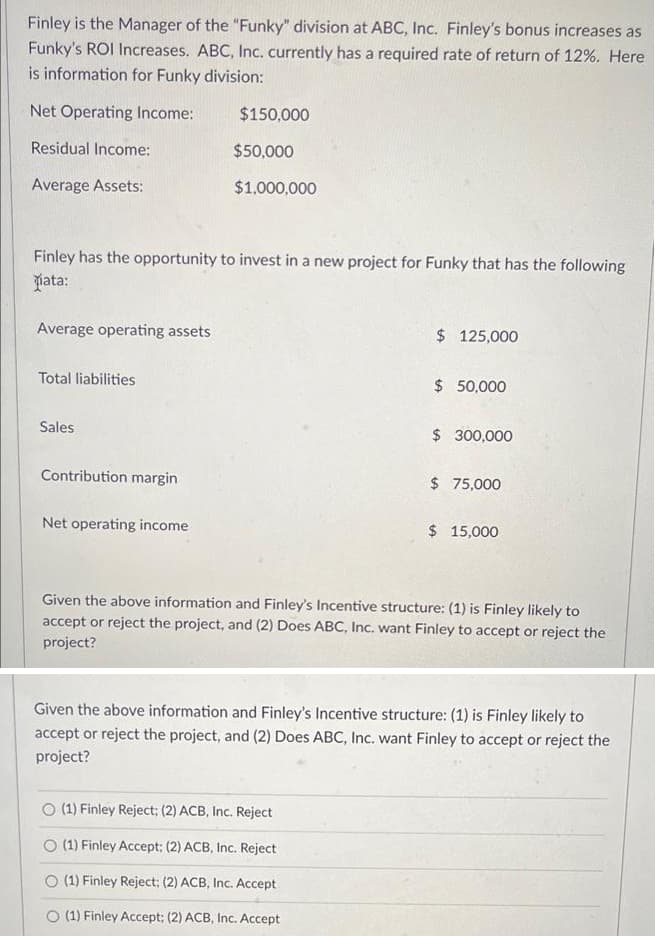

Finley is the Manager of the "Funky" division at ABC, Inc. Finley's bonus increases as Funky's ROI Increases. ABC, Inc. currently has a required rate of return of 12%. Here is information for Funky division: Net Operating Income: $150,000 Residual Income: $50,000 Average Assets: $1,000,000 Finley has the opportunity to invest in a new project for Funky that has the following pata: Average operating assets $ 125,000 Total liabilities $ 50,000 Sales $ 300,000 Contribution margin $ 75,000 Net operating income $ 15,000 Given the above information and Finley's Incentive structure: (1) is Finley likely to accept or reject the project, and (2) Does ABC, Inc. want Finley to accept or reject the project? Given the above information and Finley's Incentive structure: (1) is Finley likely to accept or reject the project, and (2) Does ABC, Inc. want Finley to accept or reject the project? O (1) Finley Reject; (2) ACB, Inc. Reject O (1) Finley Accept: (2) ACB, Inc. Reject O (1) Finley Reject; (2) ACB, Inc. Accept O (1) Finley Accept; (2) ACB, Inc. Accept

Finley is the Manager of the "Funky" division at ABC, Inc. Finley's bonus increases as Funky's ROI Increases. ABC, Inc. currently has a required rate of return of 12%. Here is information for Funky division: Net Operating Income: $150,000 Residual Income: $50,000 Average Assets: $1,000,000 Finley has the opportunity to invest in a new project for Funky that has the following pata: Average operating assets $ 125,000 Total liabilities $ 50,000 Sales $ 300,000 Contribution margin $ 75,000 Net operating income $ 15,000 Given the above information and Finley's Incentive structure: (1) is Finley likely to accept or reject the project, and (2) Does ABC, Inc. want Finley to accept or reject the project? Given the above information and Finley's Incentive structure: (1) is Finley likely to accept or reject the project, and (2) Does ABC, Inc. want Finley to accept or reject the project? O (1) Finley Reject; (2) ACB, Inc. Reject O (1) Finley Accept: (2) ACB, Inc. Reject O (1) Finley Reject; (2) ACB, Inc. Accept O (1) Finley Accept; (2) ACB, Inc. Accept

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter10: Evaluating Decentralized Operations

Section: Chapter Questions

Problem 18E

Related questions

Question

1

Transcribed Image Text:Finley is the Manager of the "Funky" division at ABC, Inc. Finley's bonus increases as

Funky's ROI Increases. ABC, Inc. currently has a required rate of return of 12%. Here

is information for Funky division:

Net Operating Income:

$150,000

Residual Income:

$50,000

Average Assets:

$1,000,000

Finley has the opportunity to invest in a new project for Funky that has the following

pata:

Average operating assets

$ 125,000

Total liabilities

$ 50,000

Sales

$ 300,000

Contribution margin

$ 75,000

Net operating income

$ 15,000

Given the above information and Finley's Incentive structure: (1) is Finley likely to

accept or reject the project, and (2) Does ABC, Inc. want Finley to accept or reject the

project?

Given the above information and Finley's Incentive structure: (1) is Finley likely to

accept or reject the project, and (2) Does ABC, Inc. want Finley to accept or reject the

project?

O (1) Finley Reject; (2) ACB, Inc. Reject

O (1) Finley Accept: (2) ACB, Inc. Reject

O (1) Finley Reject; (2) ACB, Inc. Accept

O (1) Finley Accept; (2) ACB, Inc. Accept

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT