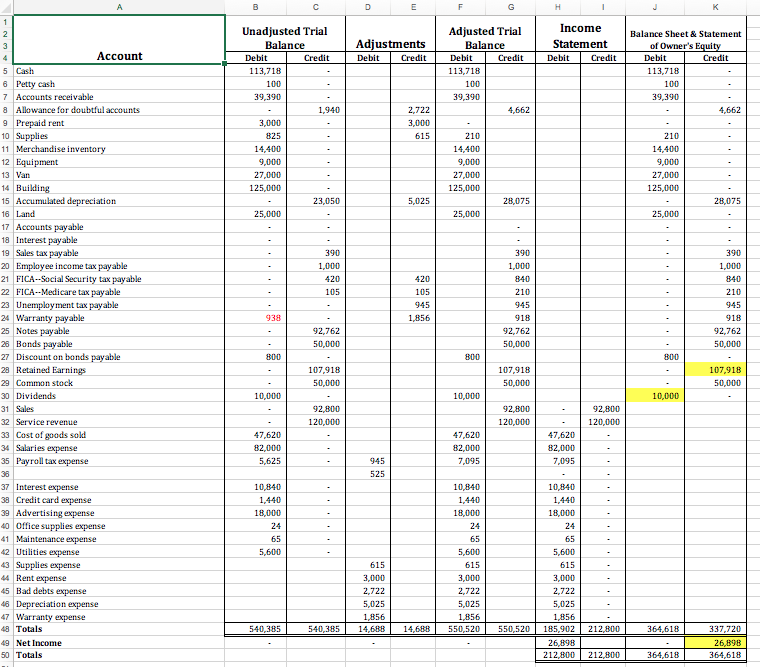

Cash OPENING 122,475 Petty cash OPENING 100 Accounts receivable OPENING 27,400 Allowance for doubtful accounts OPENING 4,390 Supplies OPENING 165 Prepaid rent OPENING 3,000 Merchandise inventory OPENING 11,020 Equipment OPENING 9,000 Van OPENING 27,000 Accumulated depreciation OPENING 23,050 Sales tax payable OPENING 290 Employee income tax payable OPENING 500 FICA--Social Security tax payable OPENING 600 FICA--Medicare tax payable OPENING 150 Warranty payable OPENING 312 Unemployment tax payable OPENING 630 Interest payable OPENING 320 Notes payable OPENING 12,000 Common stock OPENING 50,000 Retained Earnings OPENING 107,918 Sales tax payable debit 290 Cash credit 290 Employee income tax payable debit 500 FICA--Social Security tax payable debit 600 FICA--Medicare tax payable debit 150 Unemployment tax payable debit 630 Cash credit 1,880 Land debit 25,000 Building debit 125,000 Cash credit 50,000 Notes payable credit 100,000 Cash debit 49,000 Discount on bonds payable debit 1,000 Bonds payable credit 50,000 Supplies debit 660 Accounts payable credit 660 Merchandise inventory debit 51,000 Cash credit 51,000 Allowance for doubtful accounts debit 2,450 Accounts receivable credit 2,450 Accounts receivable debit 97,440 Sales credit 92,800 Sales tax payable credit 4,640 Cost of goods sold debit 47,620 Merchandise inventory credit 47,620 Accounts receivable debit 34,560 Credit card expense debit 1,440 Accounts receivable debit 84,000 Service revenue credit 120,000 Maintenance expense debit 65 Office supplies expense debit 24 Cash credit 89 Cash debit 34,560 Accounts receivable credit 34,560 Sales tax payable debit 4,250 Cash credit 4,250 Cash debit 167,000 Accounts receivable credit 167,000 Salaries expense debit 82,000 Employee income tax payable credit 9,600 FICA--Social Security tax payable credit 4,920 FICA--Medicare tax payable credit 1,230 Cash credit 66,250 Warranty payable debit 1,250 Cash credit 1,250 Notes payable debit 12,000 Interest payable debit 320 Interest expense debit 640 Cash credit 12,960 Advertising expense debit 18,000 Cash credit 18,000 Utilities expense debit 5,600 Cash credit 5,600 Payroll tax expense debit 5,625 Employee income tax payable debit 8,600 FICA--Social Security tax payable debit 4,500 FICA--Medicare tax payable debit 1,125 Cash credit 19,850 Accounts payable debit 660 Cash credit 660 Interest expense debit 3,200 Discount on bonds payable credit 200 Cash credit 3,000 Interest expense debit 7,000 Notes Payable debit 7,238 Cash credit 14,238 Dividends debit 10,000 Cash credit 10,000 Using opening account balances, journal entries, and the trial balance (see attached image), prepare a statement of cash flows.

Cash OPENING 122,475 Petty cash OPENING 100 Accounts receivable OPENING 27,400 Allowance for doubtful accounts OPENING 4,390 Supplies OPENING 165 Prepaid rent OPENING 3,000 Merchandise inventory OPENING 11,020 Equipment OPENING 9,000 Van OPENING 27,000 Accumulated depreciation OPENING 23,050 Sales tax payable OPENING 290 Employee income tax payable OPENING 500 FICA--Social Security tax payable OPENING 600 FICA--Medicare tax payable OPENING 150 Warranty payable OPENING 312 Unemployment tax payable OPENING 630 Interest payable OPENING 320 Notes payable OPENING 12,000 Common stock OPENING 50,000 Retained Earnings OPENING 107,918 Sales tax payable debit 290 Cash credit 290 Employee income tax payable debit 500 FICA--Social Security tax payable debit 600 FICA--Medicare tax payable debit 150 Unemployment tax payable debit 630 Cash credit 1,880 Land debit 25,000 Building debit 125,000 Cash credit 50,000 Notes payable credit 100,000 Cash debit 49,000 Discount on bonds payable debit 1,000 Bonds payable credit 50,000 Supplies debit 660 Accounts payable credit 660 Merchandise inventory debit 51,000 Cash credit 51,000 Allowance for doubtful accounts debit 2,450 Accounts receivable credit 2,450 Accounts receivable debit 97,440 Sales credit 92,800 Sales tax payable credit 4,640 Cost of goods sold debit 47,620 Merchandise inventory credit 47,620 Accounts receivable debit 34,560 Credit card expense debit 1,440 Accounts receivable debit 84,000 Service revenue credit 120,000 Maintenance expense debit 65 Office supplies expense debit 24 Cash credit 89 Cash debit 34,560 Accounts receivable credit 34,560 Sales tax payable debit 4,250 Cash credit 4,250 Cash debit 167,000 Accounts receivable credit 167,000 Salaries expense debit 82,000 Employee income tax payable credit 9,600 FICA--Social Security tax payable credit 4,920 FICA--Medicare tax payable credit 1,230 Cash credit 66,250 Warranty payable debit 1,250 Cash credit 1,250 Notes payable debit 12,000 Interest payable debit 320 Interest expense debit 640 Cash credit 12,960 Advertising expense debit 18,000 Cash credit 18,000 Utilities expense debit 5,600 Cash credit 5,600 Payroll tax expense debit 5,625 Employee income tax payable debit 8,600 FICA--Social Security tax payable debit 4,500 FICA--Medicare tax payable debit 1,125 Cash credit 19,850 Accounts payable debit 660 Cash credit 660 Interest expense debit 3,200 Discount on bonds payable credit 200 Cash credit 3,000 Interest expense debit 7,000 Notes Payable debit 7,238 Cash credit 14,238 Dividends debit 10,000 Cash credit 10,000 Using opening account balances, journal entries, and the trial balance (see attached image), prepare a statement of cash flows.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

100%

| Cash | OPENING | 122,475 |

| Petty cash | OPENING | 100 |

| Accounts receivable | OPENING | 27,400 |

| Allowance for doubtful accounts | OPENING | 4,390 |

| Supplies | OPENING | 165 |

| Prepaid rent | OPENING | 3,000 |

| Merchandise inventory | OPENING | 11,020 |

| Equipment | OPENING | 9,000 |

| Van | OPENING | 27,000 |

| Accumulated |

OPENING | 23,050 |

| Sales tax payable | OPENING | 290 |

| Employee income tax payable | OPENING | 500 |

| FICA--Social Security tax payable | OPENING | 600 |

| FICA--Medicare tax payable | OPENING | 150 |

| Warranty payable | OPENING | 312 |

| OPENING | 630 | |

| Interest payable | OPENING | 320 |

| Notes payable | OPENING | 12,000 |

| Common stock | OPENING | 50,000 |

| OPENING | 107,918 | |

| Sales tax payable | debit | 290 |

| Cash | credit | 290 |

| Employee income tax payable | debit | 500 |

| FICA--Social Security tax payable | debit | 600 |

| FICA--Medicare tax payable | debit | 150 |

| Unemployment tax payable | debit | 630 |

| Cash | credit | 1,880 |

| Land | debit | 25,000 |

| Building | debit | 125,000 |

| Cash | credit | 50,000 |

| Notes payable | credit | 100,000 |

| Cash | debit | 49,000 |

| Discount on bonds payable | debit | 1,000 |

| Bonds payable | credit | 50,000 |

| Supplies | debit | 660 |

| Accounts payable | credit | 660 |

| Merchandise inventory | debit | 51,000 |

| Cash | credit | 51,000 |

| Allowance for doubtful accounts | debit | 2,450 |

| Accounts receivable | credit | 2,450 |

| Accounts receivable | debit | 97,440 |

| Sales | credit | 92,800 |

| Sales tax payable | credit | 4,640 |

| Cost of goods sold | debit | 47,620 |

| Merchandise inventory | credit | 47,620 |

| Accounts receivable | debit | 34,560 |

| Credit card expense | debit | 1,440 |

| Accounts receivable | debit | 84,000 |

| Service revenue | credit | 120,000 |

| Maintenance expense | debit | 65 |

| Office supplies expense | debit | 24 |

| Cash | credit | 89 |

| Cash | debit | 34,560 |

| Accounts receivable | credit | 34,560 |

| Sales tax payable | debit | 4,250 |

| Cash | credit | 4,250 |

| Cash | debit | 167,000 |

| Accounts receivable | credit | 167,000 |

| Salaries expense | debit | 82,000 |

| Employee income tax payable | credit | 9,600 |

| FICA--Social Security tax payable | credit | 4,920 |

| FICA--Medicare tax payable | credit | 1,230 |

| Cash | credit | 66,250 |

| Warranty payable | debit | 1,250 |

| Cash | credit | 1,250 |

| Notes payable | debit | 12,000 |

| Interest payable | debit | 320 |

| Interest expense | debit | 640 |

| Cash | credit | 12,960 |

| Advertising expense | debit | 18,000 |

| Cash | credit | 18,000 |

| Utilities expense | debit | 5,600 |

| Cash | credit | 5,600 |

| Payroll tax expense | debit | 5,625 |

| Employee income tax payable | debit | 8,600 |

| FICA--Social Security tax payable | debit | 4,500 |

| FICA--Medicare tax payable | debit | 1,125 |

| Cash | credit | 19,850 |

| Accounts payable | debit | 660 |

| Cash | credit | 660 |

| Interest expense | debit | 3,200 |

| Discount on bonds payable | credit | 200 |

| Cash | credit | 3,000 |

| Interest expense | debit | 7,000 |

| Notes Payable | debit | 7,238 |

| Cash | credit | 14,238 |

| Dividends | debit | 10,000 |

| Cash | credit | 10,000 |

Using opening account balances,

Transcribed Image Text:B

D

F

G

H

K

Unadjusted Trial

Adjusted Trial

Income

2

Balance Sheet & Statement

Balance

Adjustments

Balance

Statement

of Owner's Equity

3

4

Ассount

Debit

Credit

Debit

Credit

Credit

Debit

Debit

Debit

Credit

Credit

5 Cash

6 Petty cash

7 Accounts receivable

8 Allowance for doubtful accounts

9 Prepaid rent

10 Supplies

113,718

113,718

113,718

100

100

100

39,390

39,390

39,390

1,940

2,722

4,662

4,662

3,000

3,000

825

615

210

210

11 Merchandise inventory

14,400

14,400

14,400

12 Equipment

13 Van

14 Buikling

15 Accumulated depreciation

16 Land

17 Accounts pay able

18 Interest payable

19 Sales tax payable

9,000

9,000

9,000

27,000

27,000

27,000

125,000

125,000

125,000

23,050

5,025

28,075

28,075

25,000

25,000

25,000

390

390

390

1,000

20 Employee income tax payable

21 FICA--Social Security tax payable

22 FICA--Medicare tax payable

1,000

1,000

420

420

840

840

105

105

210

210

23 Unemployment tax payable

945

945

945

918

24 Warranty payable

25 Notes payable

26 Bonds payable

27 Discount on bonds payable

28 Retained Earnings

938

1,856

918

92,762

92,762

92,762

50,000

50,000

50,000

B00

800

800

107,918

107,918

107,918

29 Common stock

50,000

50,000

50,000

30 Dividends

10,000

10,000

10,000

31 Sales

92,800

92,800

92,800

32 Service revenue

120,000

120,000

120,000

33 Cost of goods sold

34 Salaries expense

47,620

47,620

47,620

82,000

82,000

82,000

35 Payroll tax expense

5,625

945

7,095

7,095

36

525

37 Interest expense

38 Credit card expense

39 Advertising expense

40 office supplies expense

10,840

10,840

10,840

1,440

1,440

1,440

18,000

18,000

18,000

24

24

24

41 Maintenance expense

65

65

65

42 Utilities expense

5,600

5,600

5,600

43 Supplies expense

44 Rent expense

45 Bad debts expense

46 Depreciation expense

47 Warranty expense

615

615

615

3,000

3,000

3,000

2,722

2,722

2,722

5,025

5,025

5,025

1,856

185,902 212,800

1,856

1,856

48 Totals

540,385

540,385

14,688

14,688

550,520

550,520

364,618

337,720

49 Net Income

26,898

212,800

26,898

50 Totals

212,800

364,618

364,618

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education