Pauly Corporation owns 70% of Shore Company's outstanding common stock. On 01/01/20, Pauly sold a used piece of equipment to Shore in exchange for $271,000 cash. Pauly's original cost of the equipment was $837,000 and accumulated depreciation at 01/01/20 was $635,000. The remaining life of the equipment is 10 years, and Shore will use that same useful life. Both companies use the straight-line method of depreciation. REQUIRED: ANSWER THE FOLLOWING QUESTIONS RELATED TO THE REQUIRED YEAR-END CONSOLIDATION ENTRY: NOTE: BE SURE TO TYPE A SIMPLE NUMBER WITH NÓ COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. DEBIT TO 'GAIN ON SALE' IN THE AMOUNT OF:

Pauly Corporation owns 70% of Shore Company's outstanding common stock. On 01/01/20, Pauly sold a used piece of equipment to Shore in exchange for $271,000 cash. Pauly's original cost of the equipment was $837,000 and accumulated depreciation at 01/01/20 was $635,000. The remaining life of the equipment is 10 years, and Shore will use that same useful life. Both companies use the straight-line method of depreciation. REQUIRED: ANSWER THE FOLLOWING QUESTIONS RELATED TO THE REQUIRED YEAR-END CONSOLIDATION ENTRY: NOTE: BE SURE TO TYPE A SIMPLE NUMBER WITH NÓ COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. DEBIT TO 'GAIN ON SALE' IN THE AMOUNT OF:

Chapter2: Income Tax Concepts

Section: Chapter Questions

Problem 24P

Related questions

Question

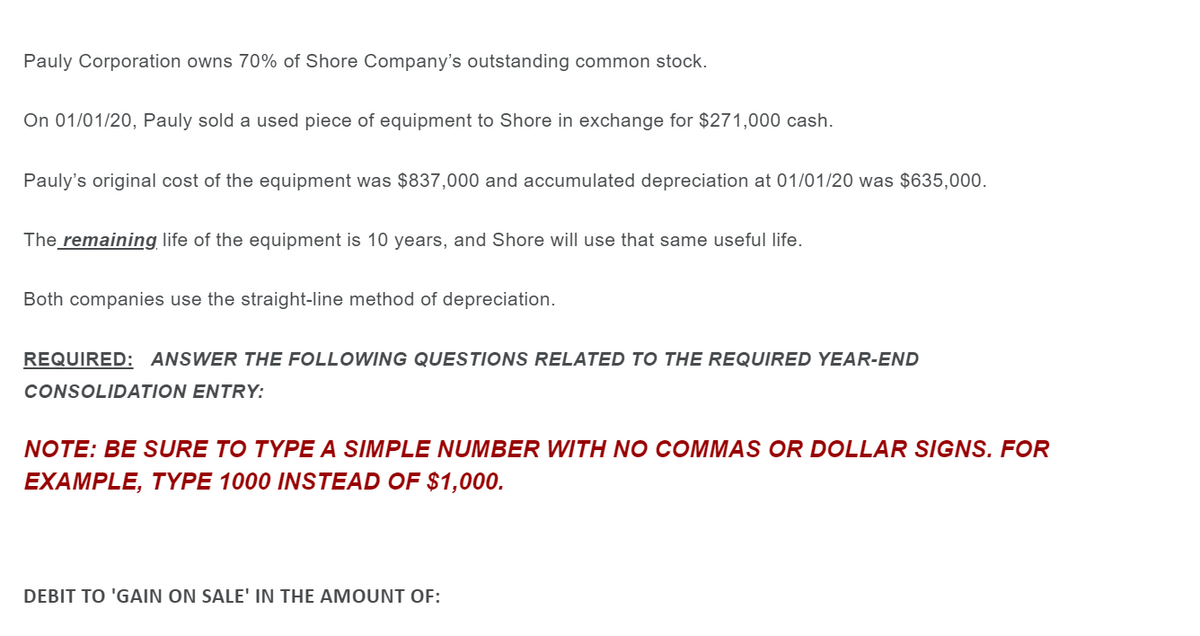

Transcribed Image Text:Pauly Corporation owns 70% of Shore Company's outstanding common stock.

On 01/01/20, Pauly sold a used piece of equipment to Shore in exchange for $271,000 cash.

Pauly's original cost of the equipment was $837,000 and accumulated depreciation at 01/01/20 was $635,000.

The remaining life of the equipment is 10 years, and Shore will use that same useful life.

Both companies use the straight-line method of depreciation.

REQUIRED: ANSWER THE FOLLOWING QUESTIONS RELATED TO THE REQUIRED YEAR-END

CONSOLIDATION ENTRY:

NOTE: BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR

EXAMPLE, TYPE 1000 INSTEAD OF $1,000.

DEBIT TO 'GAIN ON SALE' IN THE AMOUNT OF:

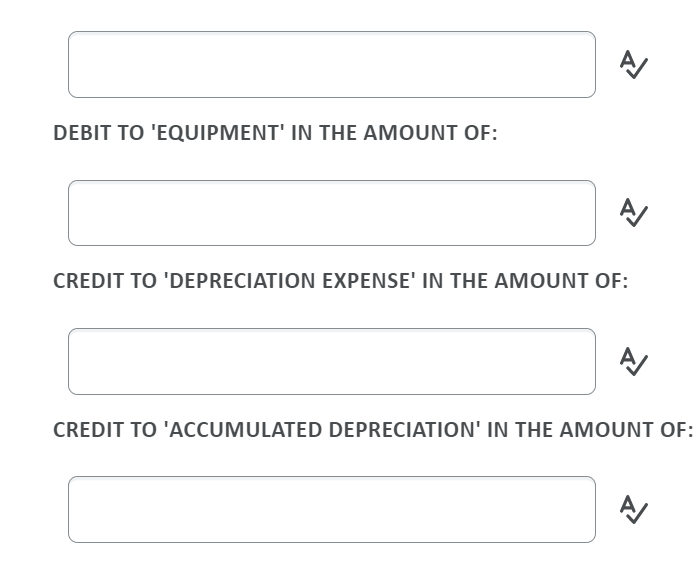

Transcribed Image Text:DEBIT TO 'EQUIPMENT' IN THE AMOUNT OF:

CREDIT TO 'DEPRECIATION EXPENSE' IN THE AMOUNT OF:

CREDIT TO 'ACCUMULATED DEPRECIATION' IN THE AMOUNT OF:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning