partnership. Their statements of financial position on Mar. 1, before adjustments, On Mar. 1, 2016, Sarabia and Abad decided to combine their businesses and for showed the following: Sarabia Abad P 9,000 18,500 30,000 30,000 11,500 6,375 P105,375 P 3,750 13,500 19,500 Cash Accounts receivable Inventories Furniture and Fixtures (net) Office Equipment (net) Prepaid Expenses 9,000 2,750 3,000 P51,500 Total P 45,750 59,625 P105,375 Accounts Payable P18,000 33,500 P51,500 Capital Total They agreed to have the following items recordėd in their books: Provide 2% allowance for doubtful accounts. Sarabia's furniture and fixtures should be P31,000, while Abad's office equipment is under-depreciated by P250. Rent expense incurred previously by Sarabia was not yet recorded amounting to P1,000, while salary expense incurred by Abad was not also recorded amounting .1. 2. 3. to P800. 4. The fair market values of inventory amounted to: For Sarabia P29,500

partnership. Their statements of financial position on Mar. 1, before adjustments, On Mar. 1, 2016, Sarabia and Abad decided to combine their businesses and for showed the following: Sarabia Abad P 9,000 18,500 30,000 30,000 11,500 6,375 P105,375 P 3,750 13,500 19,500 Cash Accounts receivable Inventories Furniture and Fixtures (net) Office Equipment (net) Prepaid Expenses 9,000 2,750 3,000 P51,500 Total P 45,750 59,625 P105,375 Accounts Payable P18,000 33,500 P51,500 Capital Total They agreed to have the following items recordėd in their books: Provide 2% allowance for doubtful accounts. Sarabia's furniture and fixtures should be P31,000, while Abad's office equipment is under-depreciated by P250. Rent expense incurred previously by Sarabia was not yet recorded amounting to P1,000, while salary expense incurred by Abad was not also recorded amounting .1. 2. 3. to P800. 4. The fair market values of inventory amounted to: For Sarabia P29,500

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.22E

Related questions

Question

Compute the bet (debit) credit adjustment for sarabia and abad

Transcribed Image Text:partnership. Their statements of financial position on Mar. 1, before adjustments, .

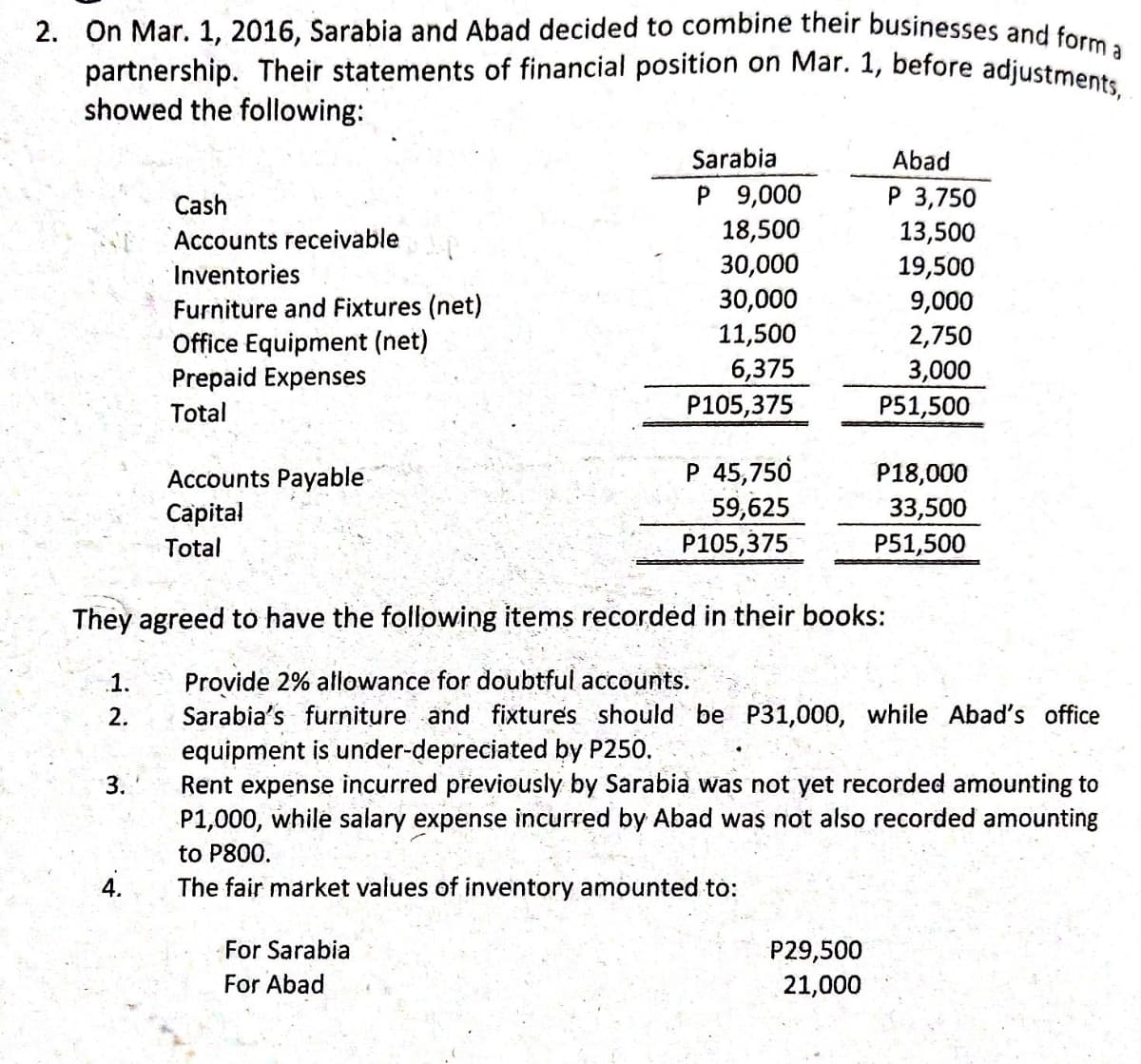

2. On Mar. 1, 2016, Sarabia and Abad decided to combine their businesses and for

showed the following:

Sarabia

Abad

P 9,000

18,500

30,000

30,000

11,500

P 3,750

13,500

19,500

9,000

Cash

Accounts receivable

Inventories

Furniture and Fixtures (net)

Office Equipment (net)

Prepaid Expenses

2,750

6,375

P105,375

3,000

P51,500

Total

P 45,750

59,625

P105,375

P18,000

Accounts Payable

Capital

33,500

P51,500

Total

They agreed to have the following items recordéd in their books:

Provide 2% allowance for doubtful accounts.

Sarabia's furniture and fixtures should be P31,000, while Abad's office

1.

2.

equipment is under-depreciated by P250.

Rent expense incurred previously by Sarabia was not yet recorded amounting to

P1,000, while salary expense incurred by Abad was not also recorded amounting

3.

to P800.

The fair market values of inventory amounted to:

For Sarabia

P29,500

For Abad

21,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning