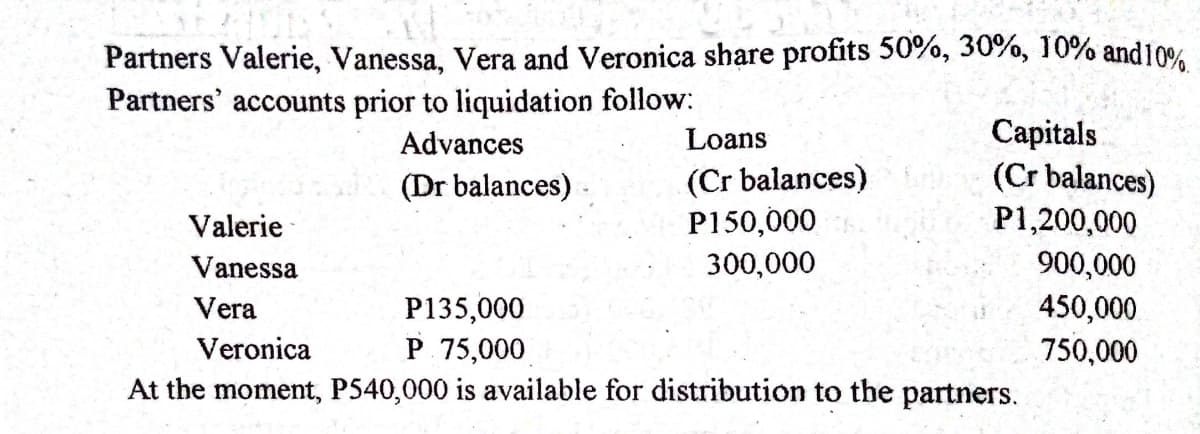

Partners Valerie, Vanessa, Vera and Veronica share profits 50%, 30%, 10% and10% Partners' accounts prior to liquidation follow: Capitals (Cr balances) P1,200,000 Advances Loans (Cr balances) P150,000 (Dr balances) Valerie Vanessa 300,000 900,000 450,000 750,000 Vera P135,000 Veronica P 75,000 At the moment, P540,000 is available for distribution to the partners.

Q: Classify the following items that may cause discrepancy between accounting profit and taxable income...

A: 1. Taxable temporary difference because tax will be charged on the insurance premium in future when ...

Q: Rey Custom Electronics (RCE) sells and installs complete security computer, audia, and video systems...

A: A budgeted cost is a projected future expenditure that the organization expects to incur. In other w...

Q: Ayayai Ltd. had the following 2020 income statement data: Sales $205,600 Cost of goods sold 119,400 ...

A: The Cash Flow statement shows the flows of cash and cash equivalent during the period under report. ...

Q: Hyatt Manufacturing Company reports the following balances at December 31, 2012: Sales Revenue Cost ...

A: Cost of goods sold = Opening stock + Purchases + Manufacturing overhead - Closing stock Cost of goo...

Q: can you help me with D,E,F,G,and H

A: AIS termed as Accounting information system which refers to the structure that companies report, col...

Q: A-A used piece of rental equipment has 1 1/2 years of useful life remaining. When rented, the equipm...

A: Time Value of money is the change in the value of money due to the increase in the value of money du...

Q: Which of the following statements is the most reasonable conclusion from the given information below...

A: Quick ratio is a popular liquidity ratio. This ratio is also known as acid test ratio. This along wi...

Q: The HEYBM CORPORATION presented the following in order to aid the accountant in preparing the CFS (D...

A: Solution Concept There are two methods of preparing cash flow statement , direct and indirect method...

Q: Pie Corporation acquired 75 percent of Slice Company's ownership on January 1, 20X8, for $99,000. At...

A: Consolidation Accounting It is the method to combine financial results of subsidiary companies into...

Q: In a business, who is responsible for setting standard costs, and who is responsible if there are ne...

A: A good system of standard costing ensures that the right staff are both rewarded and blamed when the...

Q: One element of the general transfer-pricing rule is opportunity cost. Briefly define the term 'oppor...

A: Opportunity cost is the benefit foregone from choosing the next best alternative in a decision makin...

Q: The Tolar Company has 400 obsolete desk calculators that are carried in inventory at a total histori...

A: Opportunity costs = Revenue from sale of upgraded calculator - Additional costs

Q: R. Pedro Penduko resigned in 2019 after 20 years of service. He had the following income during the ...

A: Gross Income While calculating the gross income there are number of items which are exemption from t...

Q: The annual report is considered by some to be the single most important printed document that compan...

A: Annual reports are the report which is prepared once in the year,in this report everything is given ...

Q: QUESTION 9 On July 1, 2015, ABC Corporation purchased a patent asset for $21,600 and a trademark ass...

A: Amortization expense is the write-off of an intangible asset over its anticipated useful life, indic...

Q: Mobile Video Systems sold land, investments, and issued their own common stock for $11 million, $16 ...

A: Cash flow from Financing activities: It includes transactions relating to debt, equity, and dividend...

Q: Nicole organized a new corporation. The corporation began business on April 1 of year 1. She made th...

A: Organizational expenditures are those that are directly related to the formation of the company. Cap...

Q: Required Information Use the following information for the Exercises below. [The following informati...

A: Solution:- Straight line method is one of the depreciation method. It is simplest method compared to...

Q: Zama Brooks Ltd is a company that has been known to have bad results for the past three years. Our c...

A: A takeover occurs when one company gets successful in biding to take control over another company’s ...

Q: Henrich is a single taxpayer. In 2021, his taxable income is $454,000. What is his income tax and ne...

A: Calculation of taxable income Particulars Amount Gross taxable income 454000 Less: Standard d...

Q: Kendall, who earned $130,800 during 2021, is paid on a monthly basis, is married, (spouse does not w...

A: Federal tax withholding is the amount of money deducted from salary of an individual by his employer...

Q: Straight-Line, Declining-Balance, and Sum-of-the-Years'-Digits Methods A light truck is purchased on...

A: The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage a...

Q: An insurance premium of $6,300 was paid on March 1, 2020, and was charged to Prepaid Insurance. The ...

A: The question is based on the concept of Financial Accounting.

Q: Concept Review 3.5- Please go to page 152 of the textbook. Please complete the Financial Planning C...

A: Hi! Thank you for the question, As per the honor code, we are allowed to answer three sub-parts at a...

Q: Currently, the spot exchange rate is $153E and the three-month forward exchange rate is $1.55/E The ...

A: ANSWER A)INTEREST RATE PARITY IS CURRENTLY WITHHOLDING THE CORRECT ANSWER IS NO EXPLANATION ...

Q: Assuming that Kennel does use the equity method, what amount will it report on its statement of inco...

A: Introduction: One of 3 financial Statements is that the financial statement. The financial statement...

Q: a. Return on investment b. Owners' wealth C. Sales revenue

A: The financial objective of any business is usually growing in the profits and expansion of their bus...

Q: Tech Manufacturing Company realized P15,000,000 in sales, with a cost of goods sold of P6,000,000, g...

A: The ratio analysis helps to analyze the financial statements of the business. The Return on assets i...

Q: A company’s year-end balance in accounts receivable is $2,600,000. The allowance for uncollectible a...

A: Accounts written off = Beginning balance of allowance for uncollectible accounts + bad debt expense ...

Q: Jade began operations on January 1, 2020. From 2020 to 2022, Jade provided for doubtful accounts bas...

A: Answer 3) While using allowance for doubtful debts using ageing schedule, the balance of allowance f...

Q: Required: 1. Prepare the projected income statement of Gospel Company. 2. How much is the net income...

A: Income statement refers to a statement which shows the revenue and expense of the company of a parti...

Q: Cash flows It is typical for Jane to plan, monitor, and assess her financial position using cash flo...

A: ANSWER A) 1. Calculation of total cash inflow Interest received =$440 Salary ...

Q: Assess and identify the parent/acquirer that will direct the relevant activities of theinvestee Zeu...

A: Here given the details of the identification of parent and acquirer for the given transaction which ...

Q: Jerome's Fashion Dezigns sells a variety of items of clothing including footwear for men and uses a ...

A: The question is related to First in First out method of inventory valuation. The details are given r...

Q: sp Corporation has one temporary difference at the end of 2020 that will reverse and causedeductible...

A: Temporary difference is the difference between pretax financial income and the taxable income that w...

Q: Galvanized Products is considering the purchase of a new computer system for their enterprise data m...

A: In this question firm wants to buy a new computer system.It will require an initial investment of $...

Q: I need the answer as soon as possible

A: It is a multiple-choice question, In which we have to find out which option is correct.

Q: Interpreting Information in the Statement of Shareholders' Equity The 2014 statement of stockholders...

A: Treasury Stock- The Treasury stock is also known as shareholder's reclaimed stock, which refers to s...

Q: Direct materials cost Janitor's salary Property taxes Direct labor cost Packaging costs Equipment de...

A: Fixed costs: Fixed costs means the costs that do not vary with the level of production of goods or s...

Q: Is it possible to fully eliminate non-value added activities? If yes, how? If no, why?

A: Value can simply be defined as something which the customer is willing to pay or receive. Non Value ...

Q: find out value of account receivable from following Cash $ 48,000 account payable $ 33,000 office eq...

A: Formula: Accounting equation: Assets = Liabilities + Owners equity

Q: On June 30, a company has currency of $1,236, a checking account with $45,877 on deposit, and a CD w...

A: Cash and cash equivalents are the balance-sheet line items that indicate the value of a company's as...

Q: Income statement preparation Adam and Arin Adams have collected their personal income and expense in...

A: Income and expenses statement in personal finance refers to the statement which comprises of all rel...

Q: The assets in value by $billion. (Round your response to one decimal place.) The liabilities in valu...

A: Interest is the return which a depositor or a bank gets from the amount of loan which has been given...

Q: The HEYBM CORPORATION presented the following in order to aid the accountant in preparing the CFS: (...

A: 1. Statement of Cash Flow - Cash Flow is the statement prepared by the organization for the purpose ...

Q: Help me answer problem 1 and 2 thank

A: An account receivable is defined as it is money that has not been paid by customers after using the ...

Q: Vhich of the following statements is the most reasonable conclusion from the given formation below o...

A: Solution Concept Return on equity is given as =net profit/total equity Working note ROE of ABC compa...

Q: If the non-cash assets are sold for P700,000 and both partners agree to make up for any capital defi...

A: Solution:- Given, Partners Biore and Selisana each have a P450,000 capital balance Profits and loss...

Q: On July 1, 2022, Damlen Jurado Company pays $12.000 to its insurance company for a 2-year insurance ...

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in...

Q: Inventories Beginning $34,000 135,000 110,000 Ending $40,000 150,000 102,000 Raw Materials Work in p...

A: Conversion cost: This is the cost of converting raw materials into finished goods. These costs incl...

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

- Partners WAG, MAG, PANG, and GAP, shares profits at the ratio 5:3:1:1. OnJune 30, relevant partners’ accounts follow: Advances Loans Capital Dr. Cr. Cr. WAG 20,000 160,000MAG 40,000 120,000PANG 18,000 60,000GAP 10,000 100,000On this day, cash of P72,000 is declared as available for distribution topartners as profits.How much will partner Gap receive from the 72,000 if he has a hare in it?Partners WAG, MAG, PANG, and GAP, shares profits at the ratio 5:3:1:1. OnJune 30, relevant partners’ accounts follow: Advances Loans Capital Dr. Cr. Cr. WAG 20,000 160,000MAG 40,000 120,000PANG 18,000 60,000GAP 10,000 100,000 On this day, cash of P72,000 is declared as available for distribution topartners as profits. How much will partner Gap receive from the 72,000 if he has a hare in it?Show the compleete solution. A balance sheet for the JPM Partnership, who shares profits in the ratio of 50:25:25 for partners shows the following balances just before liquidation: Cash P113,000 Other Assets 562,275 Liabilities 188,825 J Capital 207,900 P Capital 146,650 M, Capital 132,300 ON the first month of liquidation, certain assets with a book value of 500,000 were sold for 375,000. Liquidation expenses of P9450 are paid and additional liquidation expenses are anticipated. Liabilities are paid amounting to P51,500 and sufficient cash is retained to ensure the payment to creditors before making payment to partners. On the first payment to partners J receives 99537.50. 1. What is the balance of cash account after the first payment? 2. Calculate the amount of cash withheld for anticipated liquidation expenses. 3. How much cash were received by P?

- Show the compleete solution. A balance sheet for the JPM Partnership, who shares profits in the ratio of 50:25:25 for partners shows the following balances just before liquidation: Cash P113,000 Other Assets 562,275 Liabilities 188,825 J Capital 207,900 P Capital 146,650 M, Capital 132,300 ON the first month of liquidation, certain assets with a book value of 500,000 were sold for 375,000. Liquidation expenses of P9450 are paid and additional liquidation expenses are anticipated. Liabilities are paid amounting to P51,500 and sufficient cash is retained to ensure the payment to creditors before making payment to partners. On the first payment to partners J receives 99537.50. 1. Calculate the amount of cash withheld for anticipated liquidation expenses. 2. How much cash were received by P?"Partners Valerie; Vanessa, Vera and Veronica share profits 50%, 30%, 10% and]O Partners' accounts prior to liquidation follow: Advances Loans Capitals (Dr balances) (Cr balances) (Cr balances) Valerie P15O,000 P1,200,000 Vanessa 300,000 900,000 Vera P135,000 450,000 Veronica P 75,000 750.000 At the moment, P540,000 is available for distribution to the partners. 3 How much cash is to be distributed to Veronica? P198,750 6. P _ 0 P341,250 d_ P371,250 None of the above."A partnership has the following capital balances: Henry (50% of gains and losses) . . . . . . . . . . . . $ 135,000Thomas (30%) . . . . . . . . . . . .. . 85,000Catherine (20%) . . . . . . . . . . . . 80,000 Anne is going to invest $125,000 into the business to acquire a 40 percent ownership interest. Goodwill is to be recorded. What will be Anne’s beginning capital balance? Choose the correct. a. $125,000b. $170,000c. $200,000d. $245,000

- Partners Arias, Bobadilla and Briones share profits and losses 50:30:20, respectively. The statement of financial position at April 30, 2019 follows: Cash P 40,000 Accounts Payable P100,000 Other Assets 360,000 Arias, Capital 74,000 Bobadilla, Capital 130,000 Briones, Capital 96,000 Total 400,000 Total P400,000 The assets and liabilities are recorded and presented at their respective fair values. Banzon is to be admitted as a new partner with a 20% capital interest and a 20% share of profits and losses in exchange for a cash contribution. No goodwill or bonus is to be…RST partnership begins the liquidation process with the following balance sheet and profit and loss percentages Cash 280,000 Liabilities 200,000 Noncash Assets 300,000 R Capital (40%) 100,000 S Capital (30%) 150,000 T Capital (30%) 130,000 Liquidation expenses are estimated at $50,000. Assume any deficit balance in a partner’s capital account will not be repaid. What is the safe payment that can be made to partner T. answer pleaseThe balance sheet for the Delphine, Xavier, and Olivier partnership follows: Cash . . . . . . . . . . . . . . . . . . . $ 60,000 Liabilities . . . . . . . . . . . . . . . $ 40,000Noncash assets . . . . . . . . . 100,000 Delphine, capital . . . . . . . . .. 60,000Xavier, capital . . . . . . . . . . . 40,000Olivier, capital . . . . . . . . . . . 20,000 Delphine, Xavier, and Olivier share profits and losses in the ratio of 4:4:2, respectively. The partners have agreed to terminate the business and estimate that $12,000 in liquidation expenses will be incurred.a. What is the amount of cash that safely can be paid to partners prior to liquidation of noncash assets?b. How should the safe amount of cash determined in (a) be distributed to the partners?

- Partners Salvador, Garcia, and Mutuc divide profits and losses 5:3:2, respectively, and their statement of financial position on Sept. 30, 2019 follows: RTU Partnership Statement of Financial Position Sept. 30, 2019 Cash P 80,000 Other Assets 720,000 Total Assets P800,000 Accounts Payable P200,000 Salvador, Capital 148,000 Garcia, Capital 260,000 Mutuc, Capital…Partners Adan and Eba have capital balances of Paradise partnership of P400,000 and P600,000, respectively. They agree to share profits and losses as follows: Adan Eba As salaries P100,000 P120,000 As interest on capital at the beginning of the year 10% 10% Remaining profits or losses 50% 50% Based on the information above, answer the following: If income for the year was P300,000, what will be the distribution of income to Adan? If net loss for the year was P20,000, what will be the distribution to Eba?Cena, Batista, and Lashley share profits in 5:3:2 ratios. their capital accounts prior to liquidation (which is expected to resultin substantial gain) are as follows: Cena P 18,000 Cr. BalanceBatista P 27,000 Cr. BalanceLashley P 3,000 Dr. Balance The partners wish to distribute cash as it becomes available so that the capital accounts may be brought into the profits and loss ratio as rapidly as possible. Who is the partner to receive the first available cash and up to how much? a. Cena, up to P 54,000b. Batista, up to P45,000c. Batista, up to P 16,200d. Cena, up to P16,200