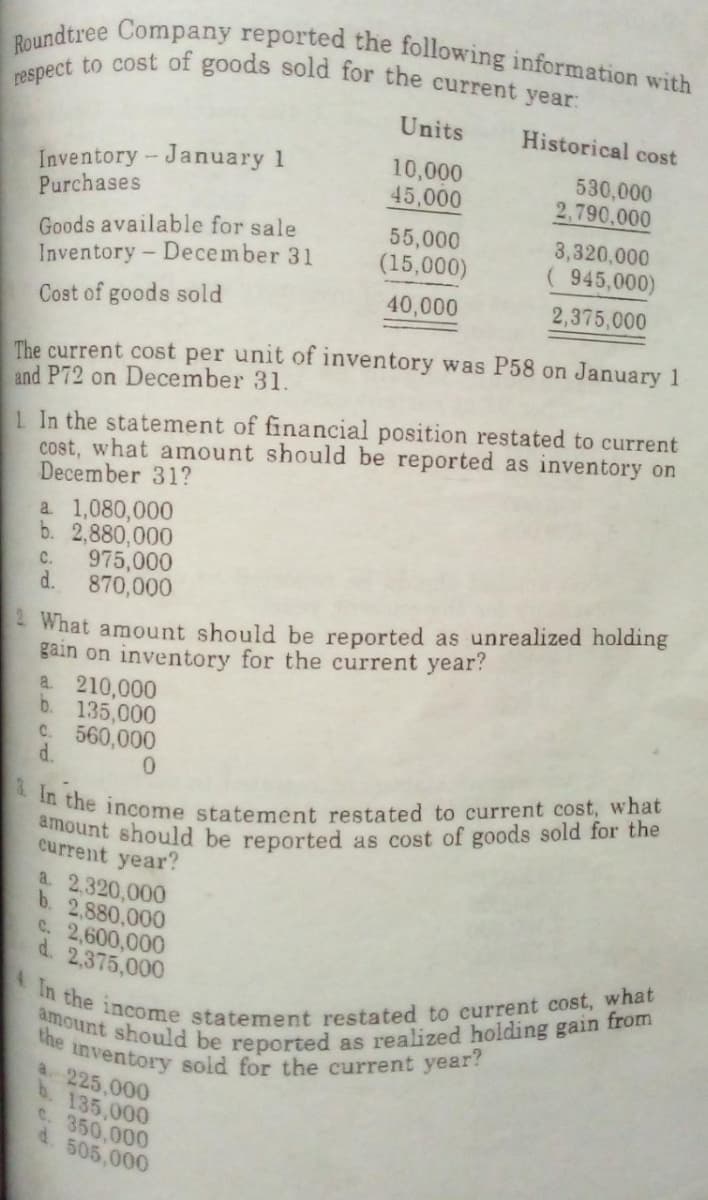

Roundtree Company reported the following information with respect to cost of goods sold for the current year: Units Historical cost 10,000 530,000 Inventory - January 1 Purchases 45,000 2,790,000 55,000 3,320,000 Goods available for sale Inventory - December 31 (15,000) ( 945,000) 40,000 2,375,000 Cost of goods sold The current cost per unit of inventory was P58 on January 1 and P72 on December 31. 1. In the statement of financial position restated to current cost, what amount should be reported as inventory on December 31? a. 1,080,000 b. 2,880,000 C. 975,000 870,000 d. 2 What amount should be reported as unrealized holding gain on inventory for the current year? a. 210,000 b. 135,000 C. 560,000 d. 0 3. In the income statement restated to current cost, what amount should be reported as cost of goods sold for the current year? a. 2,320,000 b. 2,880,000 C. 2,600,000 d. 2,375,000 4 In the income statement restated to current cost, what amount should be reported as realized holding gain from the inventory sold for the current year? a. 225,000 b. 135,000 C. 350,000 d. 505,000

Roundtree Company reported the following information with respect to cost of goods sold for the current year: Units Historical cost 10,000 530,000 Inventory - January 1 Purchases 45,000 2,790,000 55,000 3,320,000 Goods available for sale Inventory - December 31 (15,000) ( 945,000) 40,000 2,375,000 Cost of goods sold The current cost per unit of inventory was P58 on January 1 and P72 on December 31. 1. In the statement of financial position restated to current cost, what amount should be reported as inventory on December 31? a. 1,080,000 b. 2,880,000 C. 975,000 870,000 d. 2 What amount should be reported as unrealized holding gain on inventory for the current year? a. 210,000 b. 135,000 C. 560,000 d. 0 3. In the income statement restated to current cost, what amount should be reported as cost of goods sold for the current year? a. 2,320,000 b. 2,880,000 C. 2,600,000 d. 2,375,000 4 In the income statement restated to current cost, what amount should be reported as realized holding gain from the inventory sold for the current year? a. 225,000 b. 135,000 C. 350,000 d. 505,000

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 22E: Ellerson Company provided the following information for the last calendar year: During the year,...

Related questions

Topic Video

Question

Transcribed Image Text:Roundtree Company reported the following information with

respect to cost of goods sold for the current year:

Units

Historical cost

10,000

530,000

Inventory - January 1

Purchases

45,000

2,790,000

55,000

3,320,000

Goods available for sale

Inventory - December 31

(15,000)

( 945,000)

40,000

2,375,000

Cost of goods sold

The current cost per unit of inventory was P58 on January 1

and P72 on December 31.

1. In the statement of financial position restated to current

cost, what amount should be reported as inventory on

December 31?

a. 1,080,000

b. 2,880,000

C.

975,000

870,000

d.

2 What amount should be reported as unrealized holding

gain on inventory for the current year?

a. 210,000

b. 135,000

C. 560,000

d.

0

3. In the income statement restated to current cost, what

amount should be reported as cost of goods sold for the

current year?

a. 2,320,000

b. 2,880,000

C. 2,600,000

d. 2,375,000

In the income statement restated to current cost, what

the inventory sold for the current year?

amount should be reported as realized holding gain from

a 225,000

b. 135,000

C. 350,000

d. 505,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning