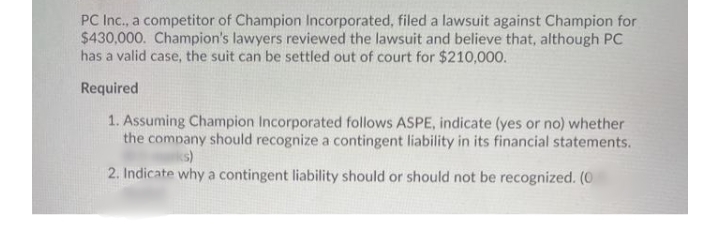

PC Inc., a competitor of Champion Incorporated, filed a lawsuit against Champion for $430,000. Champion's lawyers reviewed the lawsuit and believe that, although PC has a valid case, the suit can be settled out of court for $210,000. Required 1. Assuming Champion Incorporated follows ASPE, indicate (yes or no) whether the company should recognize a contingent liability in its financial statements. s) 2. Indicate why a contingent liability should or should not be recognized. (0

PC Inc., a competitor of Champion Incorporated, filed a lawsuit against Champion for $430,000. Champion's lawyers reviewed the lawsuit and believe that, although PC has a valid case, the suit can be settled out of court for $210,000. Required 1. Assuming Champion Incorporated follows ASPE, indicate (yes or no) whether the company should recognize a contingent liability in its financial statements. s) 2. Indicate why a contingent liability should or should not be recognized. (0

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter18: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 4P

Related questions

Question

Transcribed Image Text:PC Inc., a competitor of Champion Incorporated, filed a lawsuit against Champion for

$430,000. Champion's lawyers reviewed the lawsuit and believe that, although PC

has a valid case, the suit can be settled out of court for $210,000.

Required

1. Assuming Champion Incorporated follows ASPE, indicate (yes or no) whether

the company should recognize a contingent liability in its financial statements.

ks)

2. Indicate why a contingent liability should or should not be recognized. (0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College