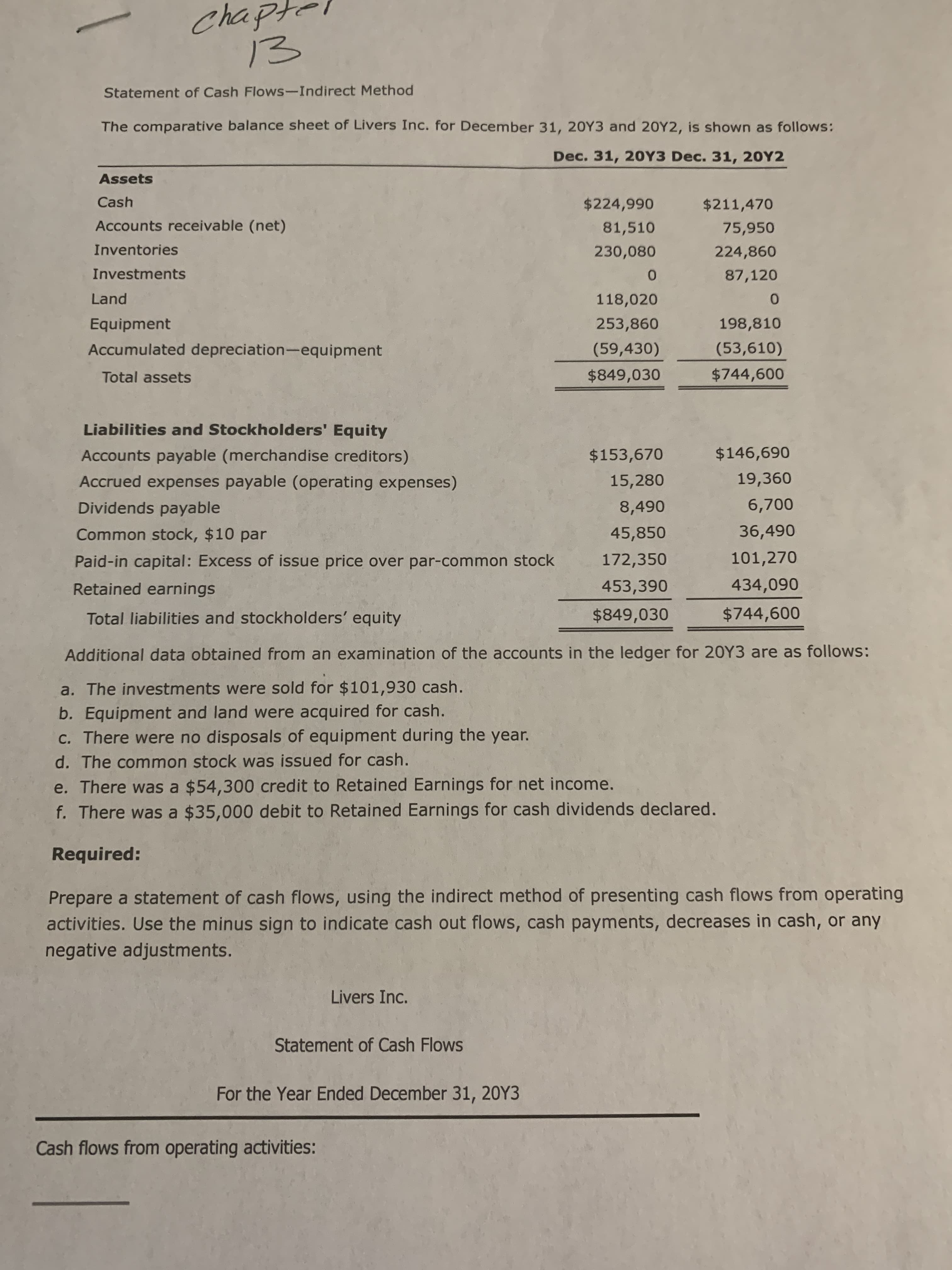

Chapter 13 Statement of Cash Flows-Indirect Method The comparative balance sheet of Livers Inc. for December 31, 20Y3 and 20Y2, is shown as follows: Dec. 31, 20Ү3 Dec. 31, 20Y2 Assets Cash $224,990 $211,470 Accounts receivable (net) 81,510 75,950 Inventories 230,080 224,860 Investments 87,120 Land 118,020 Equipment 253,860 198,810 Accumulated depreciation-equipment (59,430) (53,610) Total assets $849,030 $744,600 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $153,670 $146,690 Accrued expenses payable (operating expenses) 15,280 19,360 Dividends payable 8,490 6,700 Common stock, $10 par 45,850 36,490 Paid-in capital: Excess of issue price over par-common stock 172,350 101,270 Retained earnings 453,390 434,090 Total liabilities and stockholders' equity $849,030 $744,600 Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows: a. The investments were sold for $101,930 cash. b. Equipment and land were acquired for cash. C. There were no disposals of equipment during the year. d. The common stock was issued for cash. e. There was a $54,300 credit to Retained Earnings for net income. f. There was a $35,000 debit to Retained Earnings for cash dividends declared. Required: Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. Livers Inc. Statement of Cash Flows For the Year Ended December 31, 20Y3 Cash flows from operating activities: Adjustments to reconcile net income to net cash flow from operating activities Changes in current operabing assets and labilities: Net cash flow from operating activities Cash flows from investing activities: Net cash flow used for investing activities Cash flows from financing activities: Net cash flow from financing activities Cash at the beginning of the year Cash at the end of the year

Chapter 13 Statement of Cash Flows-Indirect Method The comparative balance sheet of Livers Inc. for December 31, 20Y3 and 20Y2, is shown as follows: Dec. 31, 20Ү3 Dec. 31, 20Y2 Assets Cash $224,990 $211,470 Accounts receivable (net) 81,510 75,950 Inventories 230,080 224,860 Investments 87,120 Land 118,020 Equipment 253,860 198,810 Accumulated depreciation-equipment (59,430) (53,610) Total assets $849,030 $744,600 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $153,670 $146,690 Accrued expenses payable (operating expenses) 15,280 19,360 Dividends payable 8,490 6,700 Common stock, $10 par 45,850 36,490 Paid-in capital: Excess of issue price over par-common stock 172,350 101,270 Retained earnings 453,390 434,090 Total liabilities and stockholders' equity $849,030 $744,600 Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows: a. The investments were sold for $101,930 cash. b. Equipment and land were acquired for cash. C. There were no disposals of equipment during the year. d. The common stock was issued for cash. e. There was a $54,300 credit to Retained Earnings for net income. f. There was a $35,000 debit to Retained Earnings for cash dividends declared. Required: Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. Livers Inc. Statement of Cash Flows For the Year Ended December 31, 20Y3 Cash flows from operating activities: Adjustments to reconcile net income to net cash flow from operating activities Changes in current operabing assets and labilities: Net cash flow from operating activities Cash flows from investing activities: Net cash flow used for investing activities Cash flows from financing activities: Net cash flow from financing activities Cash at the beginning of the year Cash at the end of the year

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter13: Statement Of Cash Flows

Section: Chapter Questions

Problem 13.1APR

Related questions

Question

Transcribed Image Text:Chapter

13

Statement of Cash Flows-Indirect Method

The comparative balance sheet of Livers Inc. for December 31, 20Y3 and 20Y2, is shown as follows:

Dec. 31, 20Ү3 Dec. 31, 20Y2

Assets

Cash

$224,990

$211,470

Accounts receivable (net)

81,510

75,950

Inventories

230,080

224,860

Investments

87,120

Land

118,020

Equipment

253,860

198,810

Accumulated depreciation-equipment

(59,430)

(53,610)

Total assets

$849,030

$744,600

Liabilities and Stockholders' Equity

Accounts payable (merchandise creditors)

$153,670

$146,690

Accrued expenses payable (operating expenses)

15,280

19,360

Dividends payable

8,490

6,700

Common stock, $10 par

45,850

36,490

Paid-in capital: Excess of issue price over par-common stock

172,350

101,270

Retained earnings

453,390

434,090

Total liabilities and stockholders' equity

$849,030

$744,600

Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows:

a. The investments were sold for $101,930 cash.

b. Equipment and land were acquired for cash.

C. There were no disposals of equipment during the year.

d. The common stock was issued for cash.

e. There was a $54,300 credit to Retained Earnings for net income.

f. There was a $35,000 debit to Retained Earnings for cash dividends declared.

Required:

Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating

activities. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any

negative adjustments.

Livers Inc.

Statement of Cash Flows

For the Year Ended December 31, 20Y3

Cash flows from operating activities:

Transcribed Image Text:Adjustments to reconcile net income to net cash flow from operating activities

Changes in current operabing assets and labilities:

Net cash flow from operating activities

Cash flows from investing activities:

Net cash flow used for investing activities

Cash flows from financing activities:

Net cash flow from financing activities

Cash at the beginning of the year

Cash at the end of the year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning