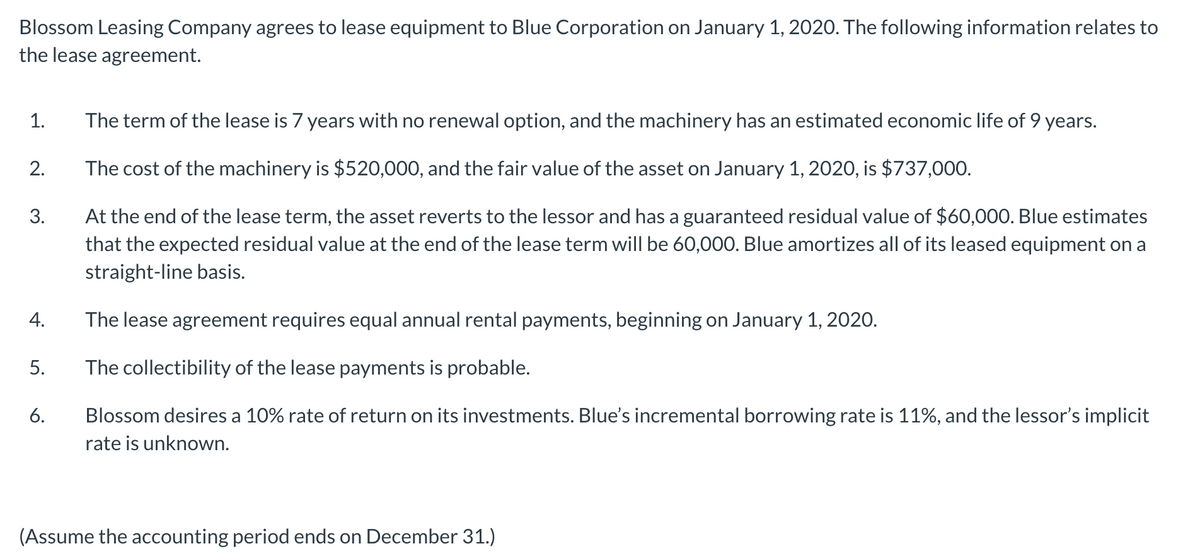

Blossom Leasing Company agrees to lease equipment to Blue Corporation on January 1, 2020. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. 2. The cost of the machinery is $520,000, and the fair value of the asset on January 1, 2020, is $737,000. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $60,000. Blue estimates that the expected residual value at the end of the lease term will be 60,00O. Blue amortizes all of its leased equipment on a 3. straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2020. 5. The collectibility of the lease payments is probable. 6. Blossom desires a 10% rate of return on its investments. Blue's incremental borrowing rate is 11%, and the lessor's implicit rate is unknown. (Assume the accounting period ends on December 31.)

Blossom Leasing Company agrees to lease equipment to Blue Corporation on January 1, 2020. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. 2. The cost of the machinery is $520,000, and the fair value of the asset on January 1, 2020, is $737,000. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $60,000. Blue estimates that the expected residual value at the end of the lease term will be 60,00O. Blue amortizes all of its leased equipment on a 3. straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2020. 5. The collectibility of the lease payments is probable. 6. Blossom desires a 10% rate of return on its investments. Blue's incremental borrowing rate is 11%, and the lessor's implicit rate is unknown. (Assume the accounting period ends on December 31.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 6E: Lessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on...

Related questions

Question

Transcribed Image Text:Blossom Leasing Company agrees to lease equipment to Blue Corporation on January 1, 2020. The following information relates to

the lease agreement.

1.

The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years.

2.

The cost of the machinery is $520,000, and the fair value of the asset on January 1, 2020, is $737,000.

At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $60,000. Blue estimates

that the expected residual value at the end of the lease term will be 60,000. Blue amortizes all of its leased equipment on a

3.

straight-line basis.

4.

The lease agreement requires equal annual rental payments, beginning on January 1, 2020.

5.

The collectibility of the lease payments is probable.

6.

Blossom desires a 10% rate of return on its investments. Blue's incremental borrowing rate is 11%, and the lessor's implicit

rate is unknown.

(Assume the accounting period ends on December 31.)

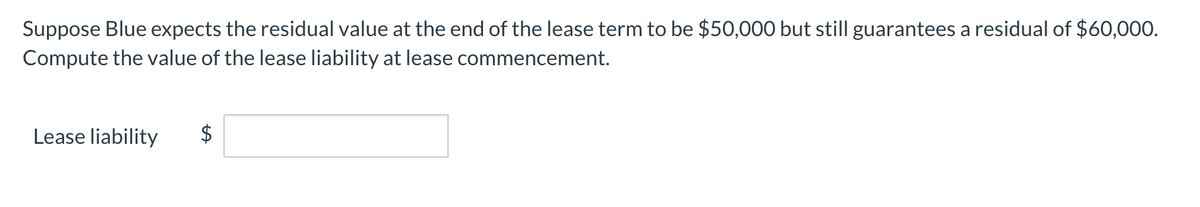

Transcribed Image Text:Suppose Blue expects the residual value at the end of the lease term to be $50,000 but still guarantees a residual of $60,000.

Compute the value of the lease liability at lease commencement.

Lease liability

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning