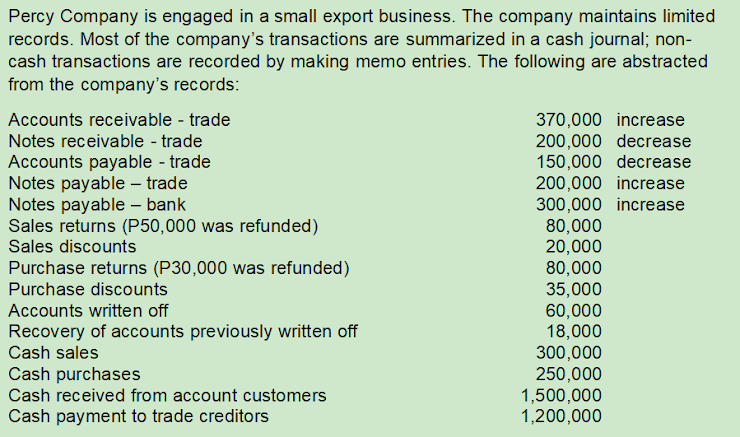

Percy Company is engaged in a small export business. The company maintains limited records. Most of the company's transactions are summarized in a cash journal; non- cash transactions are recorded by making memo entries. The following are abstracted from the company's records: Accounts receivable - trade Notes receivable - trade 370,000 increase 200,000 decrease 150,000 decrease 200,000 increase 300,000 increase 80,000 20,000 80,000 35,000 60,000 18,000 300,000 250,000 1,500,000 1,200,000 Accounts payable - trade Notes payable – trade Notes payable - bank Sales returns (P50,000 was refunded) Sales discounts Purchase returns (P30,000 was refunded) Purchase discounts Accounts written off Recovery of accounts previously written off Cash sales Cash purchases Cash received from account customers Cash payment to trade creditors

Percy Company is engaged in a small export business. The company maintains limited records. Most of the company's transactions are summarized in a cash journal; non- cash transactions are recorded by making memo entries. The following are abstracted from the company's records: Accounts receivable - trade Notes receivable - trade 370,000 increase 200,000 decrease 150,000 decrease 200,000 increase 300,000 increase 80,000 20,000 80,000 35,000 60,000 18,000 300,000 250,000 1,500,000 1,200,000 Accounts payable - trade Notes payable – trade Notes payable - bank Sales returns (P50,000 was refunded) Sales discounts Purchase returns (P30,000 was refunded) Purchase discounts Accounts written off Recovery of accounts previously written off Cash sales Cash purchases Cash received from account customers Cash payment to trade creditors

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter9: Accounting For Purchases And Cash Payments

Section: Chapter Questions

Problem 4AP

Related questions

Question

What is the amount of the gross sales?

Transcribed Image Text:Percy Company is engaged in a small export business. The company maintains limited

records. Most of the company's transactions are summarized in a cash journal; non-

cash transactions are recorded by making memo entries. The following are abstracted

from the company's records:

Accounts receivable - trade

370,000 increase

200,000 decrease

150,000 decrease

200,000 increase

300,000 increase

80,000

20,000

80,000

35,000

60,000

18,000

300,000

250,000

1,500,000

1,200,000

Notes receivable - trade

Accounts payable - trade

Notes payable – trade

Notes payable – bank

Sales returns (P50,000 was refunded)

Sales discounts

Purchase returns (P30,000 was refunded)

Purchase discounts

Accounts written off

Recovery of accounts previously written off

Cash sales

Cash purchases

Cash received from account customers

Cash payment to trade creditors

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning