Pedro, an official of Corporation X, asked for an "earlier retirement because he was migrating to Australia. He was paid P2,000,000.00 as separation pay in recognition of his valuable services to the corporation. Juan, another official of the same company, was separated for occupying a redundant position. He was given P500,000.00 as separation pay. Jose, another employee, was separated due to his faling eyesight. He was given P800,000.00 as separation pay. How much is excluded from gross income?

Pedro, an official of Corporation X, asked for an "earlier retirement because he was migrating to Australia. He was paid P2,000,000.00 as separation pay in recognition of his valuable services to the corporation. Juan, another official of the same company, was separated for occupying a redundant position. He was given P500,000.00 as separation pay. Jose, another employee, was separated due to his faling eyesight. He was given P800,000.00 as separation pay. How much is excluded from gross income?

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 74TA

Related questions

Question

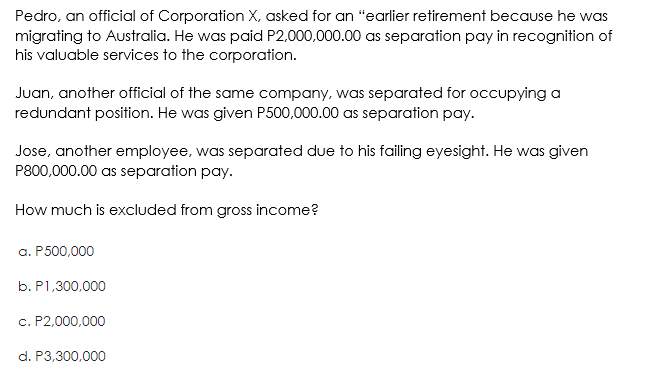

Transcribed Image Text:Pedro, an official of Corporation X, asked for an "earlier retirement because he was

migrating to Australia. He was paid P2,000,000.00 as separation pay in recognition of

his valuable services to the corporation.

Juan, another official of the same company, was separated for occupying a

redundant position. He was given P500,000.00 as separation pay.

Jose, another employee, was separated due to his failing eyesight. He was given

P800,000.00 as separation pay.

How much is excluded from gross income?

a. P500,000

b. P1,300,000

c. P2,000,000

d. P3,300,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT