Pacilio Security Services, Inc. Effect of Transactions on Financial Statements - Year 5 Balance Sheet Income Statement Statement of Cash Net Assets = Liabilities + S. Equity Revenue Transaction Expenses = Flows Income 1. OA 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15.

Pacilio Security Services, Inc. Effect of Transactions on Financial Statements - Year 5 Balance Sheet Income Statement Statement of Cash Net Assets = Liabilities + S. Equity Revenue Transaction Expenses = Flows Income 1. OA 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter2: Basic Accounting Systems: Cash Basis

Section: Chapter Questions

Problem 2.1MBA

Related questions

Question

Answer full question please.

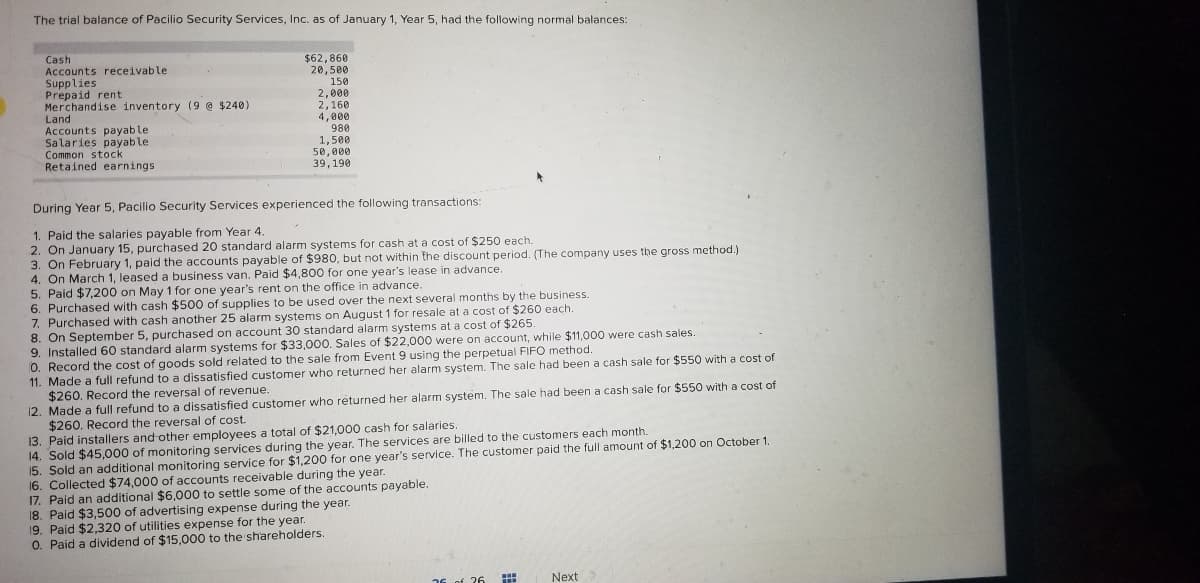

Transcribed Image Text:The trial balance of Pacilio Security Services, Inc. as of January 1, Year 5, had the following normal balances:

Cash

$62,860

20,500

Accounts receivable

Supplies

Prepaid rent

Merchandise inventory (9 @ $240)

Land

Accounts payable

Salaries payable

150

2,000

2,160

4,000

980

1,500

50,000

39,190

Common stock

Retained earnings

During Year 5, Pacilio Security Services experienced the following transactions:

1. Paid the salaries payable from Year 4.

2. On January 15, purchased 20 standard alarm systems for cash at a cost of $250 each.

3. On February 1, paid the accounts payable of $980, but not within the discount period. (The company uses the gross method.)

4. On March 1, leased a business van. Paid $4,800 for one year's lease in advance.

5. Paid $7,200 on May 1 for one year's rent on the office in advance.

6. Purchased with cash $500 of supplies to be used over the next several months by the business.

7. Purchased with cash another 25 alarm systems on August 1 for resale at a cost of $260 each.

8. On September 5, purchased on account 30 standard alarm systems at a cost of $265.

9. Installed 60 standard alarm systems for $33,00O. Sales of $22,000 were on account, while $11,000 were cash sales.

O. Record the cost of goods sold related to the sale from Event 9 using the perpetual FIFO method.

11. Made a full refund to a dissatisfied customer who returned her alarm system. The sale had been a cash sale for $550 with a cost of

$260. Record the reversal of revenue.

12. Made a full refund to a dissatisfied customer who returned her alarm system. The sale had been a cash sale for $550 with a cost of

$260. Record the reversal of cost.

13. Paid installers and other employees a total of $21,000 cash for salaries.

14. Sold $45,000 of monitoring services during the year. The services are billed to the customers each month.

15. Sold an additional monítoring service for $1,200 for one year's service. The customer paid the full amount of $1,200 on October 1.

16. Collected $74,000 of accounts receivable during the year.

17. Paid an additional $6,000 to settle some of the accounts payable.

18. Paid $3,500 of advertising expense during the year.

19. Paid $2,320 of utilities expense for the year.

0. Paid a dividend of $15,000 to the shareholders.

16 of 26

Next

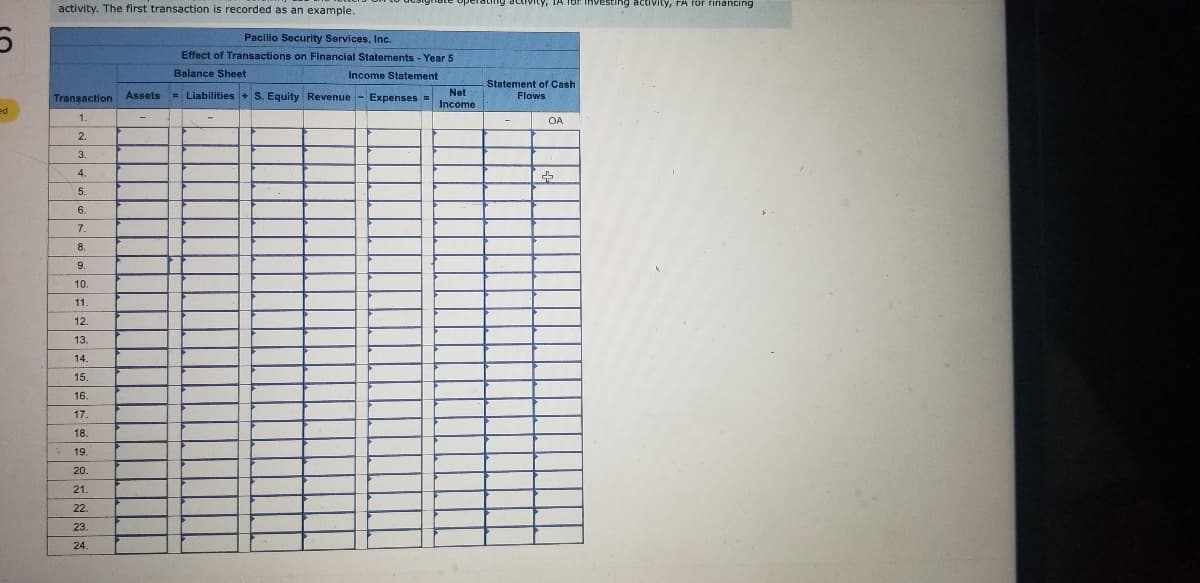

Transcribed Image Text:activity. The first transaction is recorded as an example.

activity, IA for investing activity, rA ror financing

Pacilio Security Services, Inc.

Effect of Transactions on Financial Statements - Year 5

Balance Sheet

Income Statement

Statement of Cash

Assets Liabilities + S. Equity Revenue

Net

Transaction

Expenses=

Flows

Income

ed

1.

OA

2.

3.

4.

5.

6.

7.

8.

9.

10.

11

12

13.

14.

15.

16.

17.

18.

19.

20.

21.

22

23.

24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning