Pharoah Company has a factory machine with a book value of $90,800 and a rema A new machine is available at a cost of $407 400. This machine will have a 7-year u will lower annual variable manufacturing costs from $640,100 to $581,800 Prepa should be retained or replaced. (In the first two columns, enter costs and expenses as p amounts. In the third column, enter net income increases as positive amounts and decres either a negative sign preceding the number eg.-45 or parentheses e.g. (45)) Variable manufacturing costs $ New machine cost Retain Equipment S Rep Equip

Pharoah Company has a factory machine with a book value of $90,800 and a rema A new machine is available at a cost of $407 400. This machine will have a 7-year u will lower annual variable manufacturing costs from $640,100 to $581,800 Prepa should be retained or replaced. (In the first two columns, enter costs and expenses as p amounts. In the third column, enter net income increases as positive amounts and decres either a negative sign preceding the number eg.-45 or parentheses e.g. (45)) Variable manufacturing costs $ New machine cost Retain Equipment S Rep Equip

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 10P: Dauten is offered a replacement machine which has a cost of 8,000, an estimated useful life of 6...

Related questions

Question

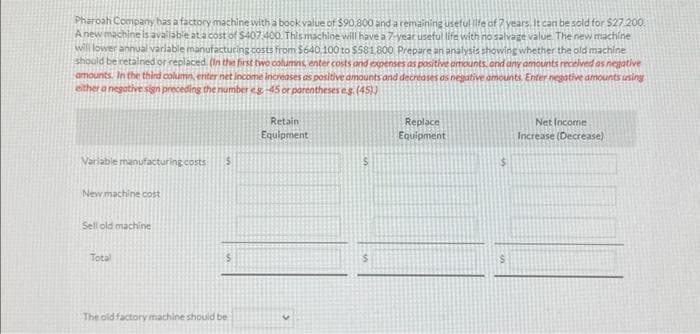

Transcribed Image Text:Pharoah Company has a factory machine with a book value of $90.800 and a remaining useful life of 7 years. It can be sold for $27.200.

A new machine is available at a cost of $407 400. This machine will have a 7-year useful life with no salvage value. The new machine

will lower annual variable manufacturing costs from $640,100 to $581.800 Prepare an analysis showing whether the old machine

should be retained or replaced. (In the first two columns, enter costs and expenses as positive amounts, and any amounts received as negative

amounts. In the third column, enter net income increases as positive amounts and decreases as negative amounts. Enter negative amounts using

either a negative sign preceding the number eg. -45 or parentheses eg. (45))

Variable manufacturing costs

New machine cost

Sell old machine

Total

S

The old factory machine should be

Retain

Equipment

$

Replace

Equipment

$

$

Net Income

Increase (Decrease)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT