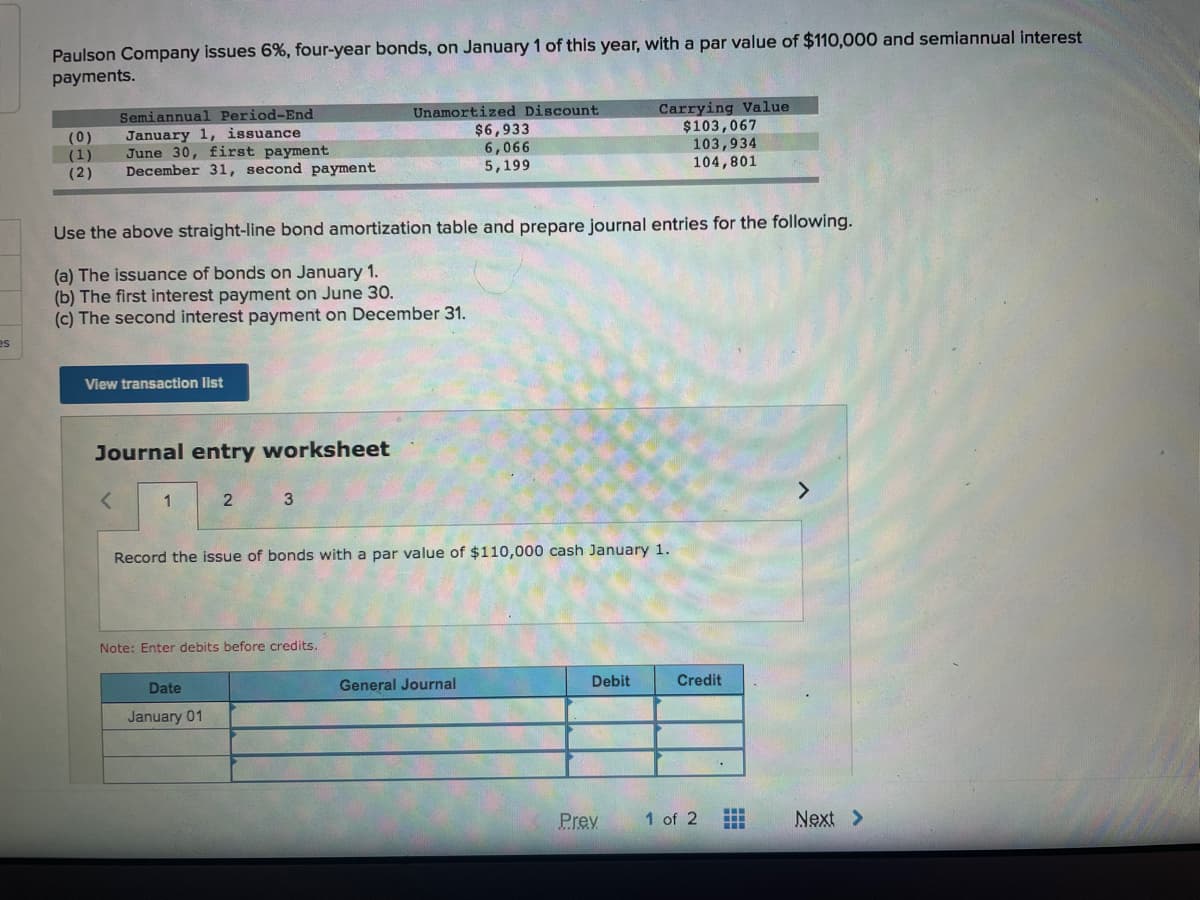

Paulson Company issues 6%, four-year bonds, on January 1 of this year, with a par value of $110,000 and semiannual interest payments. Unamortized Discount $6,933 6,066 5,199 Carrying Value $103,067 103,934 104,801 Semiannual Period-End (0) (1) (2) January 1, issuance June 30, first payment December 31, second payment Use the above straight-line bond amortization table and prepare journal entries for the following. (a) The issuance of bonds on January 1. (b) The first interest payment on June 3O. (c) The second interest payment on December 31. View transaction list Journal entry worksheet <> 1 2 Record the issue of bonds with a par value of $110,000 cash January 1. Note: Enter debits before credits. Date General Journal Debit Credit January 01 Prey 1 of 2 ... ... Next >

Paulson Company issues 6%, four-year bonds, on January 1 of this year, with a par value of $110,000 and semiannual interest payments. Unamortized Discount $6,933 6,066 5,199 Carrying Value $103,067 103,934 104,801 Semiannual Period-End (0) (1) (2) January 1, issuance June 30, first payment December 31, second payment Use the above straight-line bond amortization table and prepare journal entries for the following. (a) The issuance of bonds on January 1. (b) The first interest payment on June 3O. (c) The second interest payment on December 31. View transaction list Journal entry worksheet <> 1 2 Record the issue of bonds with a par value of $110,000 cash January 1. Note: Enter debits before credits. Date General Journal Debit Credit January 01 Prey 1 of 2 ... ... Next >

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 6PA: Aggies Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1,...

Related questions

Question

Transcribed Image Text:Paulson Company issues 6%, four-year bonds, on January 1 of this year, with a par value of $110,000 and semiannual interest

payments.

Semiannual Period-End

Unamortized Discount

(0)

(1)

(2)

January 1, issuance

June 30, first payment

December 31, second payment

$6,933

6,066

5,199

Carrying Value

$103,067

103,934

104,801

Use the above straight-line bond amortization table and prepare journal entries for the following.

(a) The issuance of bonds on January 1.

(b) The first interest payment on June 3O.

(c) The second interest payment on December 31.

es

View transaction list

Journal entry worksheet

3

<>

Record the issue of bonds with a par value of $110,000 cash January 1.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

January 01

Prev

1 of 2

Next >

中

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning