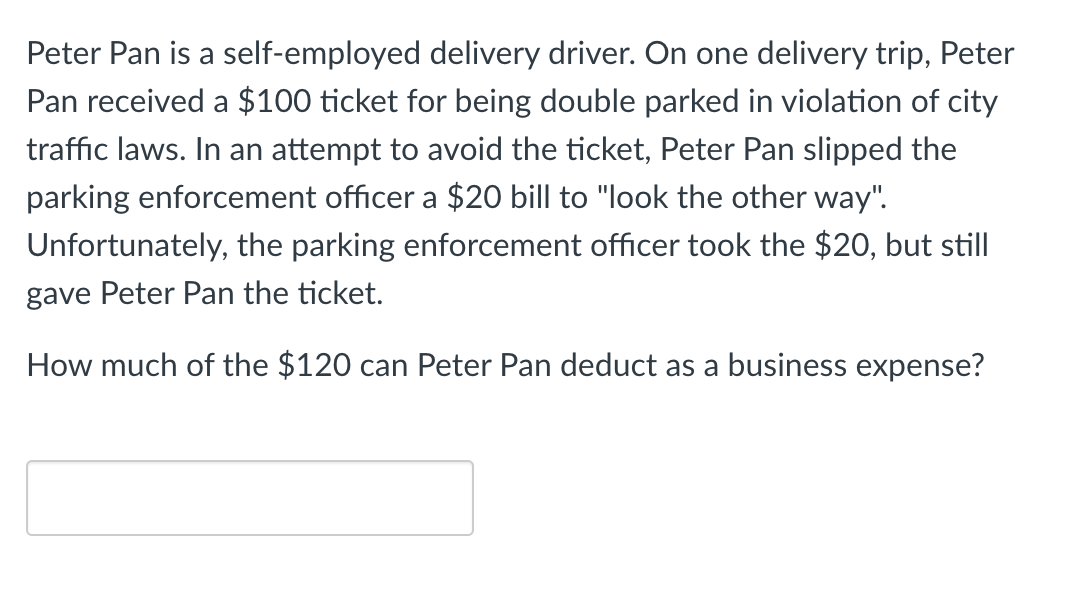

Peter Pan is a self-employed delivery driver. On one delivery trip, Peter Pan received a $100 ticket for being double parked in violation of city traffic laws. In an attempt to avoid the ticket, Peter Pan slipped the parking enforcement officer a $20 bill to "look the other way". Unfortunately, the parking enforcement officer took the $20, but still gave Peter Pan the ticket. How much of the $120 can Peter Pan deduct as a business expense?

Peter Pan is a self-employed delivery driver. On one delivery trip, Peter Pan received a $100 ticket for being double parked in violation of city traffic laws. In an attempt to avoid the ticket, Peter Pan slipped the parking enforcement officer a $20 bill to "look the other way". Unfortunately, the parking enforcement officer took the $20, but still gave Peter Pan the ticket. How much of the $120 can Peter Pan deduct as a business expense?

Chapter6: Business Expenses

Section: Chapter Questions

Problem 23P

Related questions

Question

Transcribed Image Text:Peter Pan is a self-employed delivery driver. On one delivery trip, Peter

Pan received a $100 ticket for being double parked in violation of city

traffic laws. In an attempt to avoid the ticket, Peter Pan slipped the

parking enforcement officer a $20 bill to "look the other way".

Unfortunately, the parking enforcement officer took the $20, but still

gave Peter Pan the ticket.

How much of the $120 can Peter Pan deduct as a business expense?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT