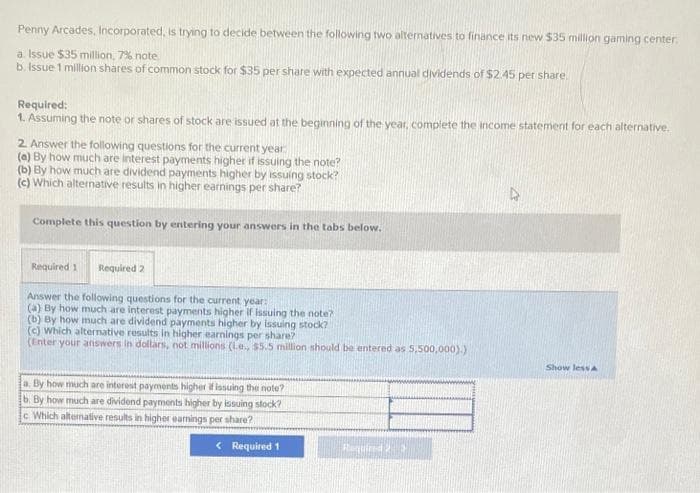

Penny Arcades, Incorporated, is trying to decide between the following two alternatives to finance its new $35 million gaming center. a. Issue $35 million, 7% note b. Issue 1 million shares of common stock for $35 per share with expected annual dividends of $2.45 per share. Required: 1. Assuming the note or shares of stock are issued at the beginning of the year, complete the income statement for each alternative. 2. Answer the following questions for the current year (a) By how much are interest payments higher if issuing the note? (b) By how much are dividend payments higher by issuing stock? (c) Which alternative results in higher earnings per share? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Answer the following questions for the current year: (a) By how much are interest payments higher if issuing the note? (b) By how much are dividend payments higher by issuing stock? (c) Which alternative results in higher earnings per share? (Enter your answers in dollars, not millions (L.e., $5.5 million should be entered as 5,500,000).) a. By how much are interesit payments higher if issuing the note? b. By how much are dividend payments higher by issuing stock? c. Which alternative results in higher earnings per share? < Required 1 Required 23 Show less A

Penny Arcades, Incorporated, is trying to decide between the following two alternatives to finance its new $35 million gaming center. a. Issue $35 million, 7% note b. Issue 1 million shares of common stock for $35 per share with expected annual dividends of $2.45 per share. Required: 1. Assuming the note or shares of stock are issued at the beginning of the year, complete the income statement for each alternative. 2. Answer the following questions for the current year (a) By how much are interest payments higher if issuing the note? (b) By how much are dividend payments higher by issuing stock? (c) Which alternative results in higher earnings per share? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Answer the following questions for the current year: (a) By how much are interest payments higher if issuing the note? (b) By how much are dividend payments higher by issuing stock? (c) Which alternative results in higher earnings per share? (Enter your answers in dollars, not millions (L.e., $5.5 million should be entered as 5,500,000).) a. By how much are interesit payments higher if issuing the note? b. By how much are dividend payments higher by issuing stock? c. Which alternative results in higher earnings per share? < Required 1 Required 23 Show less A

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

ChapterMB: Model-building Problems

Section: Chapter Questions

Problem 8M

Related questions

Question

Transcribed Image Text:Penny Arcades, Incorporated, is trying to decide between the following two alternatives to finance its new $35 million gaming center.

a. Issue $35 million, 7% note

b. Issue 1 million shares of common stock for $35 per share with expected annual dividends of $2.45 per share.

Required:

1. Assuming the note or shares of stock are issued at the beginning of the year, complete the income statement for each alternative.

2. Answer the following questions for the current year

(a) By how much are interest payments higher if issuing the note?

(b) By how much are dividend payments higher by issuing stock?

(c) Which alternative results in higher earnings per share?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Answer the following questions for the current year:

(a) By how much are interest payments higher if issuing the note?

(b) By how much are dividend payments higher by issuing stock?

(c) Which alternative results in higher earnings per share?

(Enter your answers in dollars, not millions (L.e., $5.5 million should be entered as 5,500,000).)

a. By how much are interest payments higher if issuing the note?

b. By how much are dividend payments higher by issuing stock?

c. Which alternative results in higher eamings per share?

< Required 1

Required 2

Show less A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning