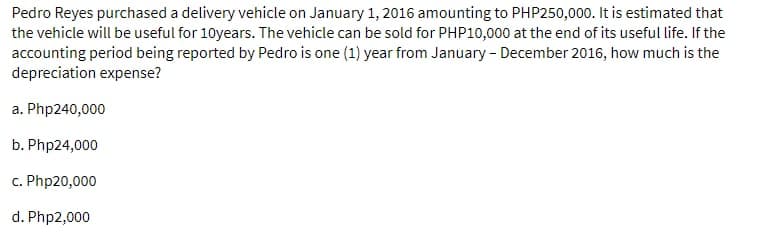

Pedro Reyes purchased a delivery vehicle on January 1, 2016 amounting to PHP250,000. It is estimated that the vehicle will be useful for 10years. The vehicle can be sold for PHP10,000 at the end of its useful life. If the accounting period being reported by Pedro is one (1) year from January - December 2016, how much is the depreciation expense? a. Php240,000 b. Php24,000

Pedro Reyes purchased a delivery vehicle on January 1, 2016 amounting to PHP250,000. It is estimated that the vehicle will be useful for 10years. The vehicle can be sold for PHP10,000 at the end of its useful life. If the accounting period being reported by Pedro is one (1) year from January - December 2016, how much is the depreciation expense? a. Php240,000 b. Php24,000

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 3EA: Montello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is...

Related questions

Question

Transcribed Image Text:Pedro Reyes purchased a delivery vehicle on January 1, 2016 amounting to PHP250,000. It is estimated that

the vehicle will be useful for 10years. The vehicle can be sold for PHP10,000 at the end of its useful life. If the

accounting period being reported by Pedro is one (1) year from January - December 2016, how much is the

depreciation expense?

a. Php240,000

b. Php24,000

c. Php20,000

d. Php2,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub