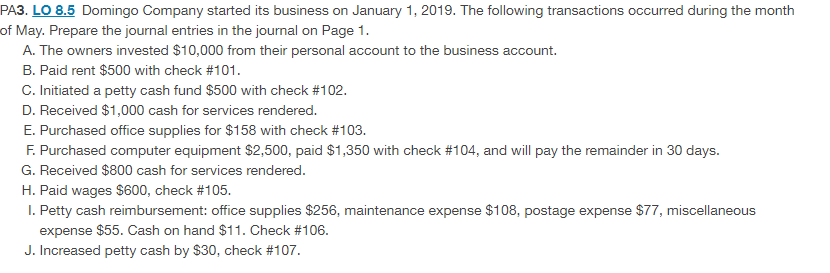

PA3. LO 8.5 Domingo Company started its business on January 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $10,000 from their personal account to the business account. B. Paid rent $500 with check #101. C. Initiated a petty cash fund $500 with check #102. D. Received $1,000 cash for services rendered. E. Purchased office supplies for $158 with check #103. F. Purchased computer equipment $2,500, paid $1,350 with check #104, and will pay the remainder in 30 days. G. Received $800 cash for services rendered. H. Paid wages $600, check #105. I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $77, miscellaneous expense $55. Cash on hand $11. Check #106. J. Increased petty cash by $30, check #107.

PA3. LO 8.5 Domingo Company started its business on January 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $10,000 from their personal account to the business account. B. Paid rent $500 with check #101. C. Initiated a petty cash fund $500 with check #102. D. Received $1,000 cash for services rendered. E. Purchased office supplies for $158 with check #103. F. Purchased computer equipment $2,500, paid $1,350 with check #104, and will pay the remainder in 30 days. G. Received $800 cash for services rendered. H. Paid wages $600, check #105. I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $77, miscellaneous expense $55. Cash on hand $11. Check #106. J. Increased petty cash by $30, check #107.

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 3PA: Domingo Company started its business on January 1, 2019. The following transactions occurred during...

Related questions

Topic Video

Question

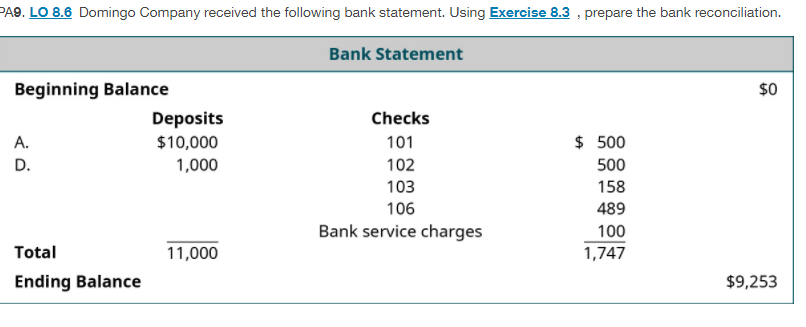

Transcribed Image Text:PA9. LO 8.6 Domingo Company received the following bank statement. Using Exercise 8.3 , prepare the bank reconciliation.

Bank Statement

Beginning Balance

$0

Deposits

Checks

A.

$10,000

101

$ 500

D.

1,000

102

500

103

158

106

489

Bank service charges

100

Total

11,000

1,747

Ending Balance

$9,253

Transcribed Image Text:PA3. LO 8.5 Domingo Company started its business on January 1, 2019. The following transactions occurred during the month

of May. Prepare the journal entries in the journal on Page 1.

A. The owners invested $10,000 from their personal account to the business account.

B. Paid rent $500 with check #101.

C. Initiated a petty cash fund $500 with check #102.

D. Received $1,000 cash for services rendered.

E. Purchased office supplies for $158 with check #103.

F. Purchased computer equipment $2,500, paid $1,350 with check #104, and will pay the remainder in 30 days.

G. Received $800 cash for services rendered.

H. Paid wages $600, check #105.

I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $77, miscellaneous

expense $55. Cash on hand $11. Check #106.

J. Increased petty cash by $30, check #107.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,