Concept explainers

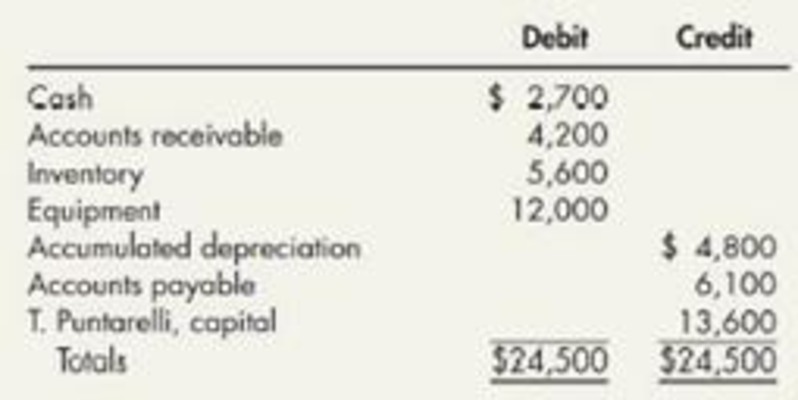

(Appendix 3.1) Cash-Basis Accounting Puntarelli Contracting keep its accounting records on a cash basis during the year. At year end, it adjusts its books to the accrual basis for preparing its financial statements. At the end of 2018, Puntarelli reported the following balance sheet items.

It is now the end of 2019. The company’s checkbook shows a balance of $4,700, which includes cash receipts from customers of $51,300 and cash payments of $49,300.

An examination of the cash payments shows that: (1) $30,600 was paid to suppliers, (2) $12,700 was paid for other operating costs (including $7,200 paid on January 1 for 2 years’ annual rent), and (3) $6,000 was withdrawn by T. Puntarelli.

On December 51, 2019, (1) customers owed Puntarelli Contracting 55,900, (2) Puntarelli owed suppliers and employees $7,000 and $900, respectively, and (3) the ending inventory was $6,300. Puntarelli is

Required:

- 1. Using accrual based accounting, prepare a 2019 income statement (show supporting calculations).

- 2. Using accrual-based accounting, prepare a December 31, 2019, balance sheet (show supporting calculations).

Trending nowThis is a popular solution!

Chapter 3 Solutions

Intermediate Accounting: Reporting And Analysis

- West End Inc., an auto mechanic shop, has the following account balances, given in no certain order, for the quarter ended March 31, 2019. Based on the information provided, prepare West Ends annual financial statements (omit the Statement of Cash Flows). Prepare West Ends annual financial statements. (Omit the Statement of Cash Flows.)arrow_forwardRefer to RE6-8. On April 23, 2020, McKinncy Co. receives a check, from Mangold Corporation for 8,500. Prepare the journal entry for McKinncy to record the collection of the account previously written off.arrow_forwardDomingo Company started its business on January 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $10,000 from their personal account to the business account. B. Paid rent $500 with check #101. C. Initiated a petty cash fund $500 with check #102. D. Received $1,000 cash for services rendered. E. Purchased office supplies for $158 with check #103. F. Purchased computer equipment $2,500, paid $1,350 with check #104, and will pay the remainder in 30 days. G. Received $800 cash for services rendered. H. Paid wages $600, check #105. I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $77, miscellaneous expense $55. Cash on hand $11. Check #106. J. Increased petty cash by $30, check #107.arrow_forward

- Inner Resources Company started its business on April 1, 2019. The following transactions occurred during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $8,500 from their personal account to the business account. B. Paid rent $650 with check #101. C. Initiated a petty cash fund $550 check #102. D. Received $750 cash for services rendered. E. Purchased office supplies for $180 with check #103. F. Purchased computer equipment $8,500, paid $1,600 with check #104 and will pay the remainder in 30 days. G. Received $1,200 cash for services rendered. H. Paid wages $560, check #105. I. Petty cash reimbursement office supplies $200, Maintenance Expense $140, Miscellaneous Expense $65. Cash on Hand $93. Check #106. J. Increased Petty Cash by $100, check #107.arrow_forwardComplex Balance Sheet Presented below is the unaudited balance sheet as of December 31, 2019, prepared by Zeus Manufacturing Corporations bookkeeper. Your company has been engaged to perform an audit, during which you discover the following information: 1. Checks totaling 14,000 in payment of accounts payable were mailed on December 31, 2019, but were not recorded until 2020. Late in December 2019, the bank returned a customers 2,000 check marked NSF, but no entry was made. Cash includes 100,000 restricted for building purposes. 2. Included in accounts receivable is a 30,000 note due on December 31, 2022, from Zeuss president. 3. During 2019, Zeus purchased 500 shares of common stock of a major corporation that supplies Zeus with raw materials. Total cost of this stock was 51,300, and fair value on December 31, 2019, was 51,300. Zeus plans to hold these shares indefinitely. 4. Treasury stock was recorded at cost when Zeus purchased 200 of its own shares for 32 per share in May 2019. This amount is included in investments. 5. On December 31, 2019, Zeus borrowed 500,000 from a bank in exchange for a 10% note payable, manning December 31, 2024. Equal principal payments are due December 31 of each year beginning in 2020. This note is collateralized by a 250,000 tract of land acquired as a potential future building site, which is included in land. 6. The mortgage payable requires 50,000 principal payments, plus interest, at the end of each month. Payments were made on January 31 and February 28, 2020. The balance of this mortgage was due June 30, 2020. On March 1, 2020, prior to issuance of the audited financial statements, Zeus consummated a non-cancelable agreement with the lender to refinance this mortgage. The new terms require 100,000 annual principal payments, plus interest, on February 28 of each year, beginning in 2021. The final payment is due February 28, 2028. 7. The lawsuit liability will be paid in 2020. 8. Of the total deferred tax liability; 5,000 is considered a current liability. 9. The current income tax expense reported in Zeuss 2019 income statement was 61,200. 10. The company was authorized to issue 100,000 shares of 50 par value common stock.arrow_forwardHajun Company started its business on May 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $5,000 from their personal account to the business account. B. Paid rent $400 with check #101. C. Initiated a petty cash fund $200 check #102. D. Received $400 cash for services rendered E. Purchased office supplies for $90 with check #103. F. Purchased computer equipment $1,000, paid $350 with check #104 and will pay the remainder in 30 days. G. Received $500 cash for services rendered. H. Paid wages $250, check #105. I. Petty cash reimbursement office supplies $25, Maintenance Expense $125, Miscellaneous Expense $35. Cash on hand $18. Check #106. J. Increased Petty Cash by $50, check #107.arrow_forward

- Lavender Company started its business on April 1, 2019. The following are the transactions that happened during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $7,500 from their personal account to the business account. B. Paid rent $600 with check #101. C. Initiated a petty cash fund $250 check #102. D. Received $350 cash for services rendered. E. Purchased office supplies for $125 with check #103. F. Purchased computer equipment $1,500, paid $500 with check #104, and will pay the remainder in 30 days. G. Received $750 cash for services rendered. H. Paid wages $375, check #105. I. Petty cash reimbursement Office Supplies $50, Maintenance Expense $80, Miscellaneous Expense $60. Cash on hand $8. Check #106. J. Increased Petty Cash by $70, check #107.arrow_forwardThe transactions completed by AM Express Company during March 2016, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March 2016, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals, and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardCromwell Company has the following trial balance account balances, given in no certain order, as of December 31, 2018. Using the information provided, prepare Cromwells annual financial statements (omit the Statement of Cash Flows).arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub