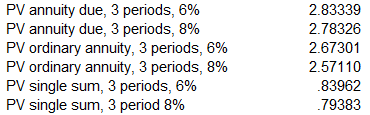

Patsy Co. and Philip Inc. sign a lease agreement dated January 1, 2020. The lease agreement specifies that Patsy (lessor) will grant right-of-use to Philip (lessee) of one of its machines that is not of a specialized nature. The lease term is non-cancelable and has a 3-year term. On January 1, 2020, the machine has a cost and fair value of $240,000, an estimated economic life of five years, and a residual value at the end of the lease of $48,000 (unguaranteed). The machine reverts to Patsy at the end of the lease term and the lease contains no renewal options. Patsy used a 6 percent rate when calculating the lease payments, and Philip is aware of this rate. Philip’s incremental rate is 8%. The payments are to be made at the beginning of the year with the first payment on January 1, 2020. Use the following PV factors: (See Attachment) Which of the following is correct regarding the journal entry made by Philip on December 31, 2020?

Patsy Co. and Philip Inc. sign a lease agreement dated January 1, 2020. The lease agreement specifies that Patsy (lessor) will grant right-of-use to Philip (lessee) of one of its machines that is not of a specialized nature. The lease term is non-cancelable and has a 3-year term. On January 1, 2020, the machine has a cost and fair value of $240,000, an estimated economic life of five years, and a residual value at the end of the lease of $48,000 (unguaranteed). The machine reverts to Patsy at the end of the lease term and the lease contains no renewal options. Patsy used a 6 percent rate when calculating the lease payments, and Philip is aware of this rate. Philip’s incremental rate is 8%. The payments are to be made at the beginning of the year with the first payment on January 1, 2020. Use the following PV factors: (See Attachment)

Which of the following is correct regarding the

Trending now

This is a popular solution!

Step by step

Solved in 4 steps