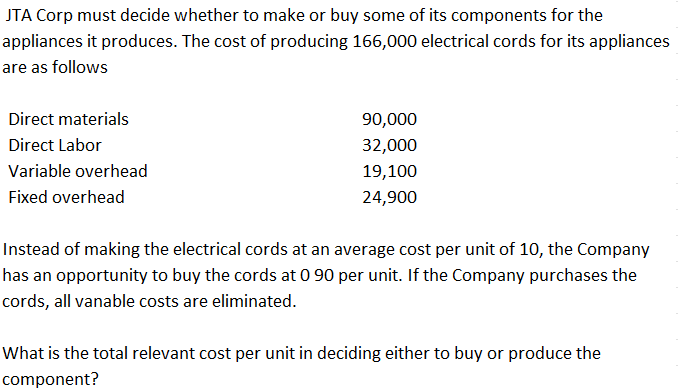

JTA Corp must decide whether to make or buy some of its components for the appliances it produces. The cost of producing 166,000 electrical cords for its appliances are as follows Direct materials 90,000 Direct Labor 32,000 Variable overhead 19,100 Fixed overhead 24,900 Instead of making the electrical cords at an average cost per unit of 10, the Company has an opportunity to buy the cords at 0 90 per unit. If the Company purchases the cords, all vanable costs are eliminated. What is the total relevant cost per unit in deciding either to buy or produce the component?

JTA Corp must decide whether to make or buy some of its components for the appliances it produces. The cost of producing 166,000 electrical cords for its appliances are as follows Direct materials 90,000 Direct Labor 32,000 Variable overhead 19,100 Fixed overhead 24,900 Instead of making the electrical cords at an average cost per unit of 10, the Company has an opportunity to buy the cords at 0 90 per unit. If the Company purchases the cords, all vanable costs are eliminated. What is the total relevant cost per unit in deciding either to buy or produce the component?

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter10: Cost Analysis For Management Decision Making

Section: Chapter Questions

Problem 15E

Related questions

Question

Transcribed Image Text:JTA Corp must decide whether to make or buy some of its components for the

appliances it produces. The cost of producing 166,000 electrical cords for its appliances

are as follows

Direct materials

90,000

Direct Labor

32,000

Variable overhead

19,100

Fixed overhead

24,900

Instead of making the electrical cords at an average cost per unit of 10, the Company

has an opportunity to buy the cords at 0 90 per unit. If the Company purchases the

cords, all vanable costs are eliminated.

What is the total relevant cost per unit in deciding either to buy or produce the

component?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning