Pachel Corporation reports the following information pertaining to its accounts receivable. Days Past Due 31-60 $25,000 Current 1-30 61-90 $40,000 Over 90 $2,000 $60,000 $12,000 The company's credit department provided the following estimates regarding the percent written off from each category listed. Current receivables outstanding Receivables 1-30 days past due Receivables 31-68a days nast due 2% 4

Pachel Corporation reports the following information pertaining to its accounts receivable. Days Past Due 31-60 $25,000 Current 1-30 61-90 $40,000 Over 90 $2,000 $60,000 $12,000 The company's credit department provided the following estimates regarding the percent written off from each category listed. Current receivables outstanding Receivables 1-30 days past due Receivables 31-68a days nast due 2% 4

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 4PA: Jars Plus recorded $861,430 in credit sales for the year and $488,000 in accounts receivable. The...

Related questions

Question

ACCT 102 - Please Do Both Subparts.

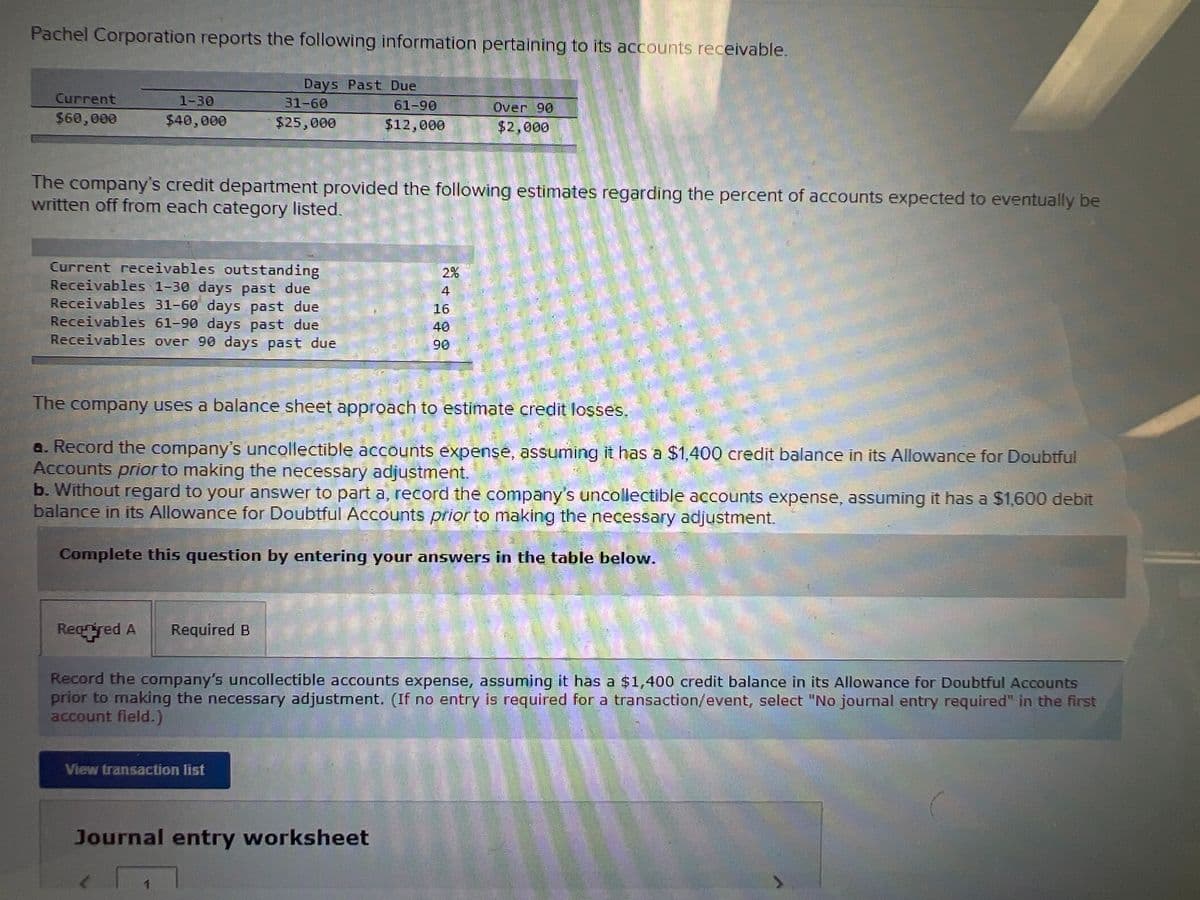

Transcribed Image Text:Pachel Corporation reports the following information pertaining to its accounts receivable.

Days Past Due

Current

1-30

31-60

61-90

Over 90

$60,000

$40,000

$25,000

$12,000

$2,000

The company's credit department provided the following estimates regarding the percent of accounts expected to eventually be

written off from each category listed.

Current receivables outstanding

Receivables 1-30 days past due

Receivables 31-60 days past due

Receivables 61-90 days past due

Receivables over 90 days past due

2%

4

16

40

90

The company uses a balance sheet approach to estimate credit losses.

a. Record the company's uncollectible accounts expense, assuming it has a $1,400 credit balance in its Allowance for Doubtful

Accounts prior to making the necessary adjustment.

b. Without regard to your answer to part a, record the company's uncollectible accounts expense, assuming it has a $1,600 debit

balance in its Allowance for Doubtful Accounts prior to making the necessary adjustment.

Complete this question by entering your answers in the table below.

Reared A

Required B

Record the company's uncollectible accounts expense, assuming it has a $1,400 credit balance in its Allowance for Doubtful Accounts

prior to making the necessary adjustment. (If no entry is required for a transaction/event, select "No journal entry required" in the first

account field.)

View transaction list

Journal entry worksheet

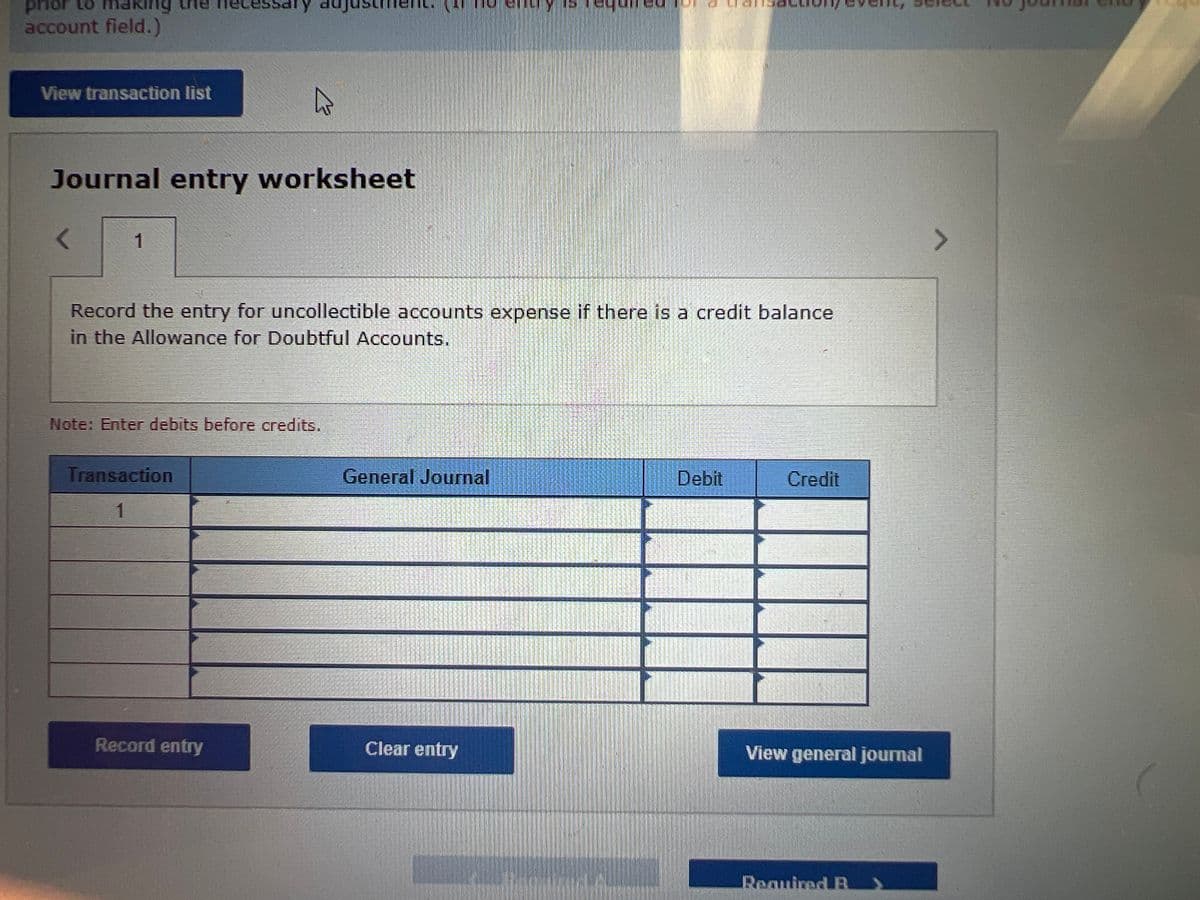

Transcribed Image Text:prior to making

account field.)

View transaction list

Journal entry worksheet

1

Record the entry for uncollectible accounts expense if there is a credit balance

in the Allowance for Doubtful Accounts.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

1

Record entry

Clear entry

View general journal

Required B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub