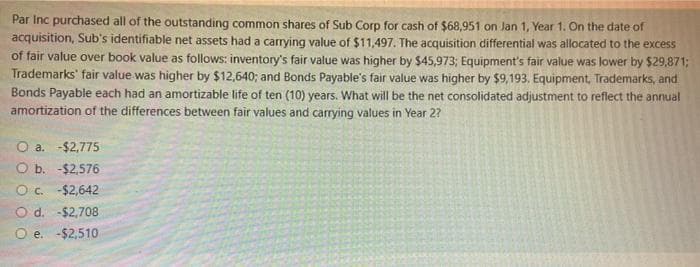

Par Inc purchased all of the outstanding common shares of Sub Corp for cash of $68,951 on Jan 1, Year 1. On the date of acquisition, Sub's identifiable net assets had a carrying value of $11,497. The acquisition differential was allocated to the excess of fair value over book value as follows: inventory's fair value was higher by $45,973; Equipment's fair value was lower by $29,871; Trademarks' fair value was higher by $12,640; and Bonds Payable's fair value was higher by $9,193, Equipment, Trademarks, and Bonds Payable each had an amortizable life of ten (10) years. What will be the net consolidated adjustment to reflect the annual amortization of the differences between fair values and carrying values in Year 2?

Par Inc purchased all of the outstanding common shares of Sub Corp for cash of $68,951 on Jan 1, Year 1. On the date of acquisition, Sub's identifiable net assets had a carrying value of $11,497. The acquisition differential was allocated to the excess of fair value over book value as follows: inventory's fair value was higher by $45,973; Equipment's fair value was lower by $29,871; Trademarks' fair value was higher by $12,640; and Bonds Payable's fair value was higher by $9,193, Equipment, Trademarks, and Bonds Payable each had an amortizable life of ten (10) years. What will be the net consolidated adjustment to reflect the annual amortization of the differences between fair values and carrying values in Year 2?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 8MC

Related questions

Question

Please help me

Transcribed Image Text:Par Inc purchased all of the outstanding common shares of Sub Corp for cash of $68,951 on Jan 1, Year 1. On the date of

acquisition, Sub's identifiable net assets had a carrying value of $11,497. The acquisition differential was allocated to the excess

of fair value over book value as follows: inventory's fair value was higher by $45,973; Equipment's fair value was lower by $29,871;

Trademarks' fair value was higher by $12,640; and Bonds Payable's fair value was higher by $9,193. Equipment, Trademarks, and

Bonds Payable each had an amortizable life of ten (10) years. What will be the net consolidated adjustment to reflect the annual

amortization of the differences between fair values and carrying values in Year 2?

O a. -$2,775

O b. -$2,576

O . -$2,642

O d. -$2,708

O e. -$2,510

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning