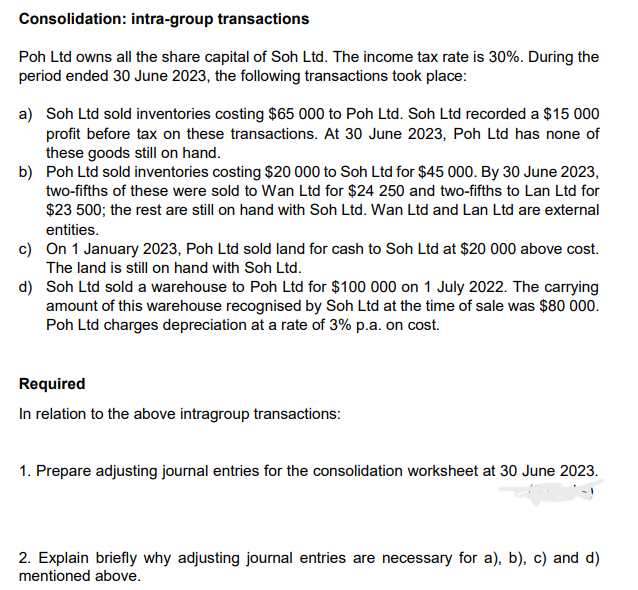

Consolidation: intra-group transactions Poh Ltd owns all the share capital of Soh Ltd. The income tax rate is 30%. During the period ended 30 June 2023, the following transactions took place: a) Soh Ltd sold inventories costing $65 000 to Poh Ltd. Soh Ltd recorded a $15 000 profit before tax on these transactions. At 30 June 2023, Poh Ltd has none of these goods still on hand. b) Poh Ltd sold inventories costing $20 000 to Soh Ltd for $45 000. By 30 June 2023, two-fifths of these were sold to Wan Ltd for $24 250 and two-fifths to Lan Ltd for $23 500; the rest are still on hand with Soh Ltd. Wan Ltd and Lan Ltd are external entities. c) On 1 January 2023, Poh Ltd sold land for cash to Soh Ltd at $20 000 above cost. The land is still on hand with Soh Ltd. d) Soh Ltd sold a warehouse to Poh Ltd for $100 000 on 1 July 2022. The carrying amount of this warehouse recognised by Soh Ltd at the time of sale was $80 000. Poh Ltd charges depreciation at a rate of 3% p.a. on cost. Required In relation to the above intragroup transactions: 1. Prepare adjusting journal entries for the consolidation worksheet at 30 June 2023. 2. Explain briefly why adjusting journal entries are necessary for a), b), c) and d) mentioned above.

Consolidation: intra-group transactions Poh Ltd owns all the share capital of Soh Ltd. The income tax rate is 30%. During the period ended 30 June 2023, the following transactions took place: a) Soh Ltd sold inventories costing $65 000 to Poh Ltd. Soh Ltd recorded a $15 000 profit before tax on these transactions. At 30 June 2023, Poh Ltd has none of these goods still on hand. b) Poh Ltd sold inventories costing $20 000 to Soh Ltd for $45 000. By 30 June 2023, two-fifths of these were sold to Wan Ltd for $24 250 and two-fifths to Lan Ltd for $23 500; the rest are still on hand with Soh Ltd. Wan Ltd and Lan Ltd are external entities. c) On 1 January 2023, Poh Ltd sold land for cash to Soh Ltd at $20 000 above cost. The land is still on hand with Soh Ltd. d) Soh Ltd sold a warehouse to Poh Ltd for $100 000 on 1 July 2022. The carrying amount of this warehouse recognised by Soh Ltd at the time of sale was $80 000. Poh Ltd charges depreciation at a rate of 3% p.a. on cost. Required In relation to the above intragroup transactions: 1. Prepare adjusting journal entries for the consolidation worksheet at 30 June 2023. 2. Explain briefly why adjusting journal entries are necessary for a), b), c) and d) mentioned above.

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 15CE

Related questions

Question

help me to solve this problem

Transcribed Image Text:Consolidation: intra-group transactions

Poh Ltd owns all the share capital of Soh Ltd. The income tax rate is 30%. During the

period ended 30 June 2023, the following transactions took place:

a) Soh Ltd sold inventories costing $65 000 to Poh Ltd. Soh Ltd recorded a $15 000

profit before tax on these transactions. At 30 June 2023, Poh Ltd has none of

these goods still on hand.

b) Poh Ltd sold inventories costing $20 000 to Soh Ltd for $45 000. By 30 June 2023,

two-fifths of these were sold to Wan Ltd for $24 250 and two-fifths to Lan Ltd for

$23 500; the rest are still on hand with Soh Ltd. Wan Ltd and Lan Ltd are external

entities.

c) On 1 January 2023, Poh Ltd sold land for cash to Soh Ltd at $20 000 above cost.

The land is still on hand with Soh Ltd.

d) Soh Ltd sold a warehouse to Poh Ltd for $100 000 on 1 July 2022. The carrying

amount of this warehouse recognised by Soh Ltd at the time of sale was $80 000.

Poh Ltd charges depreciation at a rate of 3% p.a. on cost.

Required

In relation to the above intragroup transactions:

1. Prepare adjusting journal entries for the consolidation worksheet at 30 June 2023.

2. Explain briefly why adjusting journal entries are necessary for a), b), c) and d)

mentioned above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning