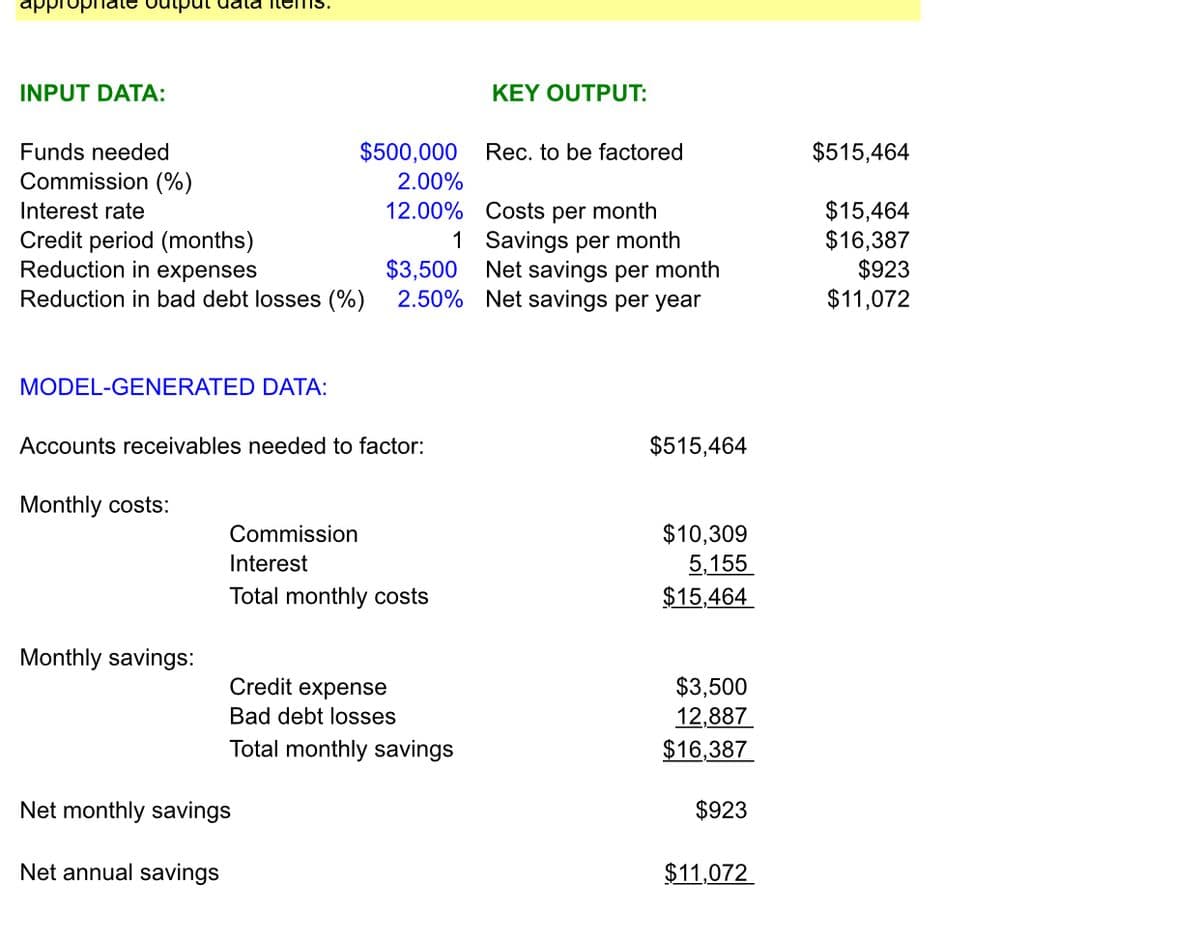

Percentages need to be entered in decimal format, for instance 3% would be entered as .03.) Cooley Industries needs an additional $500,000, which it plans to obtain through a factoring arrangement. The factor would purchase Cooley's accounts receivables and advance the invoice amount, minus a 2% commission, on the invoices purchased each month. Cooley sells on terms of net 30 days. In addition, the factor charges a 12% annual interest rate on the total invoice amount, to be deducted in advance. (This information is shown on the spreadsheet provided.) Would it be to Cooley's advantage to offer to pay the factor a commission of 2.5% if it would lower the interest rate to 10.5% annually? Assume the firm needs $500,000. Explain your answer. Assume a commission of 2% and an interest rate of 12%. What would be the total cost of the factoring arrangement if Cooley's funding needs rose to $650,000? Would the factoring arrangement be profitable under these circumstances? Why or why not?

Percentages need to be entered in decimal format, for instance 3% would be entered as .03.) Cooley Industries needs an additional $500,000, which it plans to obtain through a factoring arrangement. The factor would purchase Cooley's accounts receivables and advance the invoice amount, minus a 2% commission, on the invoices purchased each month. Cooley sells on terms of net 30 days. In addition, the factor charges a 12% annual interest rate on the total invoice amount, to be deducted in advance. (This information is shown on the spreadsheet provided.) Would it be to Cooley's advantage to offer to pay the factor a commission of 2.5% if it would lower the interest rate to 10.5% annually? Assume the firm needs $500,000. Explain your answer. Assume a commission of 2% and an interest rate of 12%. What would be the total cost of the factoring arrangement if Cooley's funding needs rose to $650,000? Would the factoring arrangement be profitable under these circumstances? Why or why not?

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter13: Budgeting And Standard Costs

Section: Chapter Questions

Problem 13.6.2MBA

Related questions

Question

Percentages need to be entered in decimal format, for instance 3% would be entered as .03.)

Cooley Industries needs an additional $500,000, which it plans to obtain through a factoring arrangement. The factor would purchase Cooley's

- Would it be to Cooley's advantage to offer to pay the factor a commission of 2.5% if it would lower the interest rate to 10.5% annually? Assume the firm needs $500,000. Explain your answer.

- Assume a commission of 2% and an interest rate of 12%. What would be the total cost of the factoring arrangement if Cooley's funding needs rose to $650,000? Would the factoring arrangement be profitable under these circumstances? Why or why not?

Transcribed Image Text:appropiale output uala ileiTIs.

INPUT DATA:

ΚΕY OUTPUT

Funds needed

$500,000

Rec. to be factored

$515,464

Commission (%)

2.00%

12.00% Costs per month

$15,464

$16,387

$923

$11,072

Interest rate

Credit period (months)

Reduction in expenses

1 Savings per month

$3,500

2.50% Net savings per year

Net savings per month

Reduction in bad debt losses (%)

MODEL-GENERATED DATA:

Accounts receivables needed to factor:

$515,464

Monthly costs:

$10,309

5,155

$15,464

Commission

Interest

Total monthly costs

Monthly savings:

Credit expense

$3,500

12,887

Bad debt losses

Total monthly savings

$16,387

Net monthly savings

$923

Net annual savings

$11,072

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning