollectible Accounts and insert the July 31, 2012, balances as given. 2. Journalize the following assumed transactions of Quick Mail Corp. for the year ended July 31, 2013 (explanations are not required): a. Service revenue on account, $32,480 million b. Collections from customers on account, $30,880 million c. Uncollectible-account expense, 4% of service revenue d. Write-offs of uncollectible accounts receivable, $1,340 million 3. Post your entries to the Accounts Receivable and the Allowance for Uncollectible Accounts T-accounts. 4. Compute the ending balances for Accounts Receivable and the Allowance for Uncollectible Accounts and compare your balances to the actual July 31, 2013, amounts. They should be the same.

P5-63A (Learning Objectives 2, 3, 4: Apply GAAP for revenue, receivables, collections, and uncollectibles using the percent-of-sales method) This problem takes you through the accounting for sales, receivables, and uncollectibles for Quick Mail Corp., the overnight shipper. By selling on credit, the company cannot expect to collect 100% of its

Trending now

This is a popular solution!

Step by step

Solved in 3 steps