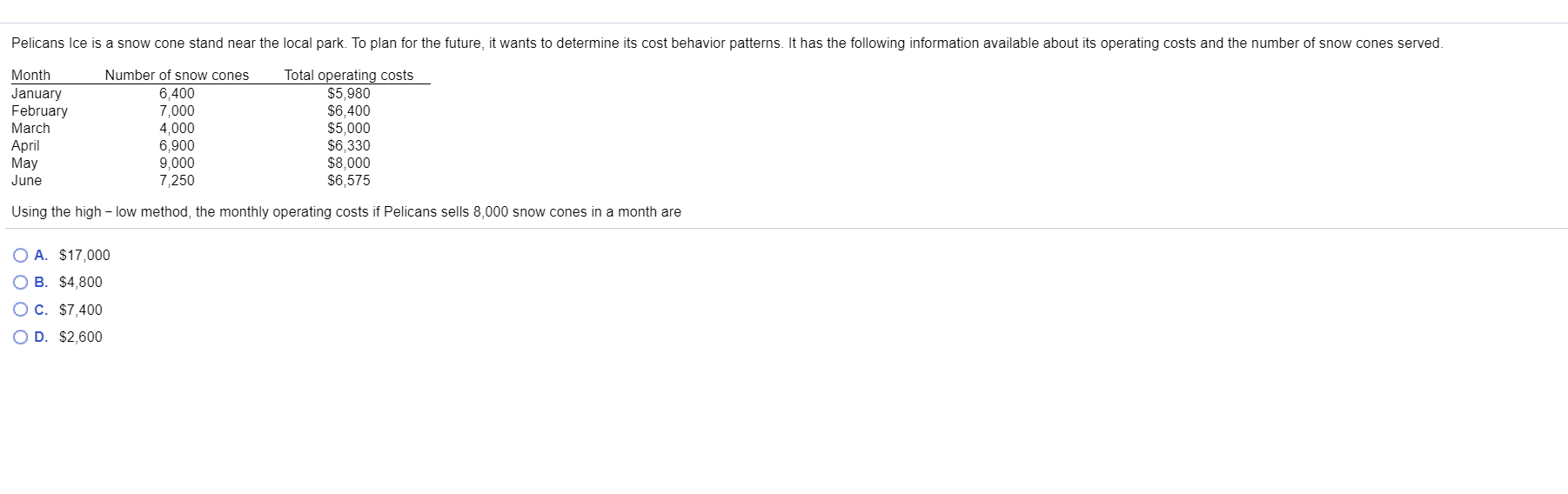

Pelicans Ice is a snow cone stand near the local park. To plan for the future, it wants to determine its cost behavior patterns. It has the following information available about its operating costs and the number of snow cones served. Number of snow cones Total operating costs $5,980 $6.400 $5,000 $6,330 $8,000 $6,575 Month January February 6,400 7,000 4,000 6,900 9,000 7,250 March April May June Using the high - low method, the monthly operating costs if Pelicans sells 8,000 snow cones in a month are O A. $17,000 о В. $4,800 O C. $7,400 O D. $2,600

Q: 1. Compute the total estimated cost Drab will incur to purchase the needed materials and then…

A: Hi, in accordance with the policies, i am solving the first three parts of the problem Activity…

Q: The Everest Company provides landscaping services to corporations and businesses. All its…

A: Solution- Contribution margin for Contribution margin for…

Q: Doaktown Products manufactures fishing equipment for recreational uses. The Miramichi plant produces…

A: Activity based costing is the different approach to assign overhead where the overheads are based on…

Q: Gentex Electrical Corporation is a maker of fuse box for a variety of contractors. Sometime during…

A: The financial position of the company can be arrived from the income statement prepared by the…

Q: Cardinal Company needs 20,000 units of a certain part to use in its production cycle. The following…

A: When a business has to choose between two alternatives one is purchasing from outside and other is…

Q: Using the high-low method, the monthly operating costs if Pelicans sells 12,000 snow cones in a…

A: When there is limited cost information, it becomes complex to ascertain the variable cost and fixed…

Q: The manager of a regional warehouse must decide on the number of loading docks to request for a new…

A: Cost per day - Driver truck $205 Cost per day/ Dock + Loading crew $1,118 Arrival…

Q: Mighty Muffler, Inc. operates an automobile service facility that specializes in replacing mufflers…

A: Fixed costs are the cost that remains intact irrespective of number of units being produced.…

Q: $225.00 Production level used to calculate average cost 1,000 Total fixed costs…

