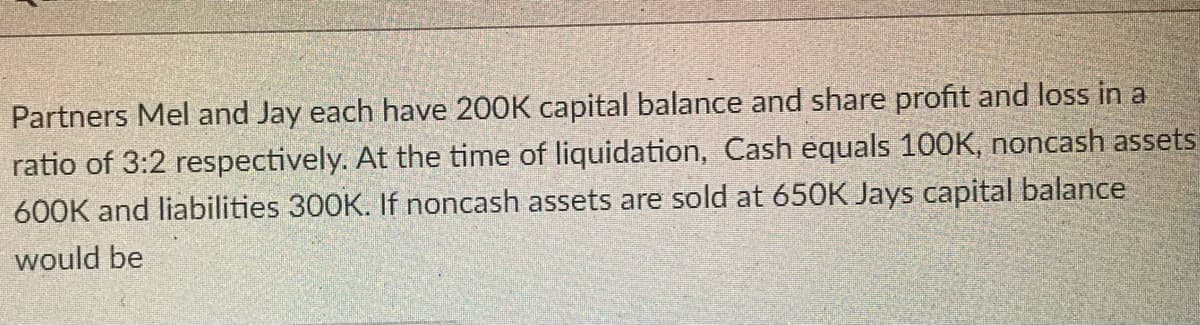

Partners Mel and Jay each have 200K capital balance and share profit and loss in a ratio of 3:2 respectively. At the time of liquidation, Cash equals 100K, noncash assets 600K and liabilities 300K. If noncash assets are sold at 650K Jays capital balance would be

Q: Determine the number of days from Actual Time to Approximate Time Loan date - July 31, 2021 Due da...

A: Actual days are the number of actual days in a month e.g. April - 30 days, may - 31 days. Approximat...

Q: Consolidation: intra-group transactions Poh Ltd owns all the share capital of Soh Ltd. The income ta...

A: Solution Journal entries records the financial transaction which a business done throughout the year...

Q: Globe Company, a real estate developer, is owned by five founding shareholders. On December 1, 2019,...

A: calculation of dividend payable are as follows:

Q: What are the characteristics of real estate, stocks, and mutual funds. Also give the similarities be...

A: What are the characteristics of real estate, stocks, and mutual funds. Also give the similarities ...

Q: ABC Corporation presented the following information in its 2021 statement of financial position: Co...

A: Journal entry is the first step in recording financial transactions in the books of the company. It ...

Q: Campbell Pointers Corporation expects to begin operations on January 1, year 1; it will operate as a...

A: Answer a) Sales Budget for First Quarter January February March Quarter Sales $...

Q: 1. Prepare Appropriations, Encumbrances, Expenditure and Fund Balance Ledger from the following info...

A: Ledger- A ledger is a book or assortment of accounts in which account dealings are recorded. Every a...

Q: Instructions: Identify each of the following accounts as an asset, Liability or Equity. ACCOUNTS Own...

A: Introduction: Balance sheet: All Assets and liabilities are shown in Balance sheet. It tells the net...

Q: AA and BB are parthers who have capital of P600,000 and P480,000 sharing profits in the ratio of 3:2...

A: Bonus method gives the additional capital to the incoming partner in case of goodwill brought by the...

Q: Financial data for Joel de Paris, Incorporated, for last year follow: Joel de Paris, Incorporate...

A: Solution Calculation of Total operating assets- Beginning balance Ending balance Cash 12800...

Q: The distribution of a dividend that represents a partial return of the original investment made by t...

A: Dividend is the disbursement of profit in consideration to the shares purchased by the shareholders....

Q: Record the following transactions to the journal and post it to the T-accounts. Make a footing and g...

A: The first step of recording any transaction is a journal entry. A Journal book is a book of the firs...

Q: Assume the following independent events occurred during 2022. Identify the most relevant accounting ...

A: The balance sheet and income statement are the important financial statements of the business, where...

Q: The distribution of a dividend t original investment made by th

A: This is a multiple-choice question in which we have to select the correct option.

Q: On which of the following dates related to the declaration and payment of dividends is a journal ent...

A: dividends will be declared first and then the payment for the same will be made. generally dividend...

Q: Instructions Labels and Amount Descriptions Statement of Stockholders' Equity Final Question Instruc...

