Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Perform profitability analysis for the two quotas

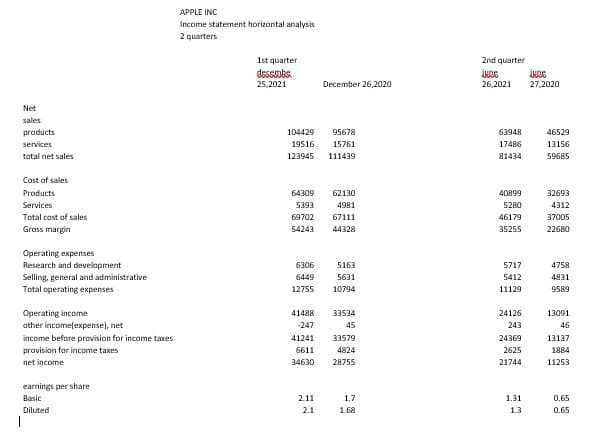

Transcribed Image Text:APPLE INC

Income statement horizontal analysis

2 quarters

1st quarter

2nd quarter

dessuobs

25,2021

December 26.2020

26,2021

27,2020

Net

sales

praducts

104429

95678

63948

46529

services

19516

15761

17486

13156

tatal net sales

123945

111439

81434

59685

Cast of sales

Products

64309

62130

40899

32693

Services

5393

4981

5280

4312

Total cost of sales

69702

67111

46179

37005

Grass margin

54243

44328

35255

22680

Operating expenses

Research and development

6306

5163

5717

4758

Selling, general and administrative

Total operating expenses

6449

5631

5412

4831

12755

10794

11129

9589

Operating income

ather income(expense), net

41488

33534

24126

13091

-247

45

243

46

income before provision for income taxes

pravision for income taxes

41241

33579

24369

13137

6611

4824

2625

1884

net income

34630

28755

21744

11253

earnings per share

Basic

2.11

1.7

1.31

0.65

Diluted

2.1

1.68

1.3

0.65

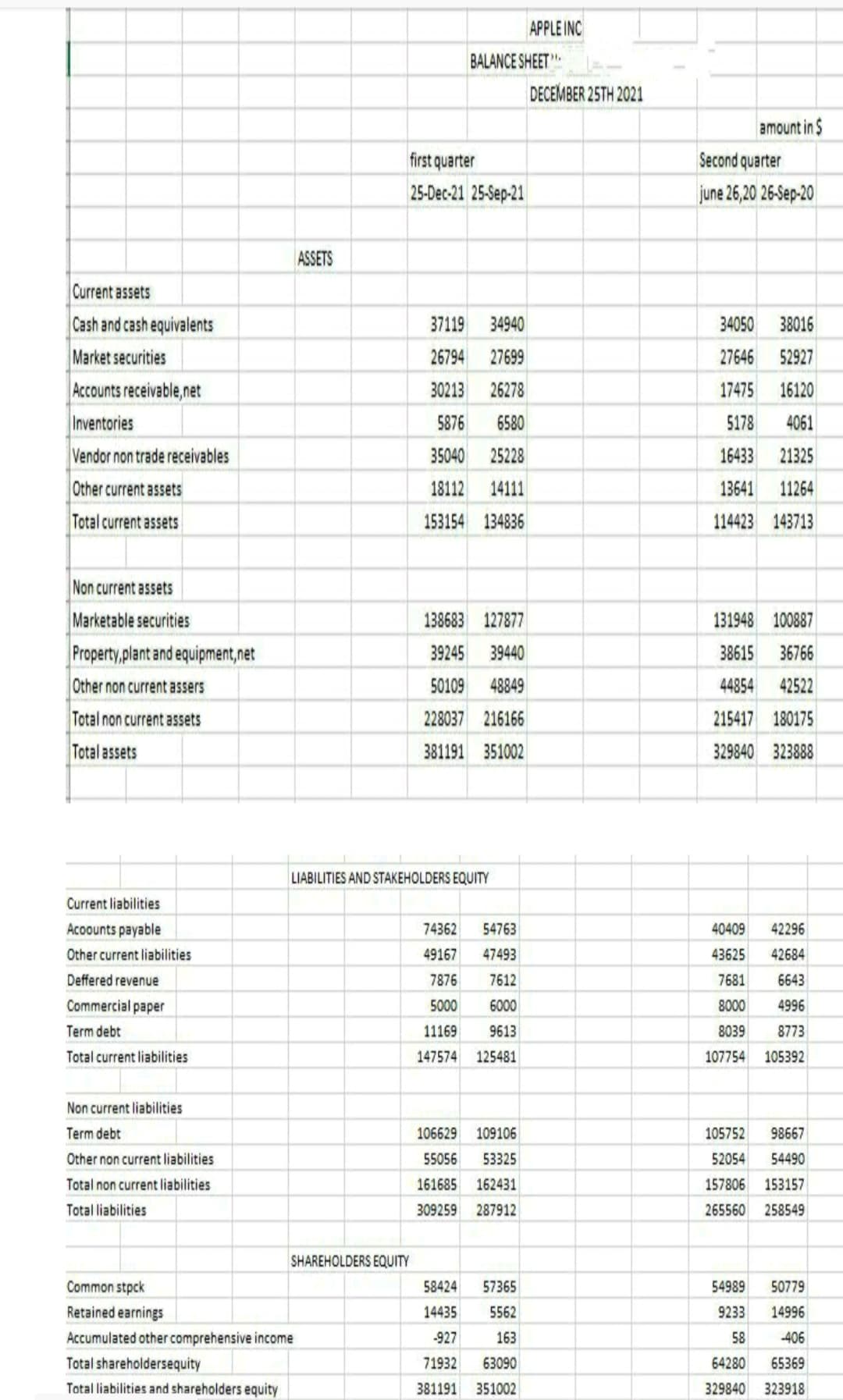

Transcribed Image Text:APPLE INC

BALANCE SHEET"

DECEMBER 25TH 2021

amount in $

first quarter

Second quarter

25-Dec-21 25-Sep-21

june 26,20 26-Sep-20

ASSETS

Current assets

Cash and cash equivalents

Market securities

Accounts receivable,net

Inventories

Vendor non trade receivables

37119

34940

34050

38016

26794

27699

27646

52927

30213

26278

17475

16120

5876

6580

5178

4061

35040

25228

16433

21325

Other current assets

18112

14111

13641

11264

Total current assets

153154 134836

114423 143713

Non current assets

Marketable securities

Property,plant and equipment,net

138683 127877

131948 100887

39245

39440

38615

36766

Other non current assers

50109

48849

44854

42522

Total non current assets

228037 216166

215417 180175

Total assets

381191 351002

329840 323888

LIABILITIES AND STAKEHOLDERS EQUITY

Current liabilities

Acoounts payable

74362

54763

40409

42296

Other current liabilities

49167

47493

43625

42684

Deffered revenue

7876

7612

7681

6643

Commercial paper

5000

6000

8000

4996

Term debt

11169

9613

8039

8773

Total current liabilities

147574

125481

107754

105392

Non current liabilities

Term debt

106629

109106

105752

98667

Other non current liabilities

55056

53325

52054

54490

Total non current liabilities

161685

162431

157806

153157

Total liabilities

309259

287912

265560

258549

SHAREHOLDERS EQUITY

Common stpck

58424

57365

54989

50779

Retained earnings

14435

5562

9233

14996

Accumulated other comprehensive income

-927

163

58

-406

Total shareholdersequity

71932

63090

64280

65369

Total liabilities and shareholders equity

381191

351002

329840

323918

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education