A: Given Average total cost per unit $225.00 Production level used to calculate average cost…

Q: Erie Company manufactures a mobile fitness device called the Jogging Mate. The company uses…

A: 1. Standard hours required for 1 unit - 27 minute Therefore standard hours required for 19200 unit =…

Q: Your Company produces batteries which are used in the production of their riding tractors. The costs…

A: Relevant cost of production = Direct material + direct labor + variable overhead + avoidable fixed…

Q: Mathes Corporation manufactures paper products. The company operates a landfill, which it uses to…

A:

Q: XYZ Corp. currently produces a part but is looking to reduce costs. Units 20,000 Per…

A: The make or buy decisions are made by analysing the relevant cost of buying it from outside.…

Q: Doaktown Products manufactures fishing equipment for recreational uses. The Miramichi plant produces…

A: There are two types of costing methods that are in use. One is traditional costing method and other…

Q: Suzy's Cool Treatz is a snow cone stand near the local park. To plan for the future, the owner wants…

A: High-low method is a cost computation technique which separates variable and fixed cost from total…

Q: Calculate the company's time charges and the material charges percentage. 2. Compute the price for…

A: Job sheet is the statement prepared under the cost accounting to compute the value of cost…

Q: Erie Company manufactures a mobile fitness device called the Jogging Mate. The company uses…

A:

Q: Pietro Frozen Foods, Inc., produces frozen pizzas. For next year, Pietropredicts that 50,000 units…

A: ‘’Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Quarantine Company manufactures Part AA for use in its production cycle. The costs per unit fo…

A: Solution Given Number of units =25000 For making Direct material 7.5 Direct…

Q: 2. Sunshine Company sells custom made surf boards in California. The finance manager has supplied…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Winter Sports manufactures snowboards. Its cost of making 1,700 bindings is as follows: (Click the…

A: Make cost is the cost incurred in producing the product. Buy cost is the cost of purchasing the…

Q: Topper Toys has developed a new toy called the Brainbuster. The company has a standard cost system…

A: Lets understand the basics. Material price variance is a variance between the standard price at…

Q: Fatima Electronics LLC also plans to introduce a new model of mobile phone in the market. The…

A: Following is the answer to the given question

Q: Jack's Back Porch manufactures rustic furniture. The cost accounting system estimates manufacturing…

A: Markup refers to the difference between the selling price and cost. It is the percentage of profit…

Q: Pamela Company makes steel blades for lawn mowers that it heat treats, assembles and sells. The cost…

A: The decisions of buying and purchasing should be made after considering the relevant cost of the…

Q: etters Cabinets, Inc., needs to choose a production method for its new office shelf, the Maxistand.…

A: Annual profit is the total amount of profit earned by selling the product. It includes all the costs…

Q: XOX Company manufactures part C-1 in producing product B. To save on cost, the company is planning…

A: The fixed costs are unavoidable when product is brought from suppliers instead of manufacturing.

Q: A local furniture company has estimated the following components for a new product. (in pesos)…

A: Variable cost per unit = Material cost per unit + Labour cost per unit = 2.15 + 2.00 = 4.15…

Q: Old People Racquets manufactures pickleball racquets in four different models. For the year, the…

A: Decision making process has to look into short-term as well as long-term perspectives. On deciding…

Q: Maxwell Company makes treadmills. The company controller wants to calculate the fixed and variable…

A: Regression table by least square method…

Q: JTA Corp must decide whether to make or buy some of its components for the appliances it produces.…

A: Relevant costs are those costs which are affected due to the decision making i;e they change with…

Q: Hernandez, Inc. manufactures three models of picture frames for a total of 8,000 frames per year.…

A: Solution:- Calculation of an incremental analysis for the make-or-buy decision as follows under:-…

Q: Filhaal Electronics LLC also plans to introduce a new model of mobile phone in the market. The…

A: The life cycle cost is the entire cost incurred on a product over its useful life. All costs are…

Q: A machine part is manufactured at a unit cost of 40¢ for material and 15¢ for direct labor. An…

A: Material cost = $0.40 per unit Direct labor cost = $0.15 per unit Other cost = 2.50 × $0.15=$0.375…

Q: The Winter Products Division of American Sports Corporation produces and markets two products for…

A: The following calculations are done in the records of Winter products to evaluate the discontinuity…

Q: The first task: It was decided to establish a factory to produce building . units from sustainable…

A: "Since you have posted a question with multiple sub parts, we will solve first three sub parts for…

Q: Neptune Company produces toys and other items for use in beach and resort areas. A small, inflatable…

A: Break-even analysis is the easiest form of cost-volume-profit analysis. Break-even analysis is used…

Q: A manufacturing firm is considering two locations for a plant to produce a new product. The two…

A: Cost of indifference = Difference in Fixed Cost / Difference in variable cost

Q: Zeus Company, a manufacturer of snowmobiles, is operating at 70% of plant capacity. Its plant…

A: Manufacturing cost consist of direct materials, direct labor and manufacturing variable overheads.

