penses: S 27,000 40,000 ation 35,000 102,000 xed expenses ating income $128,000 ue of the project's assets at the end of the project would be $17,000. The cash in

penses: S 27,000 40,000 ation 35,000 102,000 xed expenses ating income $128,000 ue of the project's assets at the end of the project would be $17,000. The cash in

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 19EA: Redbird Company is considering a project with an initial investment of $265,000 in new equipment...

Related questions

Question

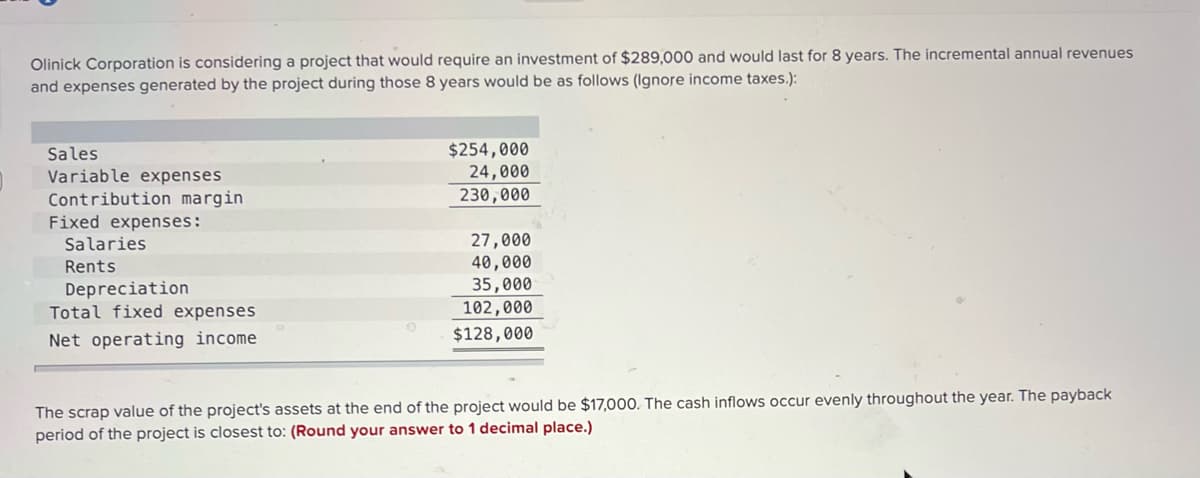

Transcribed Image Text:Olinick Corporation is considering a project that would require an investment of $289,000 and would last for 8 years. The incremental annual revenues

and expenses generated by the project during those 8 years would be as follows (Ignore income taxes.):

Sales

$254,000

24,000

Variable expenses

230,000

Contribution margin

Fixed expenses:

Salaries

27,000

Rents

40,000

Depreciation

35,000

Total fixed expenses

102,000

$128,000

Net operating income

The scrap value of the project's assets at the end of the project would be $17,000. The cash inflows occur evenly throughout the year. The payback

period of the project is closest to: (Round your answer to 1 decimal place.)

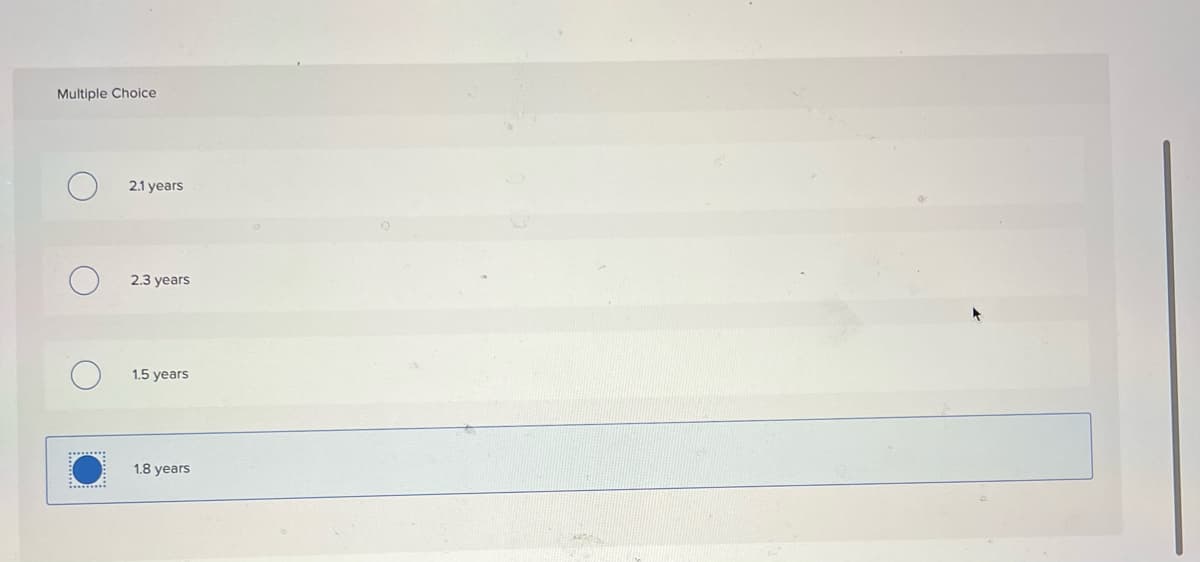

Transcribed Image Text:Multiple Choice

2.1 years

2.3 years

1.5 years

1.8 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning