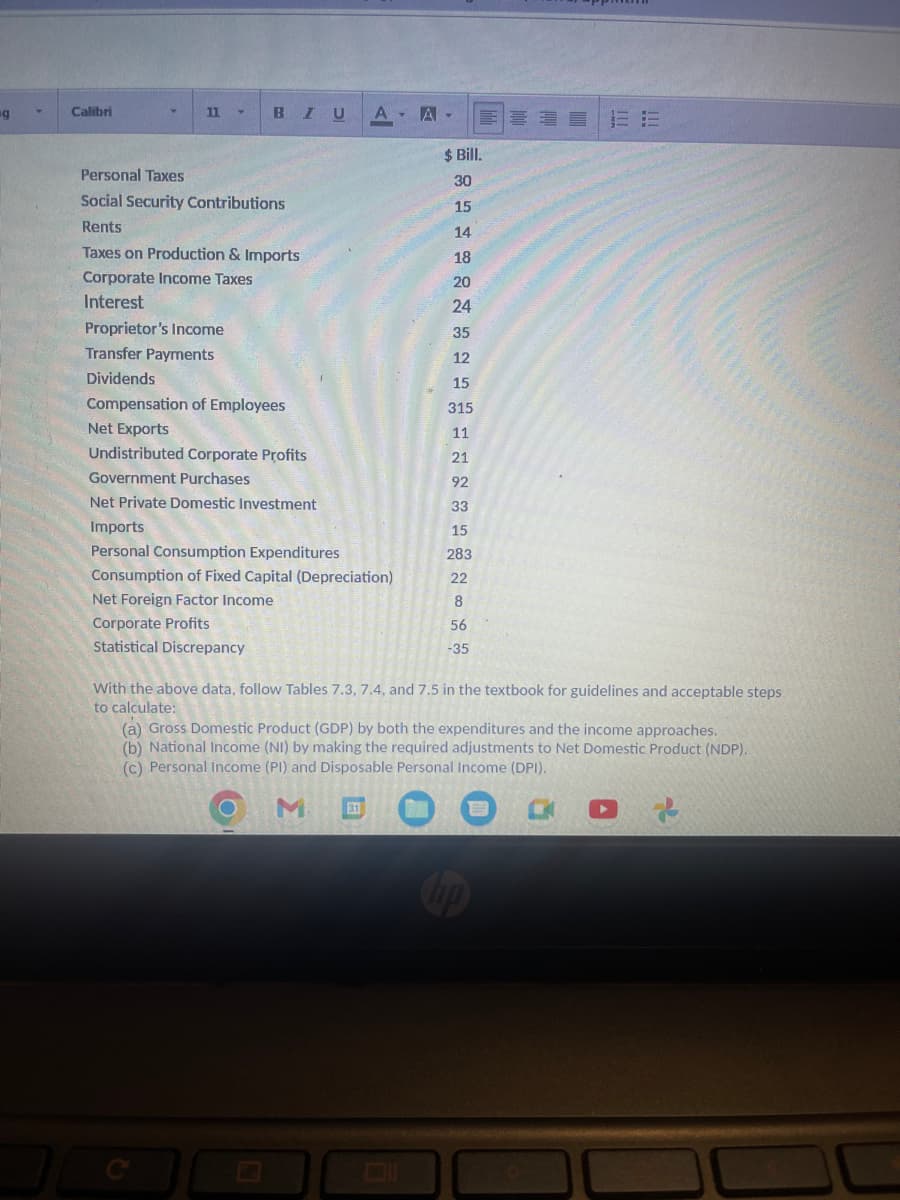

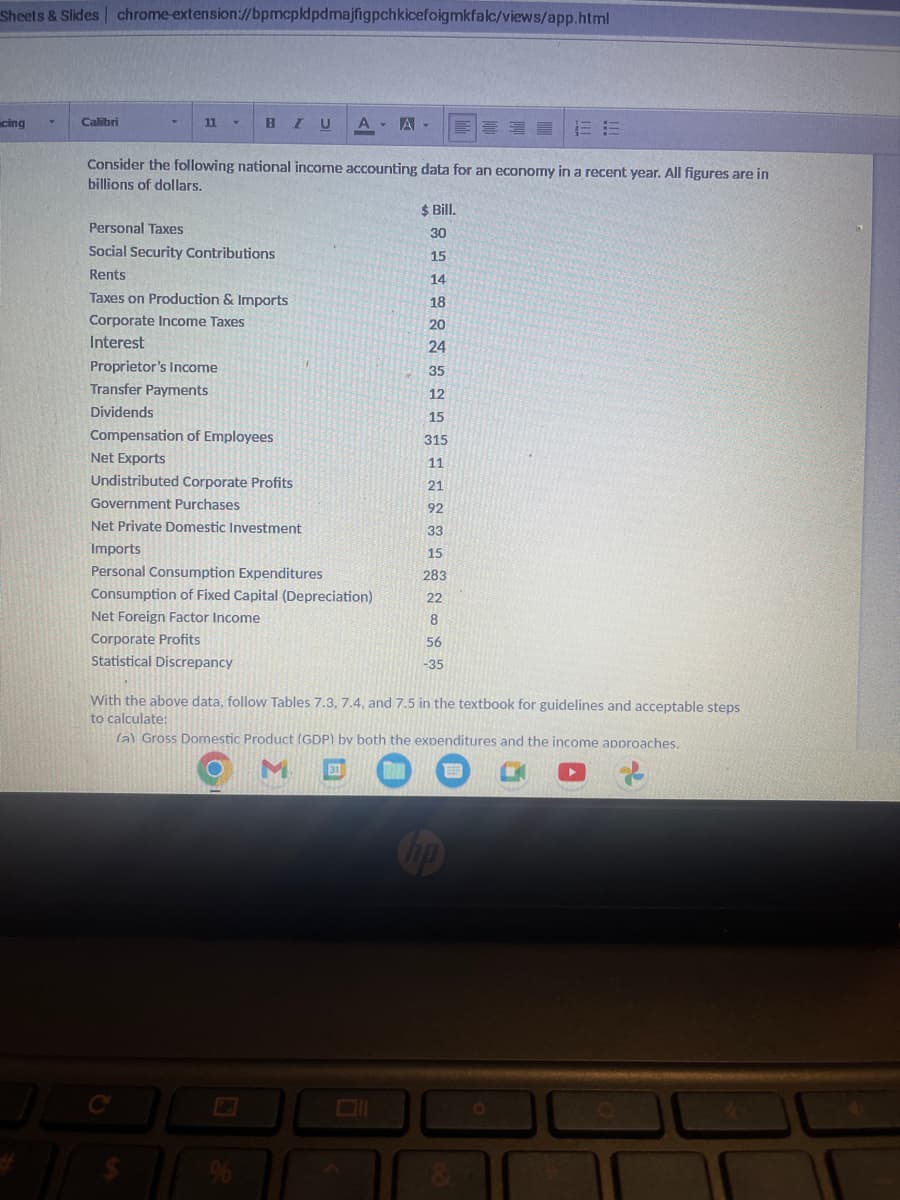

Personal Taxes Social Security Contributions Rents Taxes on Production & Imports Corporate Income Taxes Interest Proprietor's Income Transfer Payments Dividends Compensation of Employees Net Exports Undistributed Corporate Profits Government Purchases Net Private Domestic Investment Imports Personal Consumption Expenditures Consumption of Fixed Capital (Depreciation) Net Foreign Factor Income Corporate Profits Statistical Discrepancy $Bill. 30 15 14 18 20 24 35 12 15 315 11 21 92 33 15 283 22 8 56 -35 With the above data, follow Tables 7.3, 7.4, and 7.5 in the textbook for guidelines and acceptable steps to calculate: (a) Gross Domestic Product (GDP) by both the expenditures and the income approaches. (b) National Income (NI) by making the required adjustments to Net Domestic Product (NDP). (c) Personal Income (PI) and Disposable Personal Income (DPI).

Personal Taxes Social Security Contributions Rents Taxes on Production & Imports Corporate Income Taxes Interest Proprietor's Income Transfer Payments Dividends Compensation of Employees Net Exports Undistributed Corporate Profits Government Purchases Net Private Domestic Investment Imports Personal Consumption Expenditures Consumption of Fixed Capital (Depreciation) Net Foreign Factor Income Corporate Profits Statistical Discrepancy $Bill. 30 15 14 18 20 24 35 12 15 315 11 21 92 33 15 283 22 8 56 -35 With the above data, follow Tables 7.3, 7.4, and 7.5 in the textbook for guidelines and acceptable steps to calculate: (a) Gross Domestic Product (GDP) by both the expenditures and the income approaches. (b) National Income (NI) by making the required adjustments to Net Domestic Product (NDP). (c) Personal Income (PI) and Disposable Personal Income (DPI).

Chapter8: Aggregate Demand And The Powerful Consumer

Section8.A: National Income Accounting

Problem 3TY

Related questions

Question

Transcribed Image Text:ig

Y

Calibri

Y

11 -

Personal Taxes

Social Security Contributions

Rents

BIU A A-

Taxes on Production & Imports

Corporate Income Taxes

Interest

Proprietor's Income

Transfer Payments

Dividends

Compensation of Employees

Net Exports

Undistributed Corporate Profits

Government Purchases

Net Private Domestic Investment

Imports

Personal Consumption Expenditures

Consumption of Fixed Capital (Depreciation)

Net Foreign Factor Income

Corporate Profits

Statistical Discrepancy

C

$ Bill.

30

15

14

18

20

24

35

12

15

315

11

21

92

33

15

283

31

22

8

56

-35

With the above data, follow Tables 7.3, 7.4, and 7.5 in the textbook for guidelines and acceptable steps

to calculate:

(a) Gross Domestic Product (GDP) by both the expenditures and the income approaches.

(b) National Income (NI) by making the required adjustments to Net Domestic Product (NDP).

(c) Personal Income (PI) and Disposable Personal Income (DPI).

M

B

EE

Chp

Transcribed Image Text:Sheets & Slides| chrome-extension://bpmcpldpdmajfigpchkicefoigmkfalc/views/app.html

cing

Calibri

11

▾

Consider the following national income accounting data for an economy in a recent year. All figures are in

billions of dollars.

Proprietor's Income

Transfer Payments

Dividends

Personal Taxes

Social Security Contributions

Rents

Taxes on Production & Imports

Corporate Income Taxes

Interest

BIU A A-

Compensation of Employees

Net Exports

Undistributed Corporate Profits

Government Purchases

Net Private Domestic Investment

C

Imports

Personal Consumption Expenditures

Consumption of Fixed Capital (Depreciation)

Net Foreign Factor Income

Corporate Profits

Statistical Discrepancy

With the above data, follow Tables 7.3, 7.4, and 7.5 in the textbook for guidelines and acceptable steps

to calculate:

(a) Gross Domestic Product (GDP) by both the expenditures and the income approaches.

M 31

A

%

$ Bill.

30

15

14

18

20

24

35

12

15

315

11

21

92

33

15

283

22

8

56

-35

hp

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you