pens Ition, 5,000 qualified dividend from a 10% owned domestic corpor tributes all of the after-tax income to David. David is unmarri ome for two dependent children, has no other income, and d mize deductions. Calculate total tax liability before tax credits mpany and David. $26,675 $27,377

pens Ition, 5,000 qualified dividend from a 10% owned domestic corpor tributes all of the after-tax income to David. David is unmarri ome for two dependent children, has no other income, and d mize deductions. Calculate total tax liability before tax credits mpany and David. $26,675 $27,377

Chapter14: Choice Of Business Entity—operations And Distributions

Section: Chapter Questions

Problem 48P

Related questions

Question

Sir please help me sir urgently

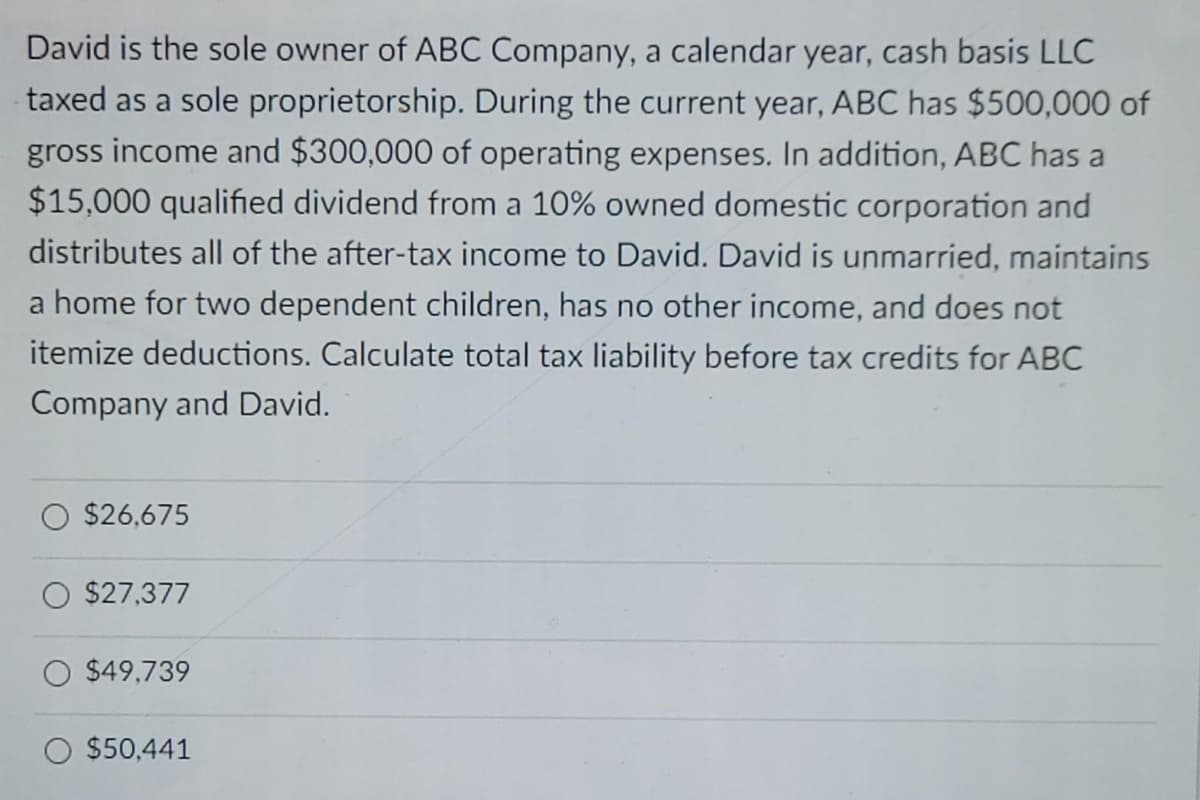

Transcribed Image Text:David is the sole owner of ABC Company, a calendar year, cash basis LLC

taxed as a sole proprietorship. During the current year, ABC has $500,000 of

gross income and $300,000 of operating expenses. In addition, ABC has a

$15,000 qualified dividend from a 10% owned domestic corporation and

distributes all of the after-tax income to David. David is unmarried, maintains

a home for two dependent children, has no other income, and does not

itemize deductions. Calculate total tax liability before tax credits for ABC

Company and David.

$26,675

$27,377

$49,739

$50,441

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you