A: Common Stock Closing balance = Common stock opening balance + Common stock issued Retained earnings ...

Q: Prepare all journal entries Dec Mahmood invested $25,000 cash in his business. Paid office rent for ...

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in...

Q: Unadjusted account balances at December 31, 2019, for Rapisarda Company are as follows: ...

A: Journal Entries Date Account Titles and Explanation Debit Credit A Depreciation Expenses $...

Q: Sylvia and Strained Ltd. made a joint election under section 85, electing a transfer price of $40,00...

A: Sylvia is the sole shareholder of Strained Ltd, a taxable Canadian corporation. Sylvia transferred...

Q: Central Avenue Company reported net income of P700,000 for the year 2021. The entity declared and pa...

A: Retained earning means the amount of profit that has not been distributed to shareholder as divided....

Q: Feal-Goode Inc. purchased a patent on a new drug. The patent cost $12,000. The patent has a life of ...

A: Formula: Amortization expense = Patent cost / Useful life years

Q: The total capital investment for a proposed chemical plant, which will produce $1,500,000 worth of g...

A: GIVEN The total capital investment for a proposed chemical plant, which will produce $1,500,000 wo...

Q: The units of Manganese Plus available for sale during the year were as follows: Mar. 1 Inventory 20...

A: Inventory cost by the average cost method=Ending Inventory Units×Total Cost Goods Available for Sale...

Q: Tweedle Jackets make and sell Tweed Jackets, which never go out of style. Tweedle Jackets uses a pro...

A: The reason why the company is determining the actual cost for the month and the budgeted cost for th...

Q: Placid Lake Corporation acquired 80 percent of the outstanding voting stock of Scenic, Inc., on Janu...

A: Disclaimer: As posted multiple sub parts questions we are answering first three sub parts only kindl...

Q: Market Makers Incorporated (MMI) provides a range of services to its retail clients-customer service...

A: Idle capacity is the one which can be achieved without incurring extra costs. Idle capacity is the s...

Q: Prepare all the necessary journal entries related to the machine from 30 June 2019 to 30 June 2021.

A: For the Period ending 30th June 2019, Particulars Dr/Cr Amount($) (1) Machinery Account Dr 2005...

Q: The number of days from 14 March, 2023 to 17 August, 2023 using 30/360 is: O A 153 O B. 156 O. 155 O...

A: The question pertains to counting the number of days on the basis of 30/360 between two specific dat...

Q: On July 1, 2021, PASSETS acquired all the net assets of SIABS at its underlying book value, which re...

A: Acqusition cost in Business combination Acqusition cost which are incurred at the time of the busine...

Q: The following are the transactions during the year: [a] Cost of equipment acquired on January 1 for ...

A: Income Statement The purpose of preparing the income statement is to know the net income which are d...

Q: Nevada Corporation has 68,200 shares of $25 par stock outstanding that has a current market value of...

A: Note: On stock split, no. of shares will increase of the company. Stock split does not impact the ov...

Q: Rick and Cindy Davis are married and file a joint return. They live at 3223 Taccone Ave., Apt. 37, M...

A: Form 1040 and schedule 1 are filled by downloading excel Federal tax spreadsheet for 2020. Along wit...

Q: advantages and disadvantages of the scattergram method as compared to the high-low method?

A: Solution High-low method takes high level activity and low level activity and measure the total cost...

Q: review of interim financial statements or information is not a common type of review engagement. TRU...

A: A review engagement is an activity that provides assurance that no major modifications are made to t...

Q: 3. (a) Lexington Homes plans to issue $1 million in unsecured, non-callable bond. This debt pays an ...

A: Comment- We’ll answer the first question since the exact one wasn’t specified. Please submit a new ...

Q: Which of the following statements regarding intellectual and tangible objects is TRUE? A. Intellectu...

A: Intellectual property or intangible property means something which is not in a physical form but is ...

Q: 2. A company manufactures and sells a single product which has the following cost and selling price ...

A: Lets understand the basics. Break even point is a point at which no profit/no loss condition arise. ...

Q: Greek Manufacturing Company produces and sells a line of product that are sold usually all year roun...

A: Solution Margin of safety is the difference between the break even point and actual sale .

Q: The estimated amount of depreciation on equipment for the current year is $8,255. Journalize the adj...

A: Depreciation (begin an expense) is debited. Accumulated depreciation Account (contra asset) is credi...

Q: this date, the c

A: Introduction Investments in company for less than 50% is accounted using equity method. Under this ...

Q: ESPAÑOL INGLÉS FRANCÉS On which of the following dates related to the declaration and payment of div...

A: The date of record is the date upon which a corporation reviews its records to determine who the cor...

Q: Using the following balance sheet and income statement data, what is the debt to assets ratio? Curre...

A: Formula: Debt to assets ratio = ( Total liabilities / Total assets ) x 100

Q: Historical cost numbers are usually harder than market value numbers select one : True, or , Fals...

A: Historical cost: It is the cost of acquisition or say it is initial cost when customer acquire the a...

Q: DEBIT CREDIT 1.Equipment Capital 1. The owner invests equipment in the business. 2. The company rece...

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in...

Q: Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Inco...

A: A common size income statement is an income statement in which each line item is expressed as a perc...

Q: Gelbart Company manufactures gas grills. Fixed costs amount to $16,192,800 per year. Variable costs ...

A: Lets understand the basics. Break even point is a point at which no profit/no loss condition arise. ...

Q: A Manager of MUUG Corporation received the following remunerat Gross salaries, net of SSS, PHIC and ...

A: Manager of MUUG Corporation received following Compensation Gross Salaries, Net of SSS, PHIC an...

Q: 28 Total sleep time of college students. In Example 4, the total sleep time per night among college ...

A: Solution:- Given, Mean μ = 6.78 hours Standard deviation σ = 1.24 hours SRS of size n = 150

Q: A. She can work at McCray-Hall educational publishing as an editor with a salary of $46,500 per year...

A: The salary calculation is made general weekly or monthly. In many cases, salary/ wages per day or pe...

Q: Using the following information: The bank statement balance is $5,002. The cash account balance is ...

A: Bank reconciliation statement is a statement in which reconciliation between the balance stated in t...

Step by step

Solved in 2 steps

- Partners Biore and Selishana each have P450,000 capital balance and share profits and losses in a 3:2 ratio. Cash equals P150,000, non-cash assets equal P1,500,000 and liabilities equal P750,000. If non-cash assets are sold for P1,000,000, the change in Selishana's capital account will be:The Sheen, Jimmy and Carl partnership had the following balance sheet just before entering liquidation: Cash P10,000 Liabilities P130,000 Noncash assets 300,000 Sheen, capital 60,000 Jimmy, capital 40,000 Carl, capital 80,000 P310,000 P310,000 Sheen, Jimmy and Carl share profits and losses in a ratio of 2:4:4. Non-cash assets were sold for P180,000. Liquidation expenses were P10,000. Assume that Jimmy was personally insolvent and could not contribute any assets to the partnership, while Sheen and Carl were both solvent. What amount of cash would Sheen receive from the distribution of partnership assets?Partners Thomas, Adams and Jones have capital balances of $24,000, $45,000, and $90,000 respectively. They split profits in the ratio of 3:3:4, respectively. Under a predistribution plan, one of the partners will get the following total amount in liquidation before any other partners get anything: a. P22,500 b. P30,000 c. P40,000 d. P75,000

- Partners Nina, Ricci, and Guess, who share profit and losses in the ratio of 2:2:1, respectively, decided to liquidate. The condensed statement of financial position account balances just prior to the liquidation are: Cash-P 100,000; Other assets-P 400,000; Liabilities - P 140.000: Nina, Loan-P 10,000; Nina, Capital-P45,000: Ricci, Capital -P 105.000; Guess, Capital - P200,000. After paying the llabilities to partnership creditors, cash of P207,500 is available for distribution to partners. Any capital deficiency is made good by the deficient partner, since all three partners are personally solvent. how much would Nina receive in the final settlement of his interest? how much would Guess receive in the final settlement of his interest?Partners Nina, Ricci, and Guess, who share profit and losses in the ratio of 2:2:1, respectively, decided to liquidate. The condensed statement of financial position account balances just prior to the liquidation are: Cash-P 100,000; Other assets-P 400,000; Liabilities - P 140.000: Nina, Loan-P 10,000; Nina, Capital-P45,000: Ricci, Capital -P 105.000; Guess, Capital - P200,000. After paying the llabilities to partnership creditors, cash of P207,500 is available for distribution to partners. Any capital deficiency is made good by the deficient partner, since all three partners are personally solvent. How much was the loss on realization? how much would Nina receive in the final settlement of his interest? how much would Ricci receive in the final settlement of his interest?On November 10, 2020, Maher, Saher, and Taher, partners of Maher, Saher, & Taher LLP, had capital account balances of $40,000, $50,000, and $18,000, respectively, and shared net income and losses in a 4 : 2 : 1 ratio respectively. the Capital per unit of income sharing ratio for Maher would be: a. $40,000. b. $10,000. c. $20,000. d. $25,000.

