peg. on to view the additional information.) e Income and Part I Federal Tax Payable for the Sebago Sh

peg. on to view the additional information.) e Income and Part I Federal Tax Payable for the Sebago Sh

Chapter25: Taxation Of International Transactions

Section: Chapter Questions

Problem 30P

Related questions

Question

1.

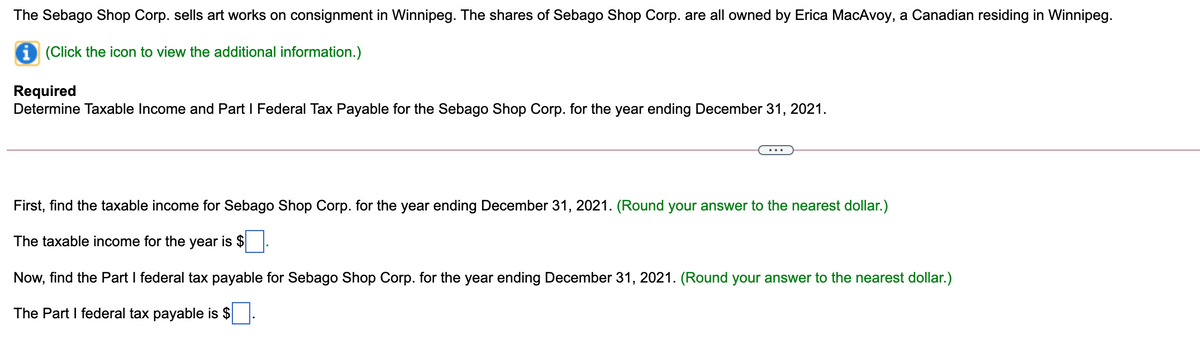

Transcribed Image Text:The Sebago Shop Corp. sells art works on consignment in Winnipeg. The shares of Sebago Shop Corp. are all owned by Erica MacAvoy, a Canadian residing in Winnipeg.

i (Click the icon to view the additional information.)

Required

Determine Taxable Income and Part I Federal Tax Payable for the Sebago Shop Corp. for the year ending December 31, 2021.

First, find the taxable income for Sebago Shop Corp. for the year ending December 31, 2021. (Round your answer to the nearest dollar.)

The taxable income for the year is $

Now, find the Part I federal tax payable for Sebago Shop Corp. for the year ending December 31, 2021. (Round your answer to the nearest dollar.)

The Part I federal tax payable is $.

Transcribed Image Text:Additional information

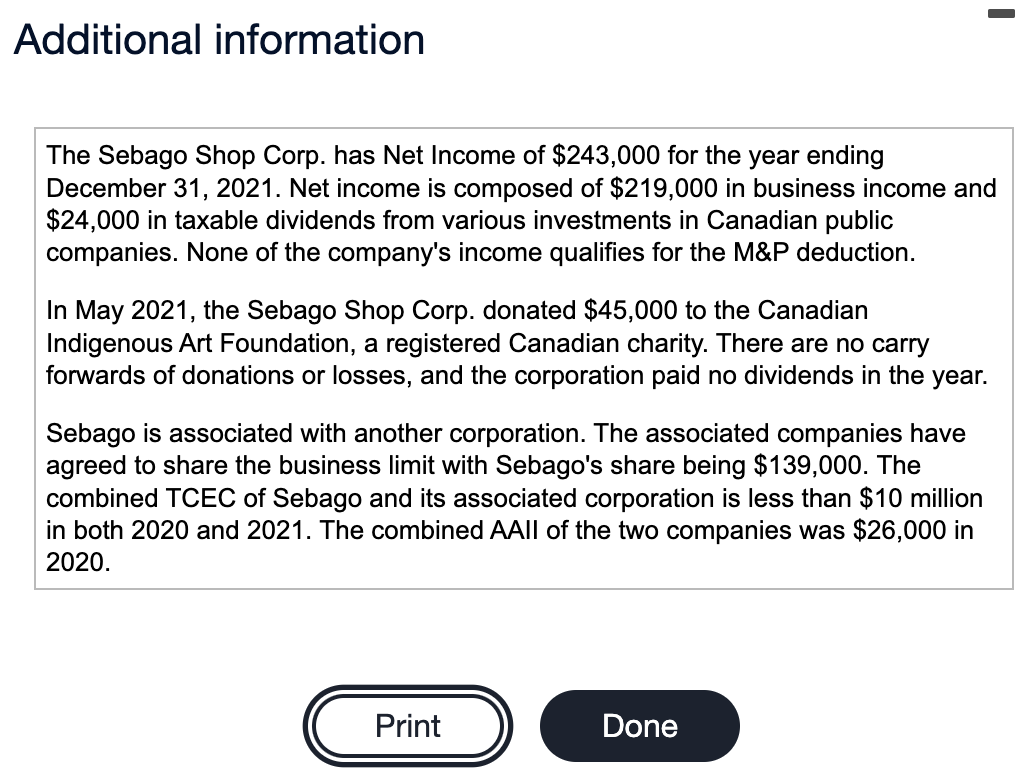

The Sebago Shop Corp. has Net Income of $243,000 for the year ending

December 31, 2021. Net income is composed of $219,000 in business income and

$24,000 in taxable dividends from various investments in Canadian public

companies. None of the company's income qualifies for the M&P deduction.

In May 2021, the Sebago Shop Corp. donated $45,000 to the Canadian

Indigenous Art Foundation, a registered Canadian charity. There are no carry

forwards of donations or losses, and the corporation paid no dividends in the year.

Sebago is associated with another corporation. The associated companies have

agreed to share the business limit with Sebago's share being $139,000. The

combined TCEC of Sebago and its associated corporation is less than $10 million

in both 2020 and 2021. The combined AAII of the two companies was $26,000 in

2020.

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you