Q: What is the net effect of moving the employee from mixing/heating to cutting/assembly? What is the…

A: Net effect means the final result after taking all the effects into consideration and finally…

Q: Sun Studio in Irvine plans to initiate an activity-based costing system with two activities:…

A: Indirect cost: It implies to the expense that is incurred in relation to multiple activities and is…

Q: What is the incremental cost or benefit of buying the wheels as opposed to making them?

A:

Q: The estimated selling price of a new mobile phone is RO 55. The company wants to earn a mark up of…

A: Target cost = RO 55 / 110% = RO 50

Q: Woodruff Company is currently producing a snowmobile that uses five specialized parts. Engineering…

A: Cost reduction refers to the process companies use in order to reduce their costs and increase their…

Q: A manufacturing plant wishes to buy a new equipment so the purchasing department did some research…

A: GIVEN A manufacturing plant wishes to buy a new equipment so the purchasing department did some…

Q: Doaktown Products manufactures fishing equipment for recreational uses. The Miramichi plant produces…

A: Overheads are the all indirect cost which are incurred in the process of selling the goods.…

Q: Southern Tier Heating, Inc. installs heating systems in new homes built in the southern tier…

A: Time and material pricing: It is a pricing concept build based on the cost-based approach, where a…

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

- A company anticipates the cost to heat the building will be $21.000. Product A Lakes up 500 square feet of space, while Product B takes up 200 square feet. The activity rate per product using activity-based costing would be which of the following? A. $30/square foot B. $4.20/square foot C. $11/square foot D. $15.20/square footPelicans Ice is a snow cone stand near the local park. To plan for the future, it wants to determine its cost behavior patterns. It has the following information available about its operating costs and the number of snow cones served. Month Number of snow cones Total operating costs January 6,400 $5,980 February 7,000 $6,400 March 4000 $5000 April 6,900 $6,330 May 8000 $9000 June 7,250 $6,575 Using the high-low method, the monthly operating costs if Pelicans sells 12,000 snow cones in a month are $1000 $13,000 $12,000 $20,000Using the High-Low Method to Estimate Variable andFixed CostsLocated on Swiftcurrent Lake in Glacier National Park, Many Glacier Hotel was built in1915 by the Great Northern Railway. In an effort to supplement its lodging revenue, the hoteldecided in 20X1 to begin manufacturing and selling small wooden canoes decorated withsymbols hand painted by Native Americans living near the park. Due to the great success ofthe canoes, the hotel began manufacturing and selling paddles as well in 20X3. Many hotelguests purchase a canoe and paddles for use in self-guided tours of Swiftcurrent Lake. Becauseproduction of the two products began in different years, the canoes and paddles are producedin separate production facilities and employ different laborers. Each canoe sells for $500, andeach paddle sells for $50. A 20X3 fire destroyed the hotel’s accounting records. However, anew system put into place before the 20X4 season provides the following aggregated data forthe hotel’s canoe and paddle…

- San Juan, Incorporated, is considering two alternatives: A and B. The costs associated with the alternatives are listed below: Alternative A Alternative B Material costs $ 35,000 $ 57,000 Processing costs 36,000 57,000 Building costs 12,000 28,000 Equipment rental 19,000 19,000 Are the materials costs and processing costs differential in the choice between alternatives A and B? Multiple Choice Neither materials costs nor processing costs are differential. Both materials costs and processing costs are differential. Only processing costs are differential. Only materials costs are differential.CleanTech manufactures equipment to mitigate the environmental effects of waste. (a) If Product A has fixed expenses of $15,000 per year and each unit of product has a $0.20 variable cost, and Product B has fixed expenses of $5000 per year and a $0.50 variable cost, at what number of units of annual production will A have the same overall cost as B? (b) As a manager at CleanTech what other data would you need to evaluate these two products?Woodruff Company is currently producing a snowmobile that uses five specialized parts. Engineering has proposed replacing these specialized parts with commodity parts, which will cost less and can be purchased in larger order quantities. Current activity capacity and demand (with specialized parts required) and expected activity demand (with only commodity parts required) are provided. Activities Activity Driver ActivityCapacity Current ActivityDemand Expected ActivityDemand Material usage Number of parts 192,000 192,000 192,000 Installing parts Direct labor hours 90,000 90,000 72,000 Purchasing parts Number of orders 20,000 17,100 10,500 Additionally, the following activity cost data are provided: Material usage: $20 per specialized part used; $16 per commodity part; no fixed activity cost. Installing parts: $14 per direct labor hour; no fixed activity cost. Purchasing parts: Four salaried clerks, each earning a $45,000…

- Woodruff Company is currently producing a snowmobile that uses five specialized parts. Engineering has proposed replacing these specialized parts with commodity parts, which will cost less and can be purchased in larger order quantities. Current activity capacity and demand (with specialized parts required) and expected activity demand (with only commodity parts required) are provided. Activities Activity Driver ActivityCapacity Current ActivityDemand Expected ActivityDemand Material usage Number of parts 200,000 200,000 200,000 Installing parts Direct labor hours 20,000 20,000 16,000 Purchasing parts Number of orders 7,600 6,498 3,990 Additionally, the following activity cost data are provided: Material usage: $11 per specialized part used; $27 per commodity part; no fixed activity cost. Installing parts: $21 per direct labor hour; no fixed activity cost. Purchasing parts: Four salaried clerks, each earning a $47,000 annual salary; each clerk is capable of processing 1,900…XYZ Corp. currently produces a part but is looking to reduce costs. Units 20,000 Per Unit Total Cost Direct Materials $ 10 $ 200,000 Direct Labor $ 5 $ 100,000 Mfg. Overhead $ 8 $ 160,000 Total $ 23 $ 460,000 The fixed mfg. overhead includes $75,000 of costs that will continue even if outsourced. If the part is outsourced, the space can be used to make other parts and generate an additional $27,000 of contribution margin. A. Show calculations to determine how much XYZ would consider paying for the part from an outside source.A company is looking to launch a new product line, which requires new facilities to be used and at the moment has two planned products, called ‘Basic’ and ‘Super’. The cost per unit is planned as follows: Basic Super Direct materials £20 £24 Direct labour £14 £16 While using the absorption costing approach, the company uses machine hours as the basis to charge its production overheads. One unit of Basic will use 3 machine hours while one unit of Super will use 4 machine hours. The business sells these products at a price that gives a standard profit mark-up of 30% of full cost. For the coming year, the company expects to make and sell 8,000 units of Basic and 6,000 units of Super. If the company adopts the ABC approach, the details relating to the…

- A company is looking to launch a new product line, which requires new facilities to be used and at the moment has two planned products, called ‘Basic’ and ‘Super’. The cost per unit is planned as follows: Basic Super Direct materials £20 £24 Direct labour £14 £16 While using the absorption costing approach, the company uses machine hours as the basis to charge its production overheads. One unit of Basic will use 3 machine hours while one unit of Super will use 4 machine hours. The business sells these products at a price that gives a standard profit mark-up of 30% of full cost. For the coming year, the company expects to make and sell 8,000 units of Basic and 6,000 units of Super. If the company adopts the ABC approach, the details relating to the…A company is looking to launch a new product line, which requires new facilities to be used and at the moment has two planned products, called ‘Basic’ and ‘Super’. The cost per unit is planned as follows: Basic Super Direct materials £20 £24 Direct labour £14 £16 While using the absorption costing approach, the company uses machine hours as the basis to charge its production overheads. One unit of Basic will use 3 machine hours while one unit of Super will use 4 machine hours. The business sells these products at a price that gives a standard profit mark-up of 30% of full cost. For the coming year, the company expects to make and sell 8,000 units of Basic and 6,000 units of Super. If the company adopts the ABC approach, the details relating to the…Middle Industries produces a sensor for use in manufacturing. It produces the sensor in a plant with an annual practical capacity of 75,000 units. The variable cost of the sensor is $185.00 per unit, and the fixed costs of the plant are $12,375,000 annually. Current annual demand is 55,000 sensors. Middle Industries bought the plant because it was close to its other manufacturing facilities and was available for sale when they were searching for a location. Required: What cost per sensor should the cost system report to facilitate management decision making? What is the cost of excess capacity? What cost per sensor would the cost system report if the smallest manufacturing plant that could be built was able to produce 75,000 sensors? What would be the cost of excess capacity?