- ABC Corporation currently has $20,000 in cash, $30,000 in noncash assets, and liabilities of $35,000. The partners, Adrian, Batch, and Crenshaw, had capital balances of $5,000, $8,000, and $2,000, respectively. The partners share a profit and loss ratio of 1:1:3. The noncash assets were sold for $60,000. Complete the liquidation chart below.On January 1, 2012 partners Aiko and Mina have capital balances of P500,000 and P280,000, respectively. They share profit and losses equally. On this date, they decided to admit Ruffa for a 40% interest in capital and profits. Ruffa paid P450,000 directly to Aiko and Mina. How much should be the new capital balances of Aiko and Mina, respectivelyThe balance sheet accounts of partners Pacman, Marquez and Mayweather before liquidation are the following: Cash, P360,000; Non-Cash Assets, P1,785,000; Liabilities, P1,000,000; Pacman, Capital (50%), P460,000; Marquez, Capital (30%), P365,000 and Mayweather, Capital (20%), P320,000. On the first month of liquidation, certain assets with a book value of P1,200,000 are sold for P960,000. Liquidation expenses of P30,000 are paid and additional expenses are anticipated. Liabilities are paid amounting to P362,000, and sufficient cash is retained to insure the payment to creditors before making payment to partners. In the first payment of cash to partners, Marquez received P107,000.

- The balance sheet of Maroon and White was as follows immediately prior to the partnership's being liquidated: cash, P20,000; other assets, P160,000; liabilities, P40,000; Maroon capital, P60,000; White capital, P80,000. The other assets were sold for P139,000. Maroon and White share profits and losses in a 2:1 ratio. As a final cash distribution from the liquidation, how much cash will Maroon receive? Prepare a statement of liquidation.The Keaton, Lewis, and Meador partnership had the following balance sheet just before entering liquidation:Cash $ 100,000 Noncash assets 210,000 Total $ 310,000 Liabilities 40,000 Keaton, capital 90,000 lewis, capital 60,000 Meador, capital 120,000 total 310,000 Keaton, Lewis, and Meador share profits and losses in a ratio of2:4:4. Assuming noncash assets were sold for $60,000 and liquidation expenses inthe amount of $10,000 were incurred, how much will each partner receive in the liquidation? Keaton Lewis MeadorA) $40,000 $26,667 $ 53,333B) $24,000 $48,000 $ 48,000C) $56,667 $ 0 $ 53,333D) $ 0 $ 0 $120,000E) $36,000 $12,000 $ 72,000Partners Ong, Rodriguez, Pamittan and Reyes who share profits andlosses at 30%, 30%, 20% and 20%, respectively, decided to liquidate. Allpartnership assets are to be converted into cash. Before liquidation, thecondensed statement of financial position follows:Cash P100, 000 Liabilities P750, 000Other Assets 1, 800, 000 Rodriguez, Loan 60, 000Reyes, Loan 50, 000Ong, Capital 420, 000Rodriguez, Capital 315, 000Pamittan, Capital 205, 000Reyes, Capital 100, 000Total P1, 900,000P1, 900,000The non-cash assets realized P800, 000, resulting to a loss of P1, 000,000. All the partners are solvent, and can contribute any additional cash tocover any deficiency. In the process of liquidation, deficiencies will occur andwill require additional investment as follows:a. Pamittan at P7, 500b. Reyes at P50, 000c. Reyes and Pamittan for P50, 000 and P7, 500, respectivelyd. None