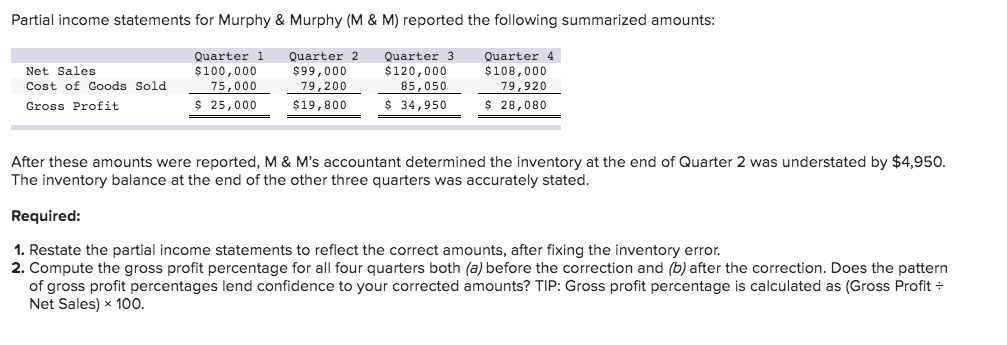

Partial income statements for Murphy & Murphy (M & M) reported the following summarized amounts: Quarter 1 $100,000 75,000 Quarter 2 $99,000 79,200 Quarter 3 $120,000 85,050 Quarter 4 $108,000 79,920 Net Sales Cost of Goods Sold Gross Profit $ 25,000 $19,800 $ 34,950 $ 28,080 After these amounts were reported, M & M's accountant determined the inventory at the end of Quarter 2 was understated by $4,950. The inventory balance at the end of the other three quarters was accurately stated. Required: 1. Restate the partial income statements to reflect the correct amounts, after fixing the inventory error. 2. Compute the gross profit percentage for all four quarters both (a) before the correction and (b) after the correction. Does the pattern of gross profit percentages lend confidence to your corrected amounts? TIP: Gross profit percentage is calculated as (Gross Profit + Net Sales) x 100.

Partial income statements for Murphy & Murphy (M & M) reported the following summarized amounts: Quarter 1 $100,000 75,000 Quarter 2 $99,000 79,200 Quarter 3 $120,000 85,050 Quarter 4 $108,000 79,920 Net Sales Cost of Goods Sold Gross Profit $ 25,000 $19,800 $ 34,950 $ 28,080 After these amounts were reported, M & M's accountant determined the inventory at the end of Quarter 2 was understated by $4,950. The inventory balance at the end of the other three quarters was accurately stated. Required: 1. Restate the partial income statements to reflect the correct amounts, after fixing the inventory error. 2. Compute the gross profit percentage for all four quarters both (a) before the correction and (b) after the correction. Does the pattern of gross profit percentages lend confidence to your corrected amounts? TIP: Gross profit percentage is calculated as (Gross Profit + Net Sales) x 100.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 38E: Sundahl Companys income statements for the past 2 years are as follows: Refer to the information for...

Related questions

Question

Transcribed Image Text:Partial income statements for Murphy & Murphy (M & M) reported the following summarized amounts:

Quarter 1

$100,000

Quarter 2

$99,000

79,200

Quarter 3

$120,000

Quarter 4

$108,000

79,920

Net Sales

Cost of Goods Sold

75,000

$ 25,000

85,050

Gross Profit

$19,800

$ 34,950

$ 28,080

After these amounts were reported, M & M's accountant determined the inventory at the end of Quarter 2 was understated by $4,950.

The inventory balance at the end of the other three quarters was accurately stated.

Required:

1. Restate the partial income statements to reflect the correct amounts, after fixing the inventory error.

2. Compute the gross profit percentage for all four quarters both (a) before the correction and (b) after the correction. Does the pattern

of gross profit percentages lend confidence to your corrected amounts? TIP: Gross profit percentage is calculated as (Gross Profit +

Net Sales) x 100.

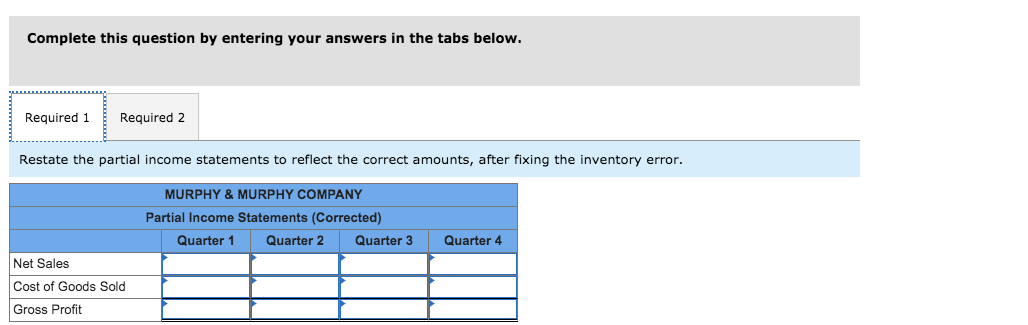

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Restate the partial income statements to reflect the correct amounts, after fixing the inventory error.

MURPHY & MURPHY COMPANY

Partial Income Statements (Corrected)

Quarter 1

Quarter 2

Quarter 3

Quarter 4

Net Sales

Cost of Goods Sold

Gross Profit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,