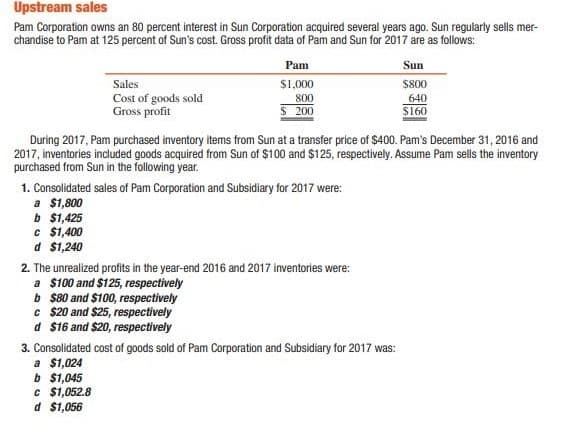

Pam Corporation owns an 80 percent interest in Sun Corporation acquired several years ago. Sun regularly sells mer- chandise to Pam at 125 percent of Sun's cost. Gross profit data of Pam and Sun for 2017 are as follows: Pam Sun Sales $1,000 $800 Cost of goods sold Gross profit 640 $160 800 200 During 2017, Pam purchased inventory items from Sun at a transfer price of $400. Pam's December 31, 2016 and 2017, inventories included goods acquired from Sun of $100 and $125, respectively. Assume Pam sells the inventory purchased from Sun in the following year. 1. Consolidated sales of Pam Corporation and Subsidiary for 2017 were: a $1,800 b $1,425 C $1,400 d $1,240 2. The unrealized profits in the year-end 2016 and 2017 inventories were: a $100 and $125, respectively b $80 and $100, respectively c $20 and $25, respectively d $16 and $20, respectively 3. Consolidated cost of goods sold of Pam Corporation and Subsidiary for 2017 was: a $1,024 b $1,045 C $1,052.8 d $1,056

Pam Corporation owns an 80 percent interest in Sun Corporation acquired several years ago. Sun regularly sells mer- chandise to Pam at 125 percent of Sun's cost. Gross profit data of Pam and Sun for 2017 are as follows: Pam Sun Sales $1,000 $800 Cost of goods sold Gross profit 640 $160 800 200 During 2017, Pam purchased inventory items from Sun at a transfer price of $400. Pam's December 31, 2016 and 2017, inventories included goods acquired from Sun of $100 and $125, respectively. Assume Pam sells the inventory purchased from Sun in the following year. 1. Consolidated sales of Pam Corporation and Subsidiary for 2017 were: a $1,800 b $1,425 C $1,400 d $1,240 2. The unrealized profits in the year-end 2016 and 2017 inventories were: a $100 and $125, respectively b $80 and $100, respectively c $20 and $25, respectively d $16 and $20, respectively 3. Consolidated cost of goods sold of Pam Corporation and Subsidiary for 2017 was: a $1,024 b $1,045 C $1,052.8 d $1,056

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 12E

Related questions

Question

Transcribed Image Text:Upstream sales

Pam Corporation owns an 80 percent interest in Sun Corporation acquired several years ago. Sun regularly sells mer-

chandise to Pam at 125 percent of Sun's cost. Gross profit data of Pam and Sun for 2017 are as follows:

Pam

Sun

Sales

$1,000

$800

Cost of goods sold

Gross profit

800

640

$ 200

$160

During 2017, Pam purchased inventory items from Sun at a transfer price of $400. Pam's December 31, 2016 and

2017, inventories included goods acquired from Sun of $100 and $125, respectively. Assume Pam sells the inventory

purchased from Sun in the following year.

1. Consolidated sales of Pam Corporation and Subsidiary for 2017 were:

a $1,800

b $1,425

c $1,400

d $1,240

2. The unrealized profits in the year-end 2016 and 2017 inventories were:

a $100 and $125, respectively

b $80 and $100, respectively

c $20 and $25, respectively

d $16 and $20, respectively

3. Consolidated cost of goods sold of Pam Corporation and Subsidiary for 2017 was:

a $1,024

b $1,045

c $1,052.8

d $1,056

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College