Required: 1. Prepare the journal entry to establish the petty cash fund. 2 Prepare a petty cash payments report for February with these categories: delivery expense, mileage expense, postage expense, merchandise inventory (for transportation-in), and office supplies expense

Required: 1. Prepare the journal entry to establish the petty cash fund. 2 Prepare a petty cash payments report for February with these categories: delivery expense, mileage expense, postage expense, merchandise inventory (for transportation-in), and office supplies expense

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter11: Work Sheet And Adjusting Entries

Section: Chapter Questions

Problem 5QY: The Supplies account has a 1,400 balance. A physical inventory is taken at the end of the fiscal...

Related questions

Question

100%

Nakashima Gallery had the following petty cash transactions in February of the current year. Nakashima uses the perpetual system to

account for merchandise inventory.

February 2 Wrote a $360 check to establish a petty cash fund.

February

5 Purchased paper for the copier for $14.75

that is immediately used.

February 9 Paid $36.50 shipping charges (transportation-in) on merchandise purchased for resale, terms FOB shipping point. These

costs are added to merchandise inventory.

February 12 Paid $7.35 postage to deliver a contract to a client

February

14 Reimbursed Adina Sharon,

the manager,

$70 for

mileage on her car

February

28 Purchased office paper for $67.77 that is immediately used.

February 23 Paid a courier $18 to deliver merchandise sold to a customer, terms FOB destination.

February 25 Paid $11.50 shipping charges (transportation-in) on merchandise purchased for resale, terms FOB shipping point. These

costs are added to merchandise inventory.

February 27 Paid $56 for postage expenses.

February 28 The fund had $22.73 remaining in the petty cashbox. Sorted the petty cash receipts by accounts affected and exchanged

them for a

check to reimburse the fund for expenditures.

February 28 The petty cash fund amount is increased by $110 to a total of $470.

Required:

1. Prepare the journal entry to establish the petty cash fund.

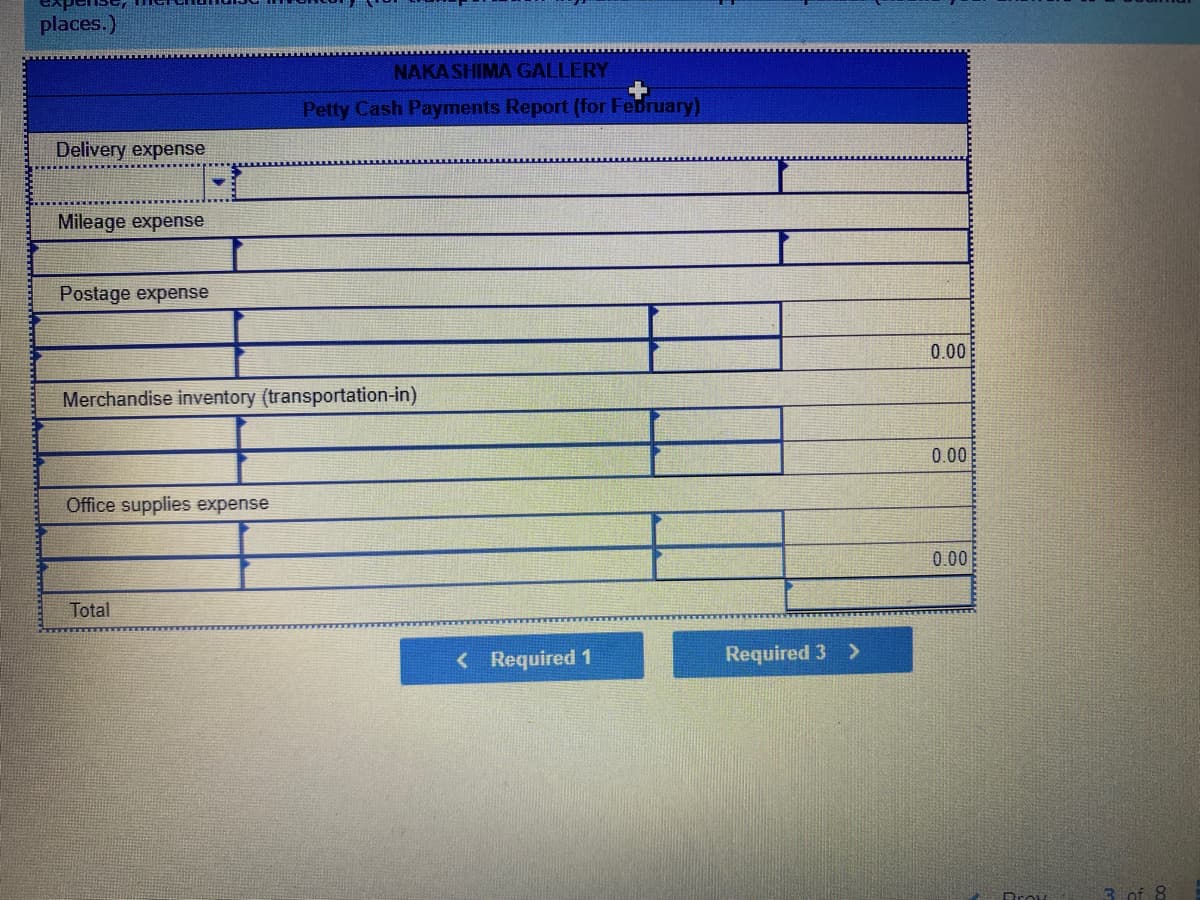

2 Prepare a petty cash payments report for February with these categories: delivery expense, mileage expense, postage expense,

merchandise inventory (for transportation-in), and office supplies expense.

3. Prepare the journal entries for required 2 to both (a) reimburse and (b) increase the fund amount.

Transcribed Image Text:places.)

Delivery expense

Mileage expense

Postage expense

Merchandise inventory (transportation-in)

Office supplies expense

NAKASHIMA GALLERY

Petty Cash Payments Report (for February)

Total

< Required 1

Required 3 >

0.00

0.00

0.00

3 of

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College