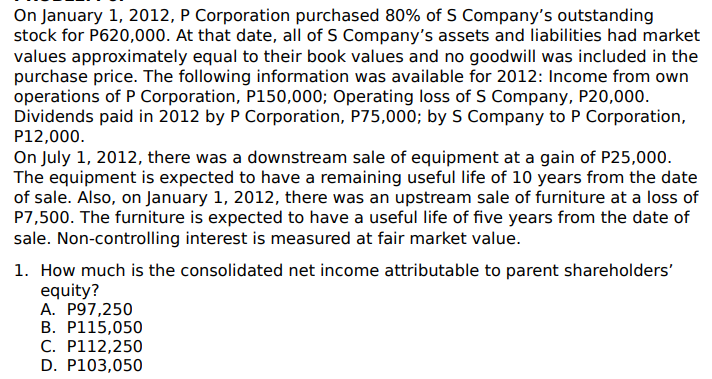

On January 1, 2012, P Corporation purchased 80% of S Company's outstanding stock for P620,000. At that date, all of S Company's assets and liabilities had market values approximately equal to their book values and no goodwill was included in the purchase price. The following information was available for 2012: Income from own operations of P Corporation, P150,000; Operating loss of S Company, P20,000. Dividends paid in 2012 by P Corporation, P75,000; by S Company to P Corporation, P12,000. On July 1, 2012, there was a downstream sale of equipment at a gain of P25,000. The equipment is expected to have a remaining useful life of 10 years from the date of sale. Also, on January 1, 2012, there was an upstream sale of furniture at a loss of P7,500. The furniture is expected to have a useful life of five years from the date of sale. Non-controlling interest is measured at fair market value. 1. How much is the consolidated net income attributable to parent shareholders' equity? A. P97,250 B. P115,050 C. P112,250 D. P103,050

On January 1, 2012, P Corporation purchased 80% of S Company's outstanding stock for P620,000. At that date, all of S Company's assets and liabilities had market values approximately equal to their book values and no goodwill was included in the purchase price. The following information was available for 2012: Income from own operations of P Corporation, P150,000; Operating loss of S Company, P20,000. Dividends paid in 2012 by P Corporation, P75,000; by S Company to P Corporation, P12,000. On July 1, 2012, there was a downstream sale of equipment at a gain of P25,000. The equipment is expected to have a remaining useful life of 10 years from the date of sale. Also, on January 1, 2012, there was an upstream sale of furniture at a loss of P7,500. The furniture is expected to have a useful life of five years from the date of sale. Non-controlling interest is measured at fair market value. 1. How much is the consolidated net income attributable to parent shareholders' equity? A. P97,250 B. P115,050 C. P112,250 D. P103,050

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 8MC

Related questions

Question

Transcribed Image Text:On January 1, 2012, P Corporation purchased 80% of S Company's outstanding

stock for P620,000. At that date, all of S Company's assets and liabilities had market

values approximately equal to their book values and no goodwill was included in the

purchase price. The following information was available for 2012: Income from own

operations of P Corporation, P150,000; Operating loss of S Company, P20,000.

Dividends paid in 2012 by P Corporation, P75,000; by S Company to P Corporation,

P12,000.

On July 1, 2012, there was a downstream sale of equipment at a gain of P25,000.

The equipment is expected to have a remaining useful life of 10 years from the date

of sale. Also, on January 1, 2012, there was an upstream sale of furniture at a loss of

P7,500. The furniture is expected to have a useful life of five years from the date of

sale. Non-controlling interest is measured at fair market value.

1. How much is the consolidated net income attributable to parent shareholders'

equity?

A. P97,250

B. P115,050

C. P112,250

D. P103,